Ah, BNB, the enigmatic creature of the crypto realm, has found itself ensnared in the glaring spotlight of recent weeks. With trading volumes soaring and a burgeoning interest in its ecosystem—meme coins like TST prancing about like jesters in a royal court—one might expect a jubilant rise. Yet, alas! The price of BNB has plummeted by more than 3% in the past week, a reflection of the market’s ever-looming uncertainty.

Its DMI, a fickle friend, reveals a weak trend strength and an ominous increase in selling pressure, while the Ichimoku Cloud looms overhead like a dark cloud of despair. The EMA lines, those indecisive serpents, offer no clear direction, leaving BNB at a crossroads: will it regain its former glory or tumble below the fateful $600 mark? The suspense is palpable! 🎭

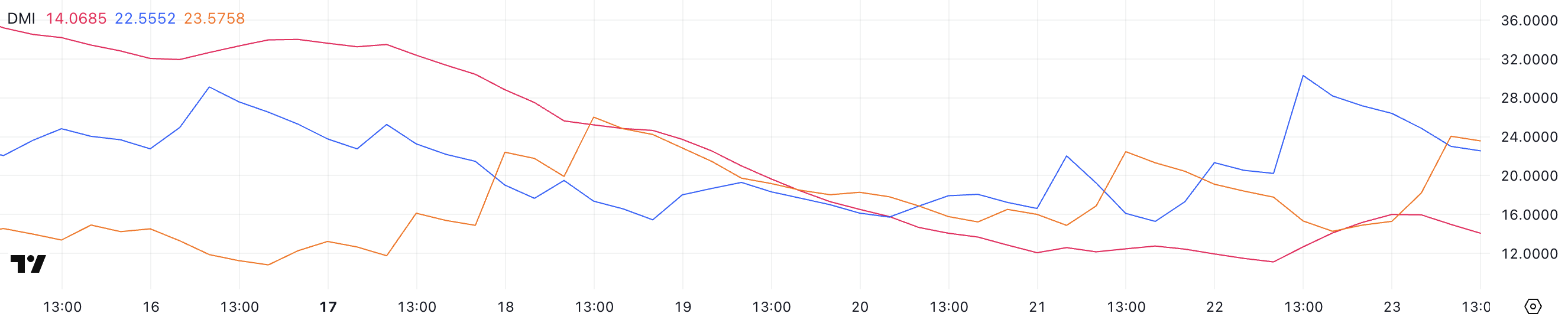

BNB DMI: A Struggle Between Buyers and Sellers

In the grand theater of BNB’s DMI chart, the ADX stands at a mere 14, a testament to its weak trend strength, having touched a low of 11.1 just yesterday, only to rise briefly to 16, like a phoenix that refuses to take flight.

Ah, the ADX, that mysterious Average Directional Index, measures the strength of a trend without revealing its true nature. It dances between 0 and 100, with values above 25 heralding a strong trend, while those below 20 suggest a weak or undefined existence.

With the ADX languishing at 14, BNB finds itself in a low-momentum phase, a state of limbo where the market lacks a clear path forward.

+DI, that hopeful figure, stands at 22.5, having risen from 15.2 yesterday, yet it has fallen from a lofty 30.3 mere hours ago, suggesting a fleeting increase in buying pressure that has now withered. Meanwhile, -DI, the harbinger of doom, rises to 23.5, up from 14.2, indicating a growing tide of selling pressure.

The proximity of +DI and -DI reveals a tug-of-war, a battle of wills between buyers and sellers, encapsulating the market’s indecision. With the ADX languishing low and +DI and -DI locked in a close embrace, BNB’s price is likely to remain trapped in a range until a stronger trend emerges.

Should +DI triumph over -DI, it may signal a bullish reversal, but if -DI maintains its dominance, further declines may be inevitable.

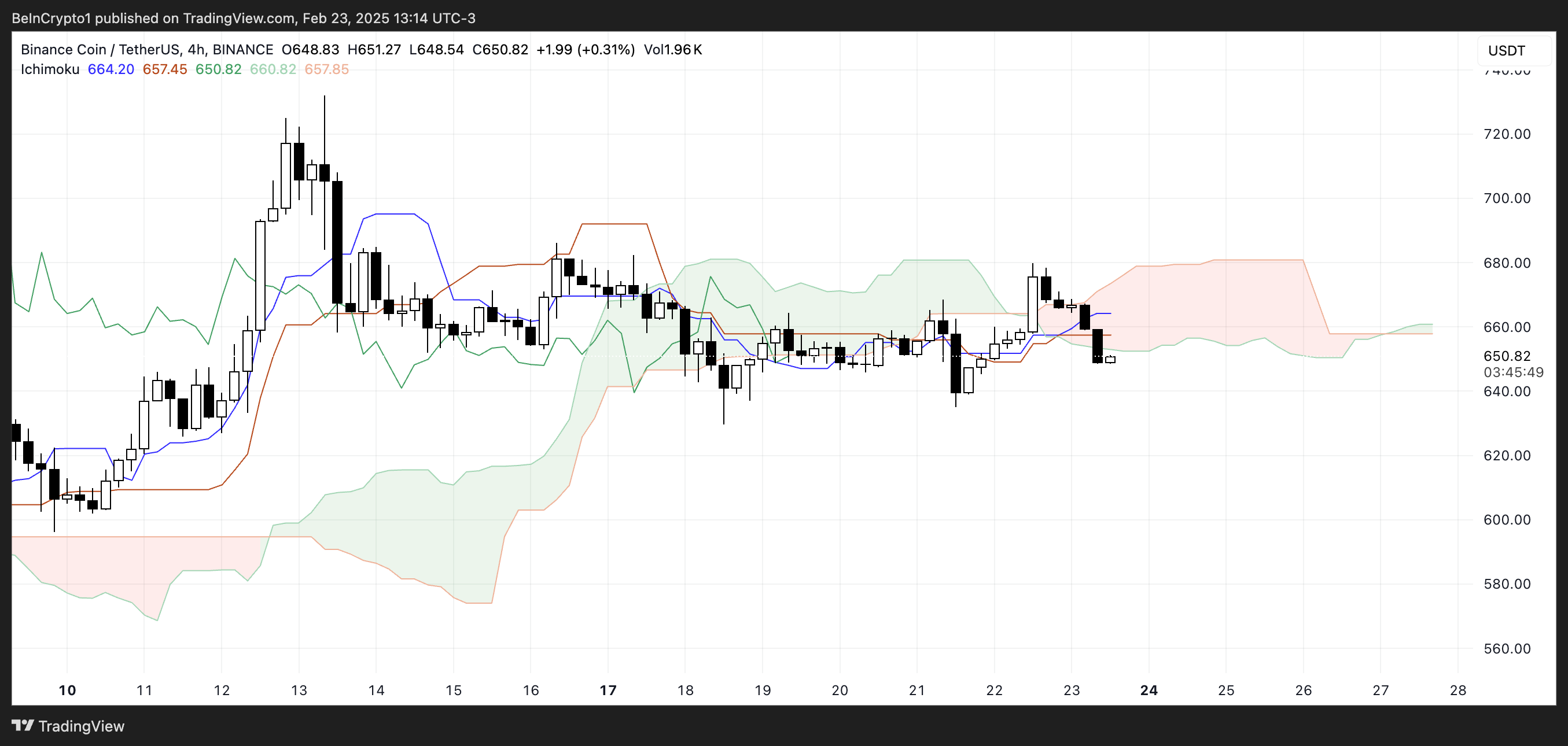

Ichimoku Cloud: A Dark Prophecy

The Ichimoku Cloud casts a shadow over BNB, revealing a bearish outlook. The price, alas, trades below the cloud, indicating a downward momentum that feels all too familiar. The ominous red cloud ahead suggests resistance, a formidable barrier preventing BNB from breaking free.

The Tenkan-sen (blue line) languishes below the Kijun-sen (orange line), confirming a bearish crossover, a signal of continued selling pressure that echoes through the market.

Moreover, the Chikou Span (green line) trails below the price action, reinforcing the bearish sentiment that hangs heavy in the air. Should this downtrend persist, BNB may find itself testing lower support levels, a fate that seems all too likely.

Yet, a breakout above the red cloud would be required to shift the narrative to a bullish one. For now, the bearish structure remains steadfast, suggesting further risks of decline.

BNB: The $600 Dilemma

BNB’s EMA lines, those fickle indicators, are currently entwined, indicating a lack of clear trend direction. This consolidation speaks of market indecision, where neither bulls nor bears can claim victory.

Despite this, BNB has captured the attention of the masses, with trading volumes surpassing even Solana, while meme coins like TST frolic within the BNB ecosystem.

Read More

- 30 Best Couple/Wife Swap Movies You Need to See

- DC: Dark Legion The Bleed & Hypertime Tracker Schedule

- PENGU PREDICTION. PENGU cryptocurrency

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- ANDOR Recasts a Major STAR WARS Character for Season 2

- In Conversation With The Weeknd and Jenna Ortega

- Clair Obscur: Expedition 33 ending explained – Who should you side with?

- The Last Of Us Season 2 Drops New Trailer: Premiers April On Max

- Scarlett Johansson’s Directorial Debut Eleanor The Great to Premiere at 2025 Cannes Film Festival; All We Know About Film

- All Hidden Achievements in Atomfall: How to Unlock Every Secret Milestone

2025-02-23 21:31