In the grand theater of finance, Bitcoin (BTC) has danced a tumultuous waltz over the past weeks, soaring past the illustrious $100,000 mark only to tumble back into the $90,000 abyss. This dramatic pirouette has ignited fervent discussions among analysts and traders alike, pondering whether the crypto market has reached its zenith.

Yet, amidst the chaos, a flicker of optimism persists. Many enthusiasts cling to the belief that Bitcoin and its altcoin companions will rise again, while others, with a hint of caution, warn against the perils of unbridled bullishness.

Hope Springs Eternal: The Bullish Outlook for Q1

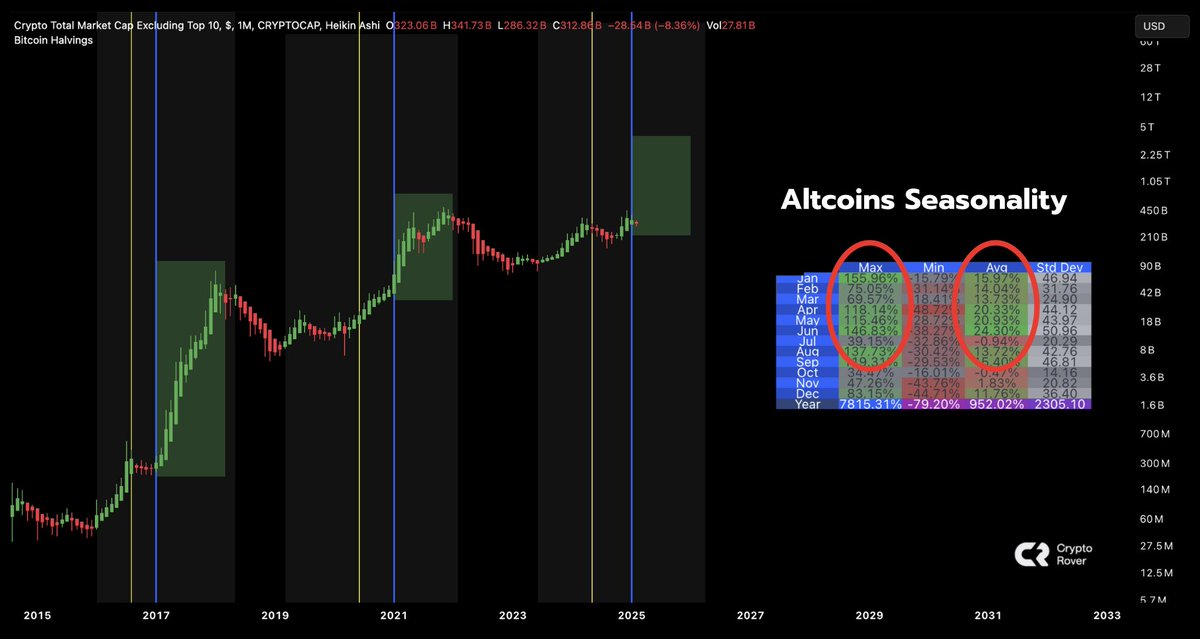

Crypto Rover, a self-proclaimed oracle of the digital realm, remains steadfast in his conviction that history shall repeat itself, with Bitcoin’s price target firmly set at a lofty $175,000. According to this esteemed analyst, a bullish breakout is not merely a possibility; it is an impending certainty.

“Q1 is always bullish for altcoins. This time will not be any different. I trust history,” Rover proclaimed, as if history were a loyal dog that never strays.

Meanwhile, a chorus of analysts implores investors to divert their gaze from the fleeting peaks of the market. Instead, they advocate for a focus on robust communities that endure, likening the crypto landscape to a “war of attrition.”

HODL Protocol, with a name that sounds like a battle cry, insists that momentum should dictate decisions rather than an obsession with market peaks. Their sage advice? Adaptability and a long-term vision are the keys to success.

In a similar vein, Crypto Nova, a seasoned sage of the trading world, warns against the folly of attempting to time the market’s apex. Instead, she suggests a gradual approach to profit-taking, regardless of whether the market continues its ascent. “This strategy,” she quips, “will ultimately leave most traders in the dust.”

“Hear it from someone that has been here for quite a while: Don’t ever try to time to the top on anything. Not on Bitcoin, not on your favorite alts, not on anything. Eventually, the goal is to take profits before the top of the market happens. Regardless if it keeps running or not. Do that and you’ll outperform almost anyone in this entire space,” the analyst jested, as if imparting the wisdom of the ages.

The Trump Effect: A Curious Influence on Bitcoin

In another corner of this financial circus, analyst Crypthoem presents a theory that would make even the most seasoned conspiracy theorist raise an eyebrow. He posits that the Trump family’s strategic announcements regarding tariffs and liquidity events have been orchestrated to depress altcoin prices, thus rendering Ethereum (ETH) a tantalizing bargain for astute investors.

“Release TRUMP Sucks liquidity out of all alts, allows world liberty fi to buy cheap ETH. Release MELANIA Dumps all alts, allows world liberty fi to buy cheap ETH. Announcing tariffs causes a liquidation cascade in an already weak altcoin market, allowing the world liberty fi to buy cheap ETH. Calls of tariffs bags have been filled,” Hoem wrote, as if narrating a Shakespearean drama.

This theory suggests that such events create shakeouts that ultimately benefit the well-positioned players, much like a game of chess where the pawns are sacrificed for the greater good.

Nachi, a top trader on Binance, discerns a pattern in Trump’s market influence, suggesting that the recent tariff news was a calculated political maneuver designed to create a crisis, shake out traders, and allow major investors to accumulate Ethereum at lower prices. He foresees this cycle repeating with China, leading to further shakeouts before another grand price rally.

Ran Neuner, founder of Crypto Banter, echoes this sentiment, referencing Eric Trump’s tweet suggesting, “It’s a great time to add ETH.” The tweet, later edited, has led analysts like Duo Nine to speculate about potential insider knowledge, as if the Trumps were the ultimate puppeteers of the crypto stage.

“The Trumps are the ultimate KOL,” Neuner remarked, as if bestowing a title of nobility upon them.

However, The DeFi Investor counters this narrative, arguing that Trump’s DeFi project had already amassed over $100 million worth of Ethereum before the tariff announcement, thus suffering alongside the rest of the market.

Proceed with Caution: Navigating Market Uncertainty

Despite the glimmers of hope, some analysts urge a cautious approach. Andrew Kang believes the recent rally was merely a mechanical bounce and advises traders to secure their profits while they can.

“Massive mechanical bounce today. If you made good profits, IMO it is a good spot to secure them. Easy mode is over for alts. Mean reversion buyers turn into mean reversion sellers. There will be more great buying opportunities in February/March,” Kang advised, as if foreseeing the future.

In a similar tone, Binaso encourages traders to cash out profits into their bank accounts rather than stablecoins or other crypto assets, advocating for a disciplined approach to securing gains. Others echo this skepticism, highlighting the excessive leverage in the market as traders have been front-running Bitcoin’s rise since $15,000. Nevertheless, with open interest still at extreme levels, the specter of a correction looms large.

Sachin Sharma, a market analyst, refutes the notion of an imminent crash, asserting that true market tops are typically marked by excessive speculation and unsustainable valuations, which, in his view, have not yet materialized. He argues that AI-driven innovations are more likely to fuel growth than to precipitate a downturn.

“Market tops near when IPO and speculative growth tech is going up with no revenue to back. As a sector, tech financial metrics are still within 1-sigma to mean. And BTW the whole AI saga which is leading the market to dip today comes with a promise that you can use AI to improve productivity, products, cash cycle, lower costs, and higher revenues,” the analyst challenged, as if delivering a manifesto.

However, Evanss6 takes a firm stance, estimating a 90-95% chance that the cycle has indeed topped.

As the debate over whether the crypto market has reached its pinnacle rages on, traders must navigate this treacherous landscape with caution. Balancing optimism with prudent risk management strategies is essential for maximizing gains, yet investors must also embark on their own quest for knowledge.

As of this writing, BeInCrypto data reveals that BTC is trading at $98,900, having risen over 5% since the opening of Tuesday’s session. A fitting reminder that in the world of crypto, fortunes can change as swiftly as the wind.

Read More

2025-02-04 11:17