In the tumultuous realm of Bitcoin, the digital construct known as BTC, we bear witness to a most disheartening spectacle. It is a tale plagued by tumult and irony. Having dared to breach the hallowed boundaries of $117,000, our brave Bitcoin faced a malignant rejection, an act reminiscent of a poorly executed joke, swiftly resulting in a cascade of despair and liquidation.

Technical Analysis: Or How to Lose Friends and Alienate Support Levels

By Shayan

The Daily Chart, or the Tragedy of Ambition

On the candlestick stage of the daily chart, our valiant BTC, having ascended to the lofty heights above $117K, met its fate in a swift descent, mirroring Icarus’s all-too-familiar fall. Descending beneath the 100-day moving average, a besmirched hero now flirts precariously with the $113K mark, a point previously revered, now rendered a charlatan in the theater of finance.

Should this tepid support manage to withstand the blows of fate, our friend Bitcoin could muster the strength for a comeback, eyeing a return to the hallowed $117K. However, the specter of deeper despair lurks in the shadows, peering from the $108K-$110K range-a last stand for weary bulls, a battlefield destined for chaos.

The 4-Hour Chart: A Comedy of Errors

Upon examining the 4-hour mesh of time, one can easily envision the liquidity sweep above $117K, followed by the heart-wrenching breakdown of the once-proud ascending trendline-a dramatic shift in the short-term momentum, not unlike the unfortunate life decisions we all occasionally make.

The resulting selloff has careened the price towards the demand zone surrounding $110K-a veritable crossroads where ambitious traders exchange glances, weighing the options of salvation or further descent. A valiant bounce might restore the bullish ambiance, but beware, for failure to cling to the $110K sanctuary could unveil a new vulnerability, attracting the ominous liquidity pool below $107K like a moth to a flame.

On-chain Analysis: The Avalanche of Liquidation

By Shayan

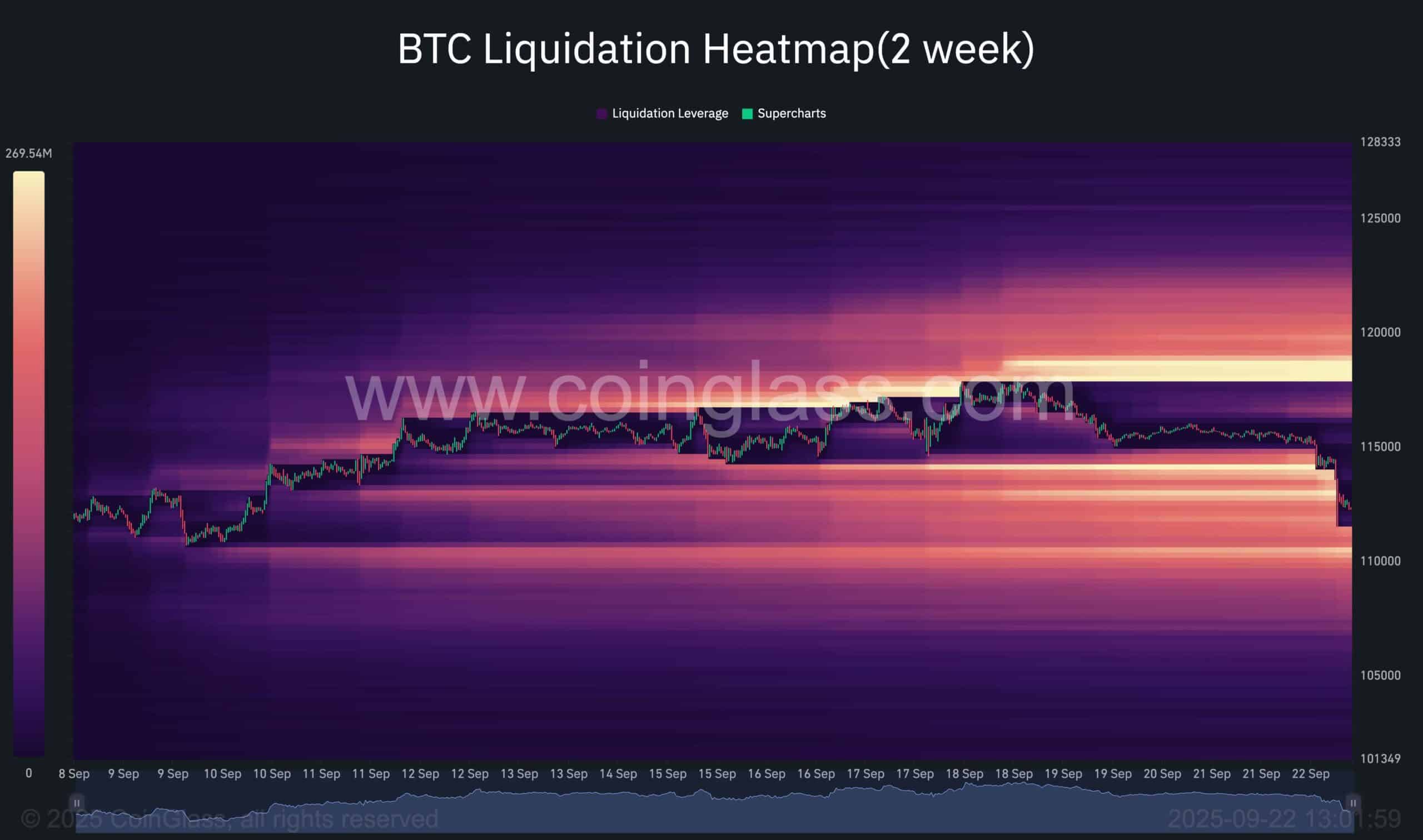

The liquidation heatmap, a comical landscape of digital misfortune, reveals the truth: our Bitcoin’s downfall was no mere whim but a glorious long squeeze! As Bitcoin frolicked in the $117K-$118K fields, hubristic long positions bloomed, awaiting a calamity which was, it seems, just over the horizon.

With the inability to maintain its elevation, a wave of liquidations surged forth, sweeping through the land and cleansing the leveraged longs, driving BTC into the humble territory of $110K-$112K, where ephemeral liquidity clusters begin to emerge, as if mocking the former highs.

In the grand theater of the market, liquidity events reign supreme-forcing sharp moves, long squeezes guised as herculean forces of correction. The heatmap betrays the existence of resting liquidity beneath the current lows, a siren’s call for price should the pressure continue to mount.

For the bulls hoping to reclaim lost glory, the looming question remains: has this liquidation purged enough excess to allow a stable recovery? Should demand spring forth from the depths of $110K, perhaps we shall see another gallant attempt at resurgence. Until then, vigilance is borne of uncertainty, as the specter of future squeezes hovers, ever watchful and eager for the unwary.

Read More

- Gold Rate Forecast

- Top 15 Insanely Popular Android Games

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- Why Nio Stock Skyrocketed Today

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- EUR UAH PREDICTION

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

- EUR TRY PREDICTION

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

2025-09-22 17:13