So, Bitcoin [BTC] is throwing a diva fit—price buzzing above $100k like it’s the hottest club in town, but guess what? The retail crowd is ghosting like it’s Monday morning. 🎉

- Exchange outflows skyrocketed, reserves took a nosedive—looks like someone’s been sneaking off with the stash.

- The big guns—large transactions—are hogging all the spotlight, but the average Joe’s activity? About as lively as a Monday morning Zoom call.

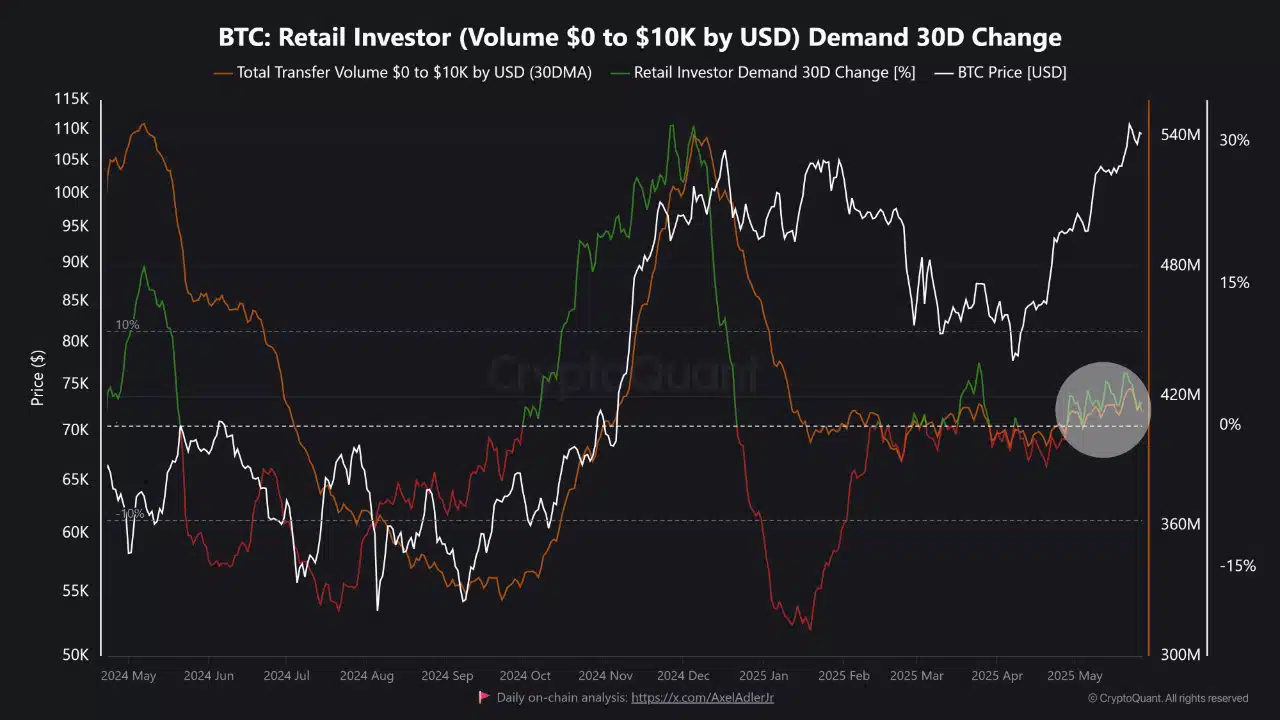

Bitcoin’s 30-day small investor activity? Basically flatlining. Despite the shiny upward movement, retail isn’t buying what the price is selling. 🤷♂️

This could mean whales—those mysterious deep-pocketed creatures—are steering the ship while retail sits in the crow’s nest, waving from afar. Historically, the real bull runs? Powered by your friendly neighborhood HODLers. But nope, we’re in silent mode now.

Without the crowd getting involved, this momentum might be just a pretty face—high but fragile. All while Bitcoin struts above $100k, pretending everything’s fine.

Valuations Are Giving Off ‘Overcooked’ Vibes

May 28th saw a brutal breakup—$721 million left the exchange party, while just shy of it, $616 million tried to crash the scene again. The reserves? Dropped 0.96%, now chilling at $266.49 billion—probably hiding in some digital bunker.

Less BTC available on the exchange? Classic sign that folks are stealing away for the long haul or handing over the keys to the big whales—because who needs liquidity anyway? Not them, apparently.

And the indicators? Showing signs of a tired, overstretched hype train. The NVT Golden Cross? Fell 26.06% to 1.075, like a teenager’s energy after too much sugar. Meanwhile, miners’ revenue metrics? Also taking a nosedive—11.22% to 1.297. The party might be over, or just getting started underground.

Retail Ghost Town & Whale Watching

While Bitcoin struts around like a rockstar, its network activity is in a slump—new addresses down 5.93%, active addresses down 6.46%, and unclaimed wallets dropping nearly 10%. Even the bots seem to have taken a coffee break.

In a true bull scenario, these numbers’d be booming—everyone scrambling to hop on the bandwagon. But nope, it’s a ghost town, and the big players are calling the shots.

And the transaction profiles? Oh boy, they’re about as symmetrical as a bad Tinder date. Tiny transactions under $100? Crashed by 66.38%. But transactions over $10 million? Up 59.26%. Looks like the pricey folks are throwing big bucks around, while the common folk stay on the sidelines—probably eating popcorn and watching the show.

This all hints: it’s the whales’ moment—big moves, small participation. But can such a rally last without the retail crowd jumping in? Stay tuned… or not.

Can This Bubble Last Without the Little Guys?

Bitcoin’s recent pump seems powered more by institutions and long-term holders—the rich kids of crypto—who’re quietly removing their stash from exchanges and whispering “trust us” to their wallets. 🕵️♂️

But here’s the catch: valuation metrics are cooling, address activity is fading, and retail transaction volumes are dropping faster than your patience during a slow Wi-Fi day. Without the retail troops, this rocket might be more of a hot air balloon—pretty but fragile.

If Bitcoin’s going to keep its crown and not crash-land, it needs the regular folks—your neighbor, the barista, that random guy—back in the game. They’re the real fuel for long-term sustainability, not just the whales throwing their weight around. 😉

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- 30 Best Couple/Wife Swap Movies You Need to See

- USD ILS PREDICTION

- Ncuti Gatwa Exits Doctor Who Amidst Controversy and Ratings Crisis!

- DC: Dark Legion The Bleed & Hypertime Tracker Schedule

- 9 Kings Early Access review: Blood for the Blood King

- All 6 ‘Final Destination’ Movies in Order

- Summoners War Tier List – The Best Monsters to Recruit in 2025

- Every Minecraft update ranked from worst to best

- Clair Obscur: Expedition 33 – All Act 3 optional bosses and where to find them

2025-05-29 09:15