Ah, Berachain (BERA), that elusive creature of the market, currently floundering around the $6.05 mark, with a market cap that teeters precariously near $653 million, having retreated from its recent high of $7.08, a peak reached on the fateful day of March 17.

In this grand theater of finance, our dear asset has been consolidating, much like a philosopher pondering the meaning of existence, after a recent price drop. The technical indicators, those fickle friends, whisper mixed signals into the ears of the weary traders. While the bearish trends still loom like dark clouds, faint glimmers of bullish momentum dare to emerge, as if mocking the very nature of despair.

Berachain RSI: A Glimmer of Hope or Just a Fool’s Errand?

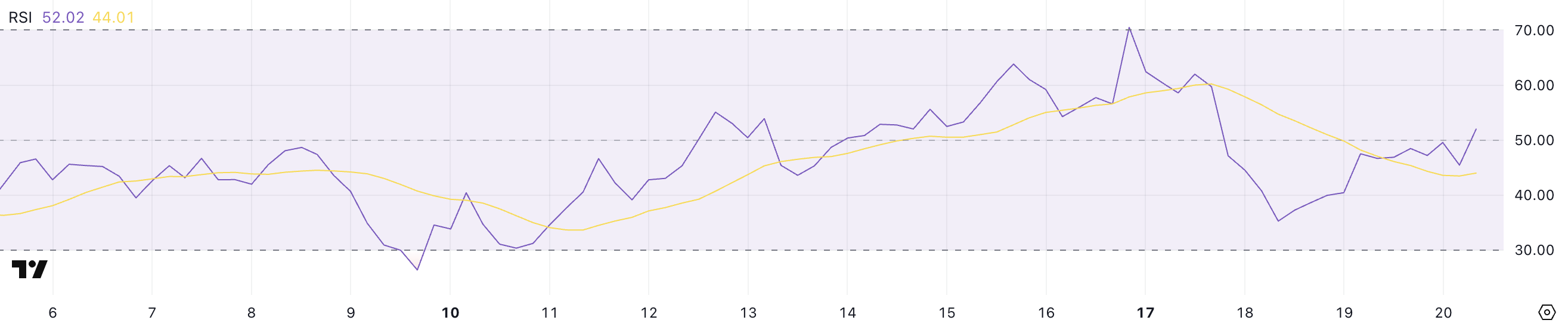

Behold! Berachain shows signs of stabilizing after a tempest of volatility, with its RSI now perched at 52, a noble rise from the depths of 35 just two days prior.

This rebound follows a sharp decline from an overbought level of 70.5, a height reached four days ago before the RSI, like a weary traveler, cooled off.

The ascent back above 50 suggests that bullish momentum is attempting to reclaim its throne after the recent correction, though the market remains a delicate balance between buyers and sellers, like a tightrope walker on the verge of a fall.

The RSI (Relative Strength Index), that ever-elusive momentum oscillator, measures the speed and magnitude of recent price changes, helping to identify potential overbought or oversold conditions.

Typically, an RSI above 70 signals that an asset might be overbought and due for a pullback, while an RSI below 30 points to oversold conditions, which could precede a price bounce.

With BERA’s RSI at 52, it finds itself in neutral territory, signaling neither an overbought nor an oversold condition. This suggests that while the selling pressure has eased, buyers must muster more momentum to drive a sustained uptrend, lest they remain mere spectators in this tragicomedy of finance.

BERA CMF: A Rising Tide or Just a Gentle Breeze?

Ah, the Berachain CMF, currently at -0.01, an improvement from -0.23 yesterday, indicating that selling pressure has begun to ease, like a sigh of relief in a crowded theater.

However, despite this slight recovery, the CMF still hovers in negative territory, suggesting that the market is yet to witness strong capital inflows, much like a party without guests.

What’s notable is that BERA’s CMF hasn’t climbed above 0.10 since March 14, signaling a prolonged period of weak buying volume and cautious investor sentiment, as if the investors are waiting for a sign from the heavens.

The Chaikin Money Flow (CMF), that volume-based indicator, measures the flow of money into and out of an asset over a given period.

Values above 0 indicate buying pressure or accumulation, while values below 0 signal selling pressure or distribution. With BERA’s CMF still near neutral but below zero, it shows that while sellers are losing momentum, buyers have yet to take control firmly, like a timid child at a school dance.

Until the CMF decisively pushes into positive territory – particularly above 0.10 – any upward price movement may struggle to sustain itself without stronger capital inflows, much like a ship without wind in its sails.

Can Berachain Surge To $7? The Eternal Question!

Alas, the Berachain EMA lines continue to reflect a bearish setup, with short-term moving averages languishing below the long-term ones.

This indicates that downward momentum still dominates the market, a cruel twist of fate. However, if Berachain manages to reverse this trend and build bullish momentum, the price could first target the resistance around $7.14, a tantalizing prospect.

A breakout above this level could open the door for a move toward $7.50

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Gold Rate Forecast

- Batman and Deadpool Unite: Epic DC/Marvel Crossover One-Shots Coming Soon!

- Who was Peter Kwong? Learn as Big Trouble in Little China and The Golden Child Actor Dies at 73

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- Hunter Schafer Rumored to Play Princess Zelda in Live-Action Zelda Movie

- 30 Best Couple/Wife Swap Movies You Need to See

- SEGA Confirms Sonic and More for Nintendo Switch 2 Launch Day on June 5

- Gachiakuta Chapter 139: Rudo And Enjin Team Up Against Mymo—Recap, Release Date, Where To Read And More

2025-03-21 03:22