Ah, Berachain (BERA), that whimsical creature of the market, has decided to rise by a modest 7% in the last 24 hours, nudging its market cap above the lofty heights of $900 million. One might say it’s like watching a tortoise sprint past a hare, supported by the strong technical indicators that whisper sweet nothings of overbought levels and buyers who seem to have taken control of the dance floor. 💃

Should this delightful uptrend persist, we might see BERA frolicking above $8.5, perhaps even daring to challenge the formidable resistance at $9. But beware, dear reader! If the momentum wanes, we may find ourselves testing the key support levels at $6.18 and $5.48, which could determine our next dramatic twist in this financial tale.

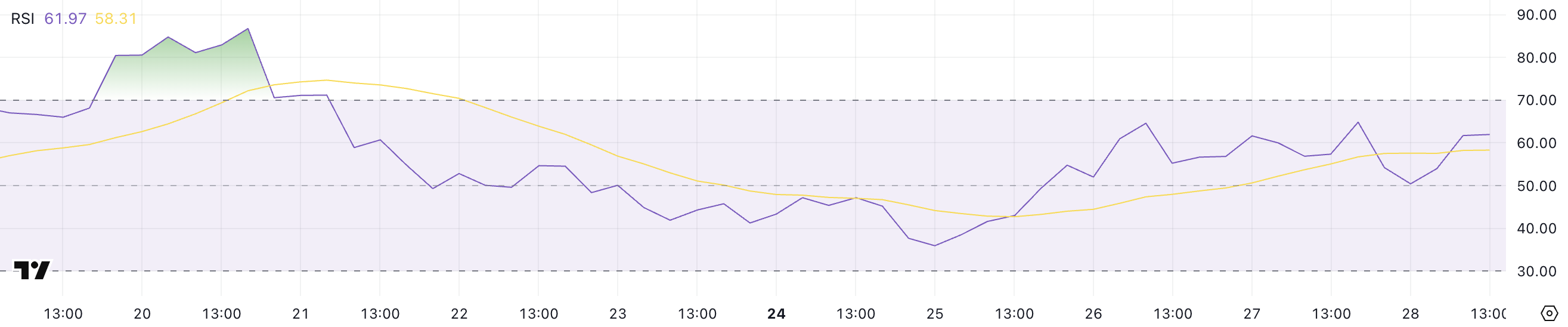

Berachain RSI Is Close to 70

Currently, Berachain’s RSI stands at a rather respectable 61.97, having risen from a rather dismal 35.9 just three days ago, after a long, neutral slumber of eight days. The Relative Strength Index (RSI) is like a mood ring for prices, measuring the speed and change of price movements, ranging from 0 to 100. 🌈

When the RSI flirts with 70, it suggests overbought conditions, hinting at a potential pullback, while a dip below 30 signals oversold conditions, indicating a possible rebound. An RSI nestled comfortably between 30 and 70 is generally considered neutral, reflecting a lack of strong directional bias—much like a politician during an election. 🗳️

With Berachain’s RSI at 61.97, it’s tiptoeing towards the overbought threshold but remains in neutral territory for now. This increase suggests a growing bullish momentum and buying interest, indicating that BERA could continue to rise if the RSI decides to get a little closer to 70. But, if it crosses into overbought territory, we might witness a short-term pullback or a consolidation phase as traders take their well-deserved profits. The next price movement will depend on whether the buyers keep the party going or if the sellers crash the bash as the RSI approaches overbought levels.

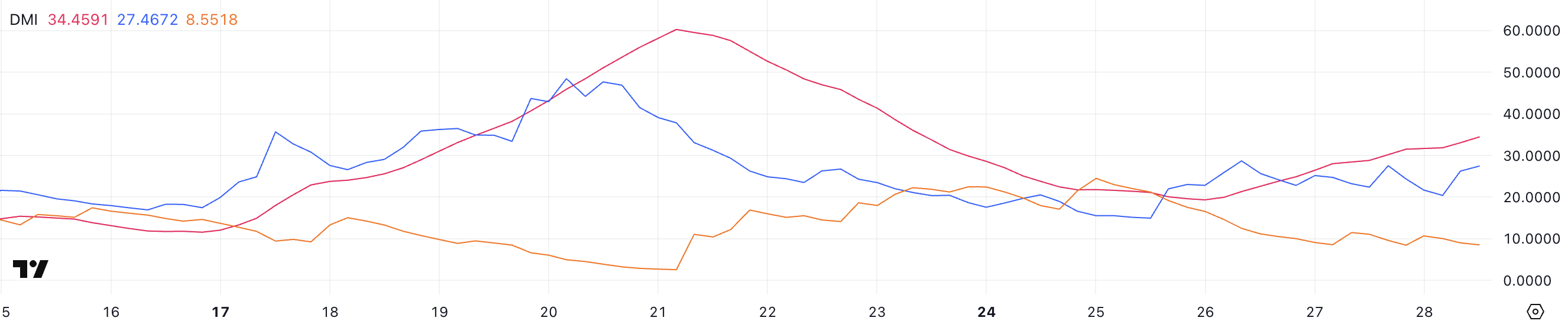

BERA DMI Shows Buyers Are In Control

Berachain’s DMI reveals that its ADX is currently at 34.4, having risen from a mere 19.3 two days ago, after previously reaching a dizzying 60.2 a week ago when BERA’s price surpassed $8.5. The Average Directional Index (ADX) measures the strength of a trend without revealing its direction, ranging from 0 to 100—like a compass that refuses to point north. 🧭

An ADX above 25 signals a strong trend, while values below 20 suggest a weak or non-trending market. The increase in ADX indicates that the current uptrend is gaining strength, reflecting growing momentum and market conviction—much like a cat gaining confidence before pouncing on an unsuspecting mouse.

Meanwhile, BERA’s +DI is at 27.4, showcasing strong buying pressure, while the -DI is at 8.55, down from 11.1 two days ago, indicating that the sellers are losing their grip. This configuration confirms that BERA is in an uptrend, with buyers clearly in control. The widening gap between the +DI and -DI suggests that the bullish momentum is increasing, making a continuation of the uptrend more likely. As long as the +DI remains above the -DI and ADX stays above 25, BERA is likely to maintain its upward trajectory—like a kite soaring high in the sky. 🪂

Will BERA Reclaim Levels Above $9 In March?

Berachain (BERA) could be on its way to retest levels above $8.5, and if the current uptrend continues to gain momentum, it could rise further to challenge resistance above $9.

With a market cap of $884 million, the $1 billion threshold could be a crucial level to watch in

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Gold Rate Forecast

- Batman and Deadpool Unite: Epic DC/Marvel Crossover One-Shots Coming Soon!

- Who was Peter Kwong? Learn as Big Trouble in Little China and The Golden Child Actor Dies at 73

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- Hunter Schafer Rumored to Play Princess Zelda in Live-Action Zelda Movie

- 30 Best Couple/Wife Swap Movies You Need to See

- SEGA Confirms Sonic and More for Nintendo Switch 2 Launch Day on June 5

- Gachiakuta Chapter 139: Rudo And Enjin Team Up Against Mymo—Recap, Release Date, Where To Read And More

2025-03-01 07:05