On the twelfth day of February, in the year of our crypto lord, B3’s price leapt like a jackrabbit, soaring nearly 50%. This meteoric rise has made it one of the fastest-growing tokens on the Base chain, a place where dreams of digital riches are spun like cotton candy at a county fair. Founded by the bright-eyed former members of the Base team, B3 has become the talk of the town, a gaming coin that has folks buzzing like bees in a blooming orchard. 🐝

But hold your horses! Despite this gallant rally, the technical indicators are whispering sweet nothings of caution. The momentum is easing, and selling pressure is creeping in like a cat burglar in the night. Will B3 keep its bullish swagger, or will it tumble down the rabbit hole of correction? Only time will tell, and it all hinges on those pesky support and resistance levels lurking in the shadows.

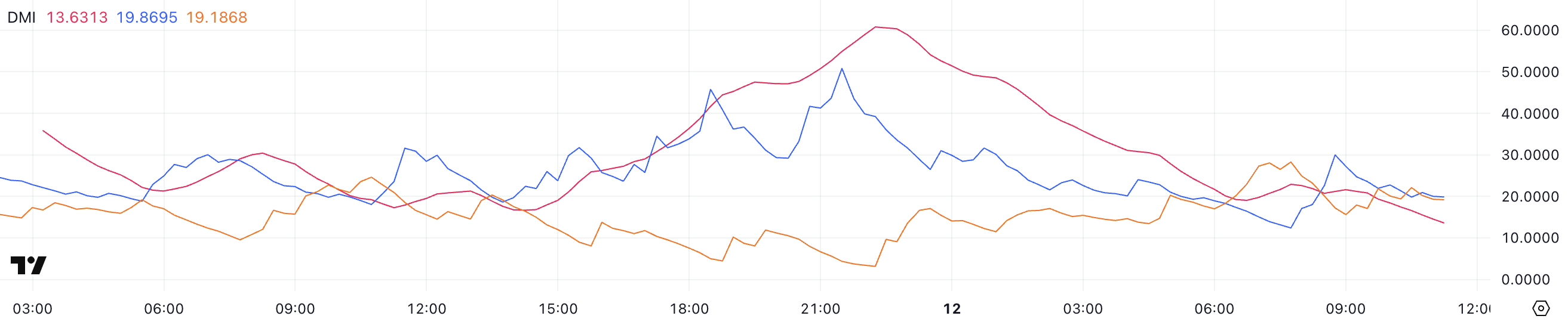

DMI Chart Shows B3 Trend Is Easing

B3, that self-proclaimed “Open Gaming Layer-3,” has seen its DMI chart take a nosedive, with the ADX plummeting from a robust 60.8 to a mere 13.6 in just twelve hours. It’s like watching a once-mighty oak tree lose its leaves in the autumn wind, signaling a rapid loss of trend strength. 🌳

The ADX, that fickle friend, measures the strength of a trend. Values above 25 are the life of the party, while those below 20 are the wallflowers, suggesting weakness or a good old-fashioned consolidation. A sudden drop like this? Well, it often hints at a fading momentum or a potential market direction shift, like a ship lost at sea.

Even with this trend strength decline, B3 is still riding high on an uptrend, as indicated by the +DI at 19.8, though it has slipped from 30. Meanwhile, the -DI has risen from 15.6 to 19.1, showing that selling pressure is knocking at the door, ready to crash the party. 🎉

With the +DI and -DI playing a game of tug-of-war, the market stands at a crossroads. A decisive move could define the next trend, like a coin toss deciding the fate of a weary traveler. If the +DI regains its strength, the uptrend could resume, but if the -DI keeps climbing, B3 might just find itself in a consolidation phase or worse, a downtrend. Since yesterday, B3 has surged to become the 9th biggest asset on Base, outpacing even the likes of AIXBT. Talk about a Cinderella story! 👑

With its recent surge, it has claimed the title of the biggest gaming coin in the Base ecosystem. Who knew gaming could be so lucrative?

B3 CMF Is Currently Negative, After Staying Positive Between Yesterday and Today

Now, let’s talk about B3’s CMF, which is currently sitting at a cozy -0.08 after enjoying a positive stay for several hours. The Chaikin Money Flow (CMF) measures the buying and selling pressure based on volume and price action. Values above zero are like a warm hug, indicating accumulation, while those below zero are more like a cold shower, signaling distribution. 🥶

A rising CMF suggests that buying interest is stronger than a double shot of espresso, while a declining or negative CMF points to increasing selling pressure, like a balloon losing air. Earlier, B3’s CMF dipped to a negative peak of -0.22, showcasing a brief period of heavy outflows before attempting to recover. Talk about a rollercoaster ride!

Although B3’s CMF has bounced back from its lowest lows, its lingering negativity at -0.08 suggests that selling pressure is still lurking like a shadow. This could mean that bullish momentum is weakening, making it harder for the price to keep climbing. If the CMF continues to recover and turns positive again, it would signal renewed accumulation, potentially supporting a price rebound. But if it declines further, we might be looking at a sell-off that could lead to more downside or a prolonged consolidation. Buckle up

Read More

- Does Oblivion Remastered have mod support?

- Thunderbolts: Marvel’s Next Box Office Disaster?

- To Be Hero X: Everything You Need To Know About The Upcoming Anime

- 30 Best Couple/Wife Swap Movies You Need to See

- DC: Dark Legion The Bleed & Hypertime Tracker Schedule

- Clair Obscur: Expedition 33 ending explained – Who should you side with?

- Summoners War Tier List – The Best Monsters to Recruit in 2025

- Elder Scrolls Oblivion Remastered: Best Paladin Build

- Demon Slayer: All 6 infinity Castle Fights EXPLORED

- Clair Obscur: Expedition 33 – All Act 3 optional bosses and where to find them

2025-02-13 05:12