As a seasoned researcher with over two decades of experience in the financial industry, I have witnessed numerous regulatory changes that impacted various markets and industries. The recent decision by the IRS and Treasury Department to expand the definition of a “broker” to encompass decentralized exchanges and other DeFi front-end services is no exception.

Having closely followed the development of cryptocurrencies since their inception, I have seen both the promise and challenges that this innovative technology presents. The move by the government to increase transparency in the crypto market is understandable, but imposing excessive compliance burdens on software developers could potentially stifle innovation and drive DeFi operations overseas.

The joint lawsuit filed by several advocacy organizations against the IRS’s expanded broker definition raises valid concerns about privacy, constitutional rights, and statutory authority. It remains to be seen how this legal challenge will unfold, but it is crucial that policymakers tread carefully to avoid unintended consequences.

Prominent figures in the industry have called on Congress to intervene, highlighting the potential impacts on decentralized platforms. I agree with their call for legislative intervention, as it is essential that regulations are crafted thoughtfully and collaboratively to ensure a balanced approach that encourages growth while protecting taxpayers and maintaining market integrity.

In my opinion, striking the right balance between regulation and innovation will be key to fostering a vibrant and responsible crypto ecosystem. In the meantime, I can’t help but wonder if the timing of the rule’s release during the holiday season was indeed a calculated decision to minimize industry pushback – much like trying to sneak spinach into a child’s dinner under a blanket of cheese.

Joke: I guess we’ll just have to wait and see if this new rule will be as easy to swallow as Brussels sprouts for the crypto community!

Starting from December 27th, the IRS and Treasury Department have broadened the term “broker” to include decentralized exchanges and other DeFi user interfaces. This means these platforms will now be required to disclose all digital asset transactions, including information about the taxpayers involved, as part of an effort to increase transparency within the cryptocurrency market. The new rule will become active in 2027.

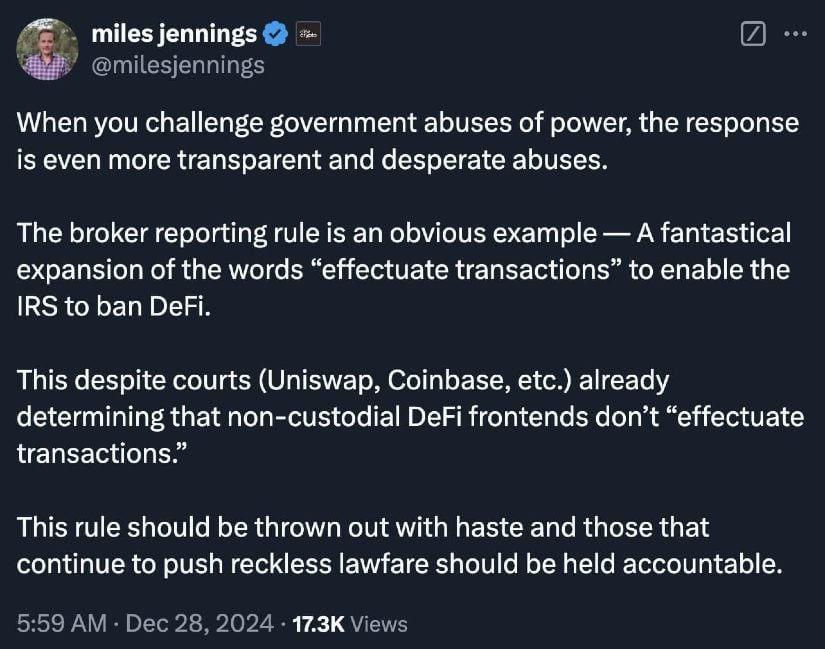

As a researcher delving into the world of Decentralized Finance (DeFi), I’ve noticed a heated debate within the crypto community regarding the proposed extension of broker obligations to DeFi operators by the Internal Revenue Service (IRS). Critics argue that this move imposes undue compliance burdens, particularly on software developers building trading interfaces. Bill Hughes, a lawyer at Consensys, suggests that the timing of this rule release, during a holiday period, was deliberately chosen to “minimize industry pushback.” Miles Jennings, General Counsel at a16z Crypto, labels this new requirement as a “drastic overreach,” stating it’s an attempt to restrict DeFi operations.

Legal Challenge

On December 27th, a collective legal action was initiated by three advocacy groups: the Blockchain Association, DeFi Education Fund, and the Texas Blockchain Council. They argue that the Internal Revenue Service’s broad interpretation of the term “broker,” as stated in its new regulations, contradicts the Administrative Procedure Act (APA) and encroaches upon privacy and constitutional freedoms.

The lawsuit claims that the actions taken by the Department of the Treasury and the Internal Revenue Service were both illegal and violated the constitution.

Marisa Coppel, Legal Head at the Blockchain Association, has stated that the IRS and Treasury Department are overstepping their legal boundaries by broadening the term ‘broker’ to encompass providers of Decentralized Finance (DeFi) trading interfaces. This action is problematic as it not only threatens the privacy rights of individuals utilizing decentralized technology, but could also drive this rapidly growing tech sector overseas.

Industry and Legislative Response

Leading professionals in the field are urging Congress to take action. Alexander Grieve, who holds the position of Vice President for Government Affairs at Paradigm, has suggested that legislators use the Congressional Review Act (CRA) procedure next year to rescind the recently implemented regulations. “The Treasury/IRS has issued their DeFi broker guidelines… The incoming pro-cryptocurrency Congress can, and it is advisable for them to, reverse these regulations via the CRA process next year,” Grieve expressed in a post.

Representatives French Hill and Patrick McHenry have made it clear they oppose the new regulations. In a social media post, Hill called the move “an excessive action by the Treasury” and labeled it as “a transparent and sloppy effort to control DeFi.” He also implied that rushing through the measure during the final days of the Biden-Harris Administration ignored bipartisan concerns.

Experts such as Alex Thorn from Galaxy Digital have emphasized the possible effects on decentralized systems. Thorn proposes that operators in the Decentralized Finance (DeFi) sector could potentially have three primary options to consider, should the current regulation persist.

- Comply with the IRS reporting requirements and accept the brokerage designation,

- Restrict access for U.S. users to bypass reporting obligations, or

- Limit or abandon any front-end functionalities and revenue generation, effectively operating through highly decentralized, autonomous smart contracts without collecting fees.

In simpler terms, Thorn pointed out that highly decentralized applications are unable to identify and therefore cannot meet the reporting obligations of brokers.

As new lawsuits unfold, the cryptocurrency community is gearing up for extended court cases and possible governmental regulations in the upcoming year.

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Gold Rate Forecast

- Batman and Deadpool Unite: Epic DC/Marvel Crossover One-Shots Coming Soon!

- Who was Peter Kwong? Learn as Big Trouble in Little China and The Golden Child Actor Dies at 73

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Hunter Schafer Rumored to Play Princess Zelda in Live-Action Zelda Movie

- 30 Best Couple/Wife Swap Movies You Need to See

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- Gachiakuta Chapter 139: Rudo And Enjin Team Up Against Mymo—Recap, Release Date, Where To Read And More

- Summer Game Fest 2025 schedule and streams: all event start times

2024-12-30 11:42