IonQ’s stock has exhibited extraordinary performance, with a fivefold increase over 12 months. This trajectory reflects heightened investor interest in quantum computing’s disruptive potential. The company’s market capitalization has grown from $1.8 billion to $11.5 billion over five years, yet its long-term prospects hinge on technological milestones and market dynamics.

Technological Roadmap and Scalability

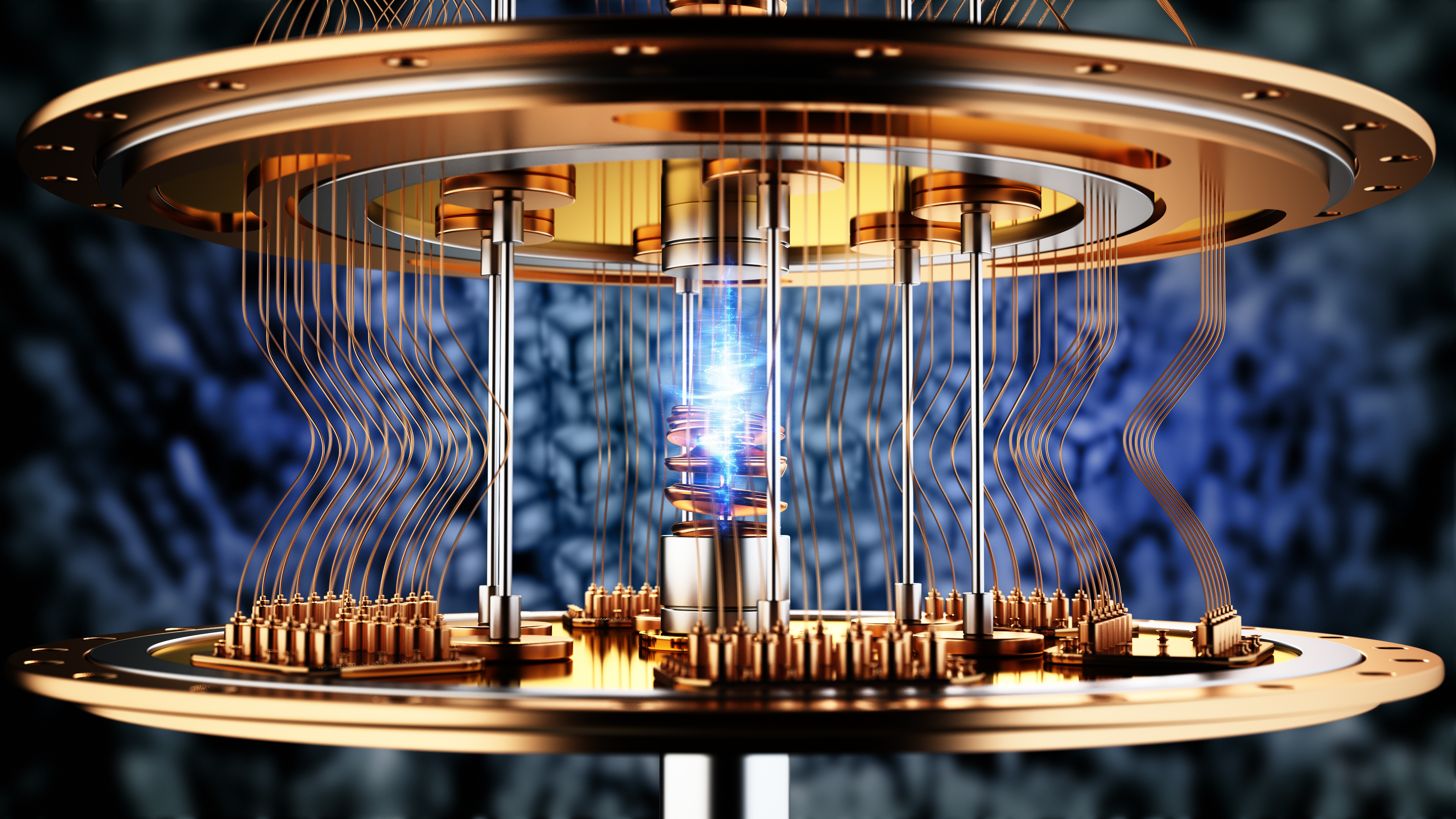

IonQ’s progress in quantum computing is anchored in its trapped-ion architecture, which offers inherent scalability. The company’s Forte system currently supports 36 physical qubits, with the Tempo system projected to expand to 100 by 2023. By 2030, IonQ aims to manage 2 million physical qubits, alongside 80,000 logical qubits-critical for error correction and practical applications.

Acquisition of Oxford Ionics enhances IonQ’s capacity to integrate qubits into silicon-based platforms, addressing a key challenge in quantum hardware. However, the transition from theoretical models to commercial viability remains contingent on overcoming engineering and material science barriers.

Market Position and Revenue Potential

IonQ’s revenue has grown at a compound annual growth rate of 175% since 2021. While sustaining this pace is improbable, conservative estimates suggest $500 million in annual revenue by 2030 under favorable conditions. Market forecasts indicate a $7.3 billion quantum computing sector by 2030, with McKinsey projecting an $87 billion addressable market by 2035.

Valuation multiples remain speculative, as IonQ’s current market cap reflects anticipation of future growth. A $25 billion valuation by 2030 appears plausible if the company meets its technical and commercial targets.

Risks and Competitive Landscape

Key risks include technological delays, execution risks, and competitive pressures. Rivals such as Google Quantum AI, IBM, and Microsoft possess superior financial resources and broader R&D capabilities. IonQ’s reliance on breakthroughs in error correction and qubit stability introduces uncertainty.

The company’s success will depend on its ability to monetize quantum computing beyond niche applications, such as drug discovery and AI model training. Broader commercial adoption remains conditional on solving scalability and cost challenges.

Investors should approach IonQ with measured optimism, recognizing both its transformative potential and the significant hurdles it faces. The quantum computing sector’s trajectory will ultimately be shaped by the interplay of innovation, capital allocation, and market demand. 🚀

Read More

- Gold Rate Forecast

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- HSR 3.7 story ending explained: What happened to the Chrysos Heirs?

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- ETH PREDICTION. ETH cryptocurrency

- Here Are the Best TV Shows to Stream this Weekend on Paramount+, Including ‘48 Hours’

- ‘Zootopia+’ Tops Disney+’s Top 10 Most-Watched Shows List of the Week

- ‘Zootopia 2’ Wins Over Critics with Strong Reviews and High Rotten Tomatoes Score

- Games That Faced Bans in Countries Over Political Themes

- The Labyrinth of Leveraged ETFs: A Direxion Dilemma

2025-08-28 12:27