Artificial intelligence stocks have been the belle of the ball in recent years, twirling markets upward like a particularly exuberant debutante. But while the AI ballroom echoes with clinking champagne glasses, another party is brewing in the lab next door: quantum computing. It’s the sort of technology that could make today’s unsolvable problems seem as trivial as forgetting where you left your car keys – assuming your car keys were orbiting Neptune on a banana-shaped spacecraft.

Enter IonQ (IONQ), a company that’s betting its future on the idea that quantum computing isn’t just science fiction, but a business plan. Investors have already thrown confetti over this notion, sending the stock up 1,200% over three years. Now, the question isn’t whether IonQ will invent a time machine (though that’s not ruled out), but whether you’ve missed the bus to Quantumville.

Solving Problems That Don’t Exist Yet

Quantum computing, for the uninitiated, is the art of solving problems so complex they’d make Einstein’s hair stand on end (which, admittedly, wasn’t hard). Classical computers use bits – zeros and ones – like a binary light switch that’s either on or off. Quantum computers use qubits, which are like light switches that exist in a superposition of states until you look at them, at which point they decide what they are. It’s Schrödinger’s switch, basically.

While giants like Alphabet and Microsoft dabble in quantum tinkering, IonQ is going all-in, like a gambler who’s decided to stake his house on a game of dice with the universe itself. The company’s ambition? To become the Nvidia of quantum computing – a one-stop shop for hardware, software, and existential dread. Unlike Nvidia’s graphics chips, though, IonQ’s trapped-ion technology involves actual ions, which are about as easy to handle as a room full of hyperactive ferrets wearing antigravity boots (if you’ve ever tried, which you probably haven’t, unless you run a particularly avant-garde zoo).

IonQ’s Reality Check

Right now, IonQ sells quantum hardware and services via cloud platforms like Microsoft Azure and Amazon Web Services – a bit like selling rocket fuel to aspiring astronauts, except the rockets are still being assembled in someone’s garage. Its consulting arm advises firms on “quantum readiness,” a term that sounds urgent until you realize most businesses are still trying to figure out how to work the printer.

Trapped-ion technology, IonQ’s chosen path, trades speed for accuracy – a bit like choosing a tortoise in a world full of hares. While superconducting qubits (used by rivals) are faster, they’re also prone to errors, which in quantum terms means “your calculation just collapsed into a puddle of existential uncertainty.” IonQ’s method, meanwhile, is like having a librarian proofreading every word – slower, but less likely to suggest that 2+2=5.

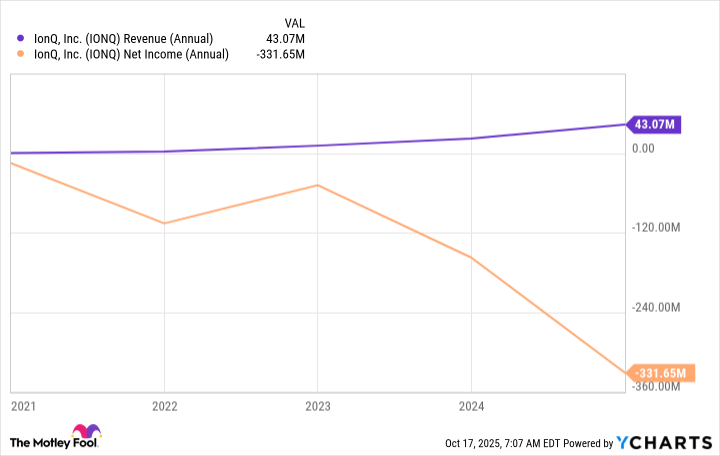

Money, Losses, and the Occasional Profit Mirage

Revenue? Up. Profits? Down. It’s the classic “build the future” playbook: spend lavishly on R&D, sprinkle in some moonshot rhetoric, and hope investors don’t notice the gaping hole in the balance sheet. IonQ’s losses are deepening faster than a philosopher’s thoughts at 3 a.m., but hey, quantum computing isn’t cheap – it’s like building a spaceship to go to the corner store.

So, should you buy now? If you’re the sort of investor who panics when your toaster breaks, IonQ is a hard pass. But if you enjoy volatility the way some people enjoy roller coasters (or existential crises), this could be your jam. Just remember: even if IonQ becomes the Nvidia of quantum computing – a company that sells everything but the kitchen sink, provided the sink is made of qubits – the road there might feel like hitchhiking through a black hole with only a towel and a faulty GPS.

In the grand cosmic lottery, IonQ is a ticket. Whether it’s a winning one? Well, as Adams might say: “The answer isn’t 42. It’s ‘Don’t Panic’ – and maybe diversify your portfolio.” 🚀

Read More

- Gold Rate Forecast

- Top 15 Insanely Popular Android Games

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- EUR UAH PREDICTION

- Silver Rate Forecast

- DOT PREDICTION. DOT cryptocurrency

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- Core Scientific’s Merger Meltdown: A Gogolian Tale

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

2025-10-18 17:01