The matter of IonQ, a company venturing into the ethereal realm of quantum computation, presents a spectacle not unlike the ambitions of men throughout history – a striving for mastery over forces beyond immediate comprehension. It is a tale of audacious hope and, one suspects, a considerable degree of speculative fervor. For years, the company existed as a quiet undertaking, a laboratory curiosity. Then, in the latter months of the year 2024, a peculiar excitement seized the market, a collective imagining of future wealth, and IonQ, along with its brethren, found itself borne aloft on a wave of investment. Over the span of five years, the stock has ascended, a gain of 277.7% – a figure that compels one to ponder the very nature of value, and whether it is truly built upon substance or merely the shifting sands of expectation.

But the question persists: has this ascent already captured all the potential reward, leaving only the inevitable reckoning? The field of quantum computation, while possessing a theoretical grandeur, is becoming increasingly crowded, a jostling of both established behemoths and nimble start-ups, each vying for dominance. One is reminded of the great landowners of old, each claiming a portion of the fertile land, and prepared to defend it with both cunning and force. Is IonQ, in this new landscape, still a prudent investment, or merely a vessel carrying the hopes – and the funds – of those who believe in a future yet unproven?

The Nature of the Qubit: A Delicate Balance

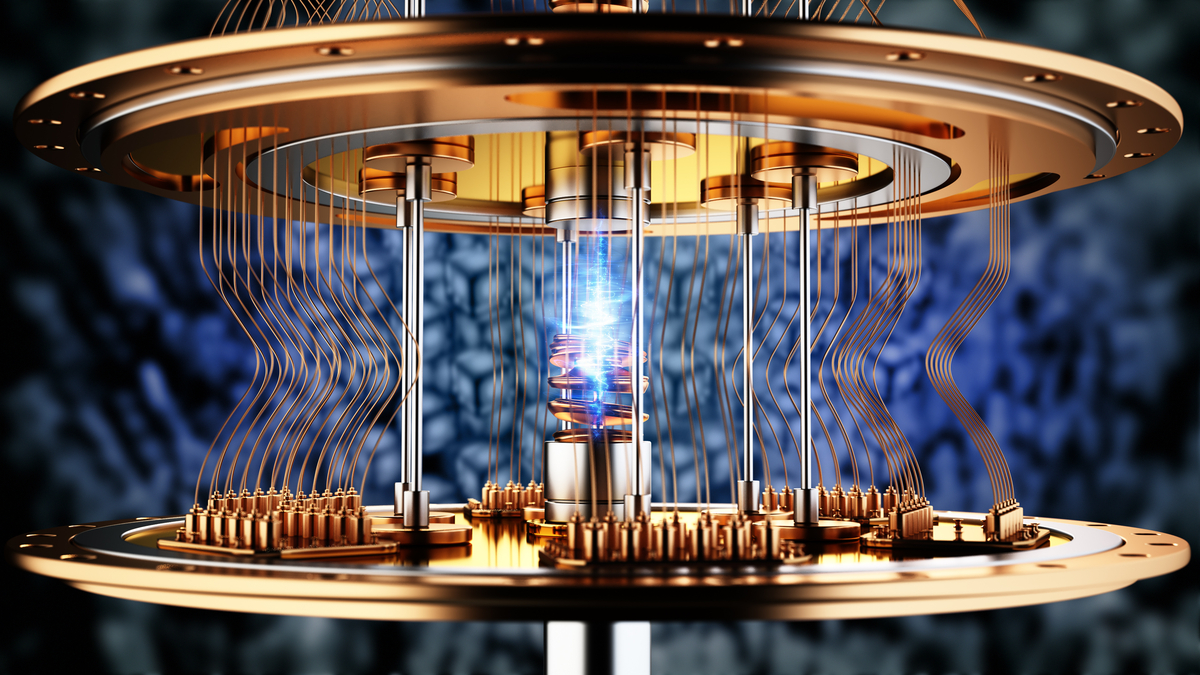

At the heart of this endeavor lies the qubit, the quantum analogue of the bit that forms the foundation of all modern computation. However, not all qubits are created equal, a truth often obscured by the enthusiasm of those who promote this technology. IonQ, it appears, has chosen a path of isolation, employing the “trapped-ion” method – suspending a single quantum particle within the embrace of a laser beam. This approach, while demanding in its execution, offers a degree of stability, a resistance to the errors that plague other methods, such as those relying on superconductors. Yet, the very stability that IonQ seeks comes at a cost – a slower processing speed. It is a familiar trade-off, one that echoes throughout the history of invention – the pursuit of perfection often requiring a sacrifice of immediacy.

The company has, with some justification, proclaimed an achievement of “four nines” (99.99%) 2-qubit gate fidelity – a measure of accuracy in quantum operations. This is a commendable feat, particularly as it was attained at a higher temperature than previously thought possible. This seemingly minor detail is, in fact, significant. In the realm of trapped ions, a substantial portion of the system’s runtime is devoted to cooling the particle, preparing it for the next computation. By demonstrating that high fidelity can be maintained at a warmer temperature, IonQ suggests a potential reduction in these cooling times, a path towards increased speed. Whether this promise will be fully realized remains to be seen, but it offers a glimmer of hope in a field often shrouded in complexity.

The Arms Race of Computation

Of course, while IonQ strives for speed, its rivals are focused on accuracy. Rigetti Computing, for example, boasts a system with 36 qubits, but with a fidelity of only 99.6%. The difference may seem small, but in the quantum world, even the smallest imperfection can have profound consequences. It is a relentless competition, a striving for the unattainable, a reminder that progress is rarely linear. The speed of Rigetti’s system, however, is noteworthy, achieving gate speeds of 50 to 70 nanoseconds – a claim that IonQ’s trapped-ion technology struggles to match. This, then, is the dilemma: accuracy versus speed, stability versus agility. The victor will likely be the one who can achieve the most harmonious balance, but the path to that equilibrium is fraught with challenges.

The entire undertaking resembles an arms race, a constant escalation of technology, a pursuit of dominance. The company that can scale its system to include the most qubits, while maintaining both accuracy and speed, is likely to emerge victorious. Cost, efficiency, and marketing will undoubtedly play a role, but ultimately, the most capable system will likely prevail. However, even if IonQ were to win this race, its stock may still not be a prudent investment at this juncture.

The Weight of Expectation

Currently, IonQ’s stock carries a valuation of $16.5 billion – a figure that seems almost fantastical when compared to established companies. Domino’s Pizza, GoDaddy, Roku, and DraftKings, all possess annual revenues between $4 billion and $5.5 billion, while IonQ’s revenue barely reaches $79.8 million. Furthermore, the company is burdened with a net loss of $1.5 billion – a sum that dwarfs those of its peers. This translates to a valuation of 142 times trailing sales, compared to the modest 2.5 to 3.5 of the aforementioned companies. It is a precarious position, a reliance on future potential rather than present reality.

Of course, IonQ is a nascent technology company in an emerging industry, and one hopes that it will eventually justify its high valuation. However, quantum computing is unlikely to break into the mainstream anytime soon. The company currently offers systems with 100 qubits, but commercially viable systems will likely require a million qubits – or more. IonQ’s management hopes to reach this threshold by 2030, but so do the engineers at Alphabet’s Google and IBM. Thus, investors who buy in now are committing to at least four years of intense competition and escalating research and development costs before the business is even commercially viable. It is a gamble, a wager on a future that is far from certain.

The Logic of Acquisition

Furthermore, IonQ appears to be pursuing an aggressive acquisition strategy, recently completing the purchase of Skyloom and announcing its intent to acquire SkyWater and Seed Innovations. While such expansion can be a sign of ambition, it also carries the risk of overextension. The company currently holds over $1 billion in cash and a mere $20 million in debt, but this cushion will not last indefinitely. It is likely that IonQ will need to issue more shares, diluting the value of current shareholders’ positions. This is a common tactic among growth companies, but it is one that investors should carefully consider.

IonQ is undoubtedly one of the premier quantum stocks available today, but with substantial gains already in the rearview mirror and an extraordinarily high valuation, investors who buy in now are taking a considerable risk. The stock is likely to experience both upward and downward fluctuations, a consequence of its inherent volatility. Long-term investors would be wise to wait for a more opportune moment, unless they possess an exceptionally high tolerance for risk and uncertainty. The allure of the future is strong, but the present demands prudence.

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- Banks & Shadows: A 2026 Outlook

- Gemini’s Execs Vanish Like Ghosts-Crypto’s Latest Drama!

- Wuchang Fallen Feathers Save File Location on PC

- QuantumScape: A Speculative Venture

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- ETH PREDICTION. ETH cryptocurrency

- When Wizards Buy Dragons: A Contrarian’s Guide to TDIV ETF

2026-02-02 11:24