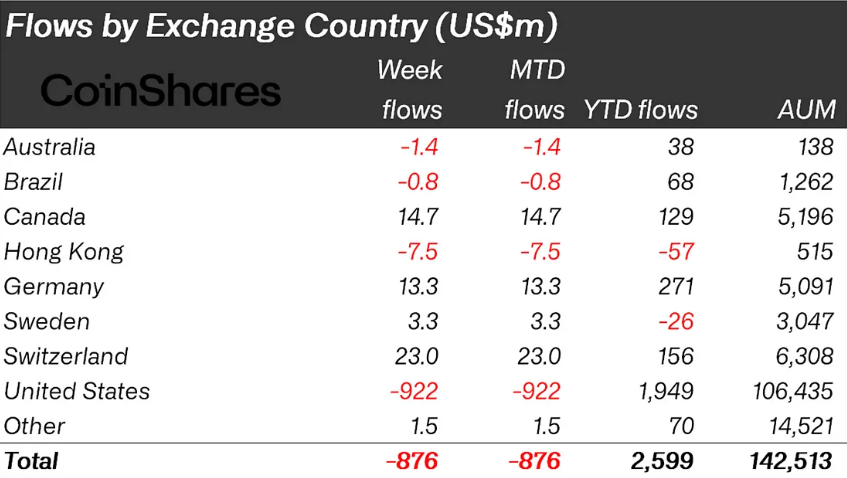

Last week, the crypto world witnessed a staggering outflow of $876 million, marking a delightful continuation of negative flows that have graced us for four consecutive weeks. How charming!

In total, we’ve seen a cumulative outflow of $4.75 billion over the past month. This has dramatically reduced the year-to-date inflows to a mere $2.6 billion. As a result, total assets under management (AuM) have taken a nosedive, plummeting by $39 billion from their peak, now resting at a cozy $142 billion—the lowest since mid-November 2024. Quite the rollercoaster, isn’t it?

Crypto Outflows Reach $876 Million

The latest CoinShares report reveals that US investors, in a fit of panic, led the charge, withdrawing a whopping $922 million from digital asset investment products. Meanwhile, in other parts of the world, investors seem to be treating the recent market pullback as a golden buying opportunity. Ah, the joys of differing perspectives!

Bitcoin, our beloved digital currency, remained the star of the show, with investors pulling $756 million from BTC investment products last week. Interestingly, short-Bitcoin products—those designed to profit from price declines—also saw outflows of $19.8 million, the largest since December 2024. It seems some investors are on the brink of capitulation, closing their short positions as uncertainty looms like a dark cloud.

Last week’s crypto outflows were yet another significant decline, following a record-breaking outflow of $2.9 billion in the first week of March. As BeInCrypto reported, this was fueled by weak investor sentiment and a healthy dose of market fear. Who doesn’t love a bit of fear in their investment strategy?

This followed $508 million in outflows the previous week, amid investor caution, and $415 million in withdrawals before that, all thanks to the Federal Reserve’s hawkish rhetoric and inflation concerns. What a delightful chain of events!

The Federal Reserve’s monetary policy has been shaping investor behavior like a sculptor with clay. As inflation exceeds expectations, the Fed has hinted that interest rates may remain elevated for a while, reducing liquidity in financial markets and weighing heavily on risk assets like crypto. How thoughtful of them!

“We do not need to be in a hurry, and are well positioned to wait for greater clarity,” Fed chair Jerome Powell stated last week, probably while sipping a cup of tea.

With four straight weeks of outflows and persistent macroeconomic headwinds, the crypto market remains under pressure. While certain assets like Solana (SOL) and XRP continue to attract inflows, the overall sentiment remains as cheerful as a rainy day, particularly among US investors.

If market conditions don’t improve, we might see further outflows in the coming weeks, reinforcing the cautious approach among investors. What a thrilling prospect!

Bitcoin and Ethereum ETFs Reflect Bearish Sentiment

The negative sentiment has extended its warm embrace beyond Bitcoin, affecting blockchain-related equity exchange-traded products (ETPs). CoinShares’ latest report indicates outflows of $48 million during the same period for these financial instruments. How generous!

This decline reflects a broader risk-off sentiment, with investors exercising caution across the digital asset sector. It aligns with a recent BeInCrypto report, which showed that Bitcoin ETFs recorded four weeks of net outflows surpassing $4.5 billion. Quite the achievement!

Similarly, Ethereum ETFs continued their negative trend, logging a second consecutive week of net outflows. These negative flows come despite the anticipation surrounding last week’s White House Crypto Summit. It seems macroeconomic concerns and strategic market positioning overshadowed the event’s impact. Who would have thought?

The general sentiment is that Trump’s tariffs are causing the sour mood and weakening investor confidence. However, some crypto analysts have differing opinions, attributing outflows from crypto investment products to hedge funds’ trading strategies. How refreshing!

“…hedge funds don’t care about Bitcoin. They were farming low-risk yield. Now that the trade is dead, they’re pulling liquidity—leaving the market in free fall…This is a classic case of liquidity games. ETFs didn’t just bring in long-term holders—they brought in hedge funds running short-term arbitrage,” crypto analyst Kyle Chassé explained, probably while shaking his head.

Read More

- Who Is Abby on THE LAST OF US Season 2? (And What Does She Want with Joel)

- DEXE/USD

- ALEO/USD

- Summoners War Tier List – The Best Monsters to Recruit in 2025

- Discover the Exciting World of ‘To Be Hero X’ – Episode 1 Release Date and Watching Guide!

- Save or Doom Solace Keep? The Shocking Choice in Avowed!

- Yellowstone 1994 Spin-off: Latest Updates & Everything We Know So Far

- ‘I’m So Brat Now’: Halle Berry Reveals If She Would Consider Reprising Her Catwoman Character Again

- To Be Hero X: Everything You Need To Know About The Upcoming Anime

- Who Is Sentry? Exploring Character Amid Speculation Over Lewis Pullman’s Role In Thunderbolts

2025-03-10 17:31