Investing wisely involves purchasing assets when they’re cheap (low prices) and later selling them for a profit (higher prices). However, some investors might perceive this strategy as simply buying a stock at a lower cost initially and then offloading it once the price goes up.

A different perspective could suggest that one should purchase when the value is low and sell when it’s high; or to put it another way, buying when a business’s fundamentals are weak and selling when they reach their peak.

Let’s dive into an example with Apple (AAPL).

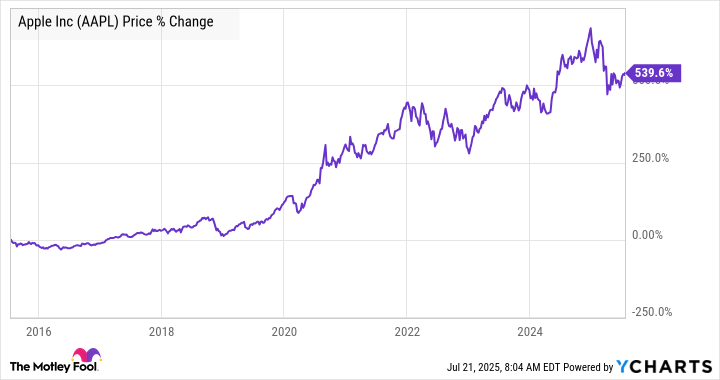

Apple stock price

According to the graph, it’s quite common for investors to sell their investments at a higher price (sell high) after buying them at a lower price (buy low) over the past ten years. However, in most cases, making that sale would have been a mistake.

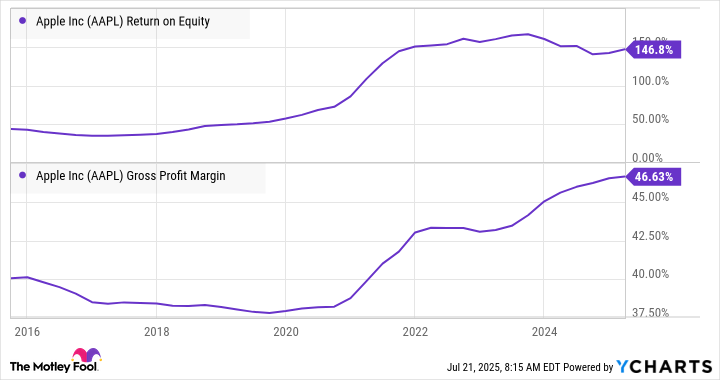

It’s perfectly fine to realize a gain or adjust your investment size to maintain a well-balanced portfolio. However, someone who simply looks at Apple’s price chart and assumes they are buying at an elevated price might overlook two crucial indicators suggesting that Apple’s earnings growth could persist for a substantial period ahead.

Over the past ten years, the company’s profitability compared to equity investment from shareholders (return on equity) and its profit margins have experienced substantial growth.

A significant factor behind the enhancement is the continuous expansion of Apple’s service ecosystem, focusing on high-profit services that are marketed to an extensive user base of Apple hardware products.

This trend shows no signs of slowing down, and even though Apple’s stock price has significantly increased over the past ten years, it appears there’s still potential for further growth.

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- Banks & Shadows: A 2026 Outlook

- Gemini’s Execs Vanish Like Ghosts-Crypto’s Latest Drama!

- ETH PREDICTION. ETH cryptocurrency

- 9 Video Games That Reshaped Our Moral Lens

- Uncovering Hidden Groups: A New Approach to Social Network Analysis

- The Weight of Choice: Chipotle and Dutch Bros

- Gay Actors Who Are Notoriously Private About Their Lives

2025-07-24 17:29