Amid the empty promises of lotteries, two fortunate souls will indeed share a sumptuous $1.8 billion Powerball, valiantly demonstrating that one must partake to perhaps snag a fortune. Such chances, however, are as bleak as a Victorian novel’s protagonist; 1 in 292 million, if my maths serve me. Alas, dear readers, one’s fortunes would be better wrought in the realm of the S&P 500, which, even now at lofty heights, presents itself as an opportune threshold for the prudent investor.

The Abyss of Fear and the Market’s Dance

As these figures flutter to and fro, we must remind ourselves of the noble purpose of the S&P 500 index. This behemoth serves as a reflection of the grand American economy, bravely selected by a very particular committee of wise souls who deem approximately 500 enterprises to be sufficiently grand and economically vital. The market-cap weighted affair paints a rather comprehensive portrait of an economy teetering on the edge of both grandeur and folly. For the common investor, a mutual fund or an ETF presents the likelihood of acquiring the whole shebang without the cumbersome need for selectivity.

Yet, entertain this notion: the market behaves like an infuriating pendulum, oscillating between euphoric bull markets and woeful bear markets. The reality is that the visage of prosperity is often quickly followed by downturns of splendid severity-one is reminded of a grand soirée giving way to a drunken debacle. It is, without debate, rooted in the cycles of commerce, yet it also bares the very soul of our human propensity to fret.

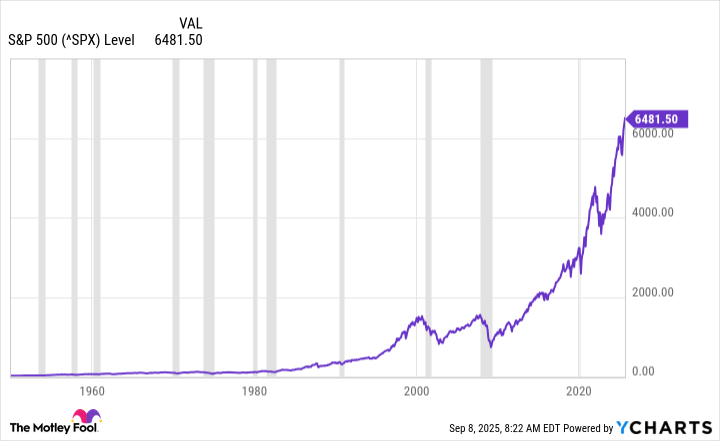

In prosperous times, investors, wrapped in anxiety for the impending flop, become paralyzed by the specter of reversal. The annals of history-that persistent tormentor-indicate that such a reversal is practically mandated. However, one must not permit ephemeral fears to deter their fiscal destinies. The graph below illustrates a prevailing truth: that the S&P 500, despite gravely dismal periods, has generally succumbed to an upward trajectory.

If, perchance, one possesses the fortitude to endure the inkling of panic and adopts a patient hand, the empirical evidence suggests that the long game remains in their favour. Thus, if fear holds you captive in a state of indecision, one would do well to relinquish this hesitance and simply invest-timing the market is a pursuit as chimerical as finding an unblemished pearl in an abominable oyster.

The Right Time to Enter This Mad Carnival

The aforementioned diversion aside, it must be confessed: timing has its own cruel whims. Investing during the throes of a bear market often bestows one with attractive valuations. Conversely, during euphoric bull runs, valuations ascend to perilously dubious heights. Consider, if you will, the unfortunate souls who wagered their fortunes at the apex of previous market exuberances-two specific eras, each ripe for calamity.

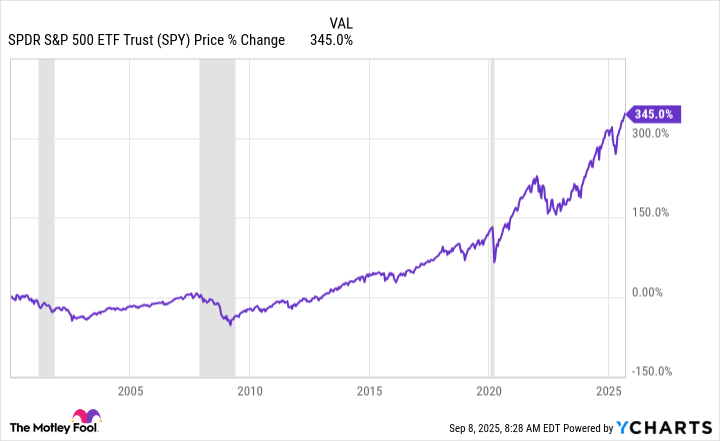

Take for instance the cohort who dared purchase shares on the inaugural trading day of a dire 2000, immediately preceding the dot.com crash. Herein lies a curious tale: despite a grueling bear market that gnawed upon the S&P 500 index by over 40% until 2003, those who clung tenaciously to their investments would now pocket a clement 345% increase. It was a trial as testing as any character in a Waugh novel, but persistent trust in equity proved to be their salvation.

Then we have the ascension in early 2007, immediately preceding another calamitous bear market, whimsically dubbed the Great Recession-echoing its foreboding predecessor, the Great Depression. Those who maintained composure and elected to invest in the S&P 500 would find themselves now enjoying a shift of about 355%. The juxtaposition of profound despair begetting eventual opulence captures the cruel irony of human investment.

How curious, indeed, that both peaks yield remarkably similar returns in the long term. It appears that the market’s proclivity for failure need not deter one from embracing its fickle nature. In retrospect, these dips, which once loomed large and menacing, simply form quaint footnotes in our financial narratives. Employing strategies such as dollar-cost averaging and the meritorious reinvestment of dividends could enhance one’s standing even further within this merry-go-round.

Bear Markets: A Certainty, Yet a Pliable Reality

A noble sage might remind us that were one to embark on the investment endeavor today, the looming specter of a bear market remains an unavoidable truth, complete with the potential for protracted periods of paper losses. One might find themselves resigned, bearing such losses akin to a millstone around one’s neck. History serves as our cappuccinotinted friend, proclaiming with confidence that perseverance invariably yields handsome returns in the long run.

If a correction is what you seek, passivity may well cater to your inclinations, but the pragmatic amongst us shall argue that mere participation in the market bears far greater importance. After all, discerning the precise moment to invest rivals the perplexity of correctly timing an exit-both ventures bear a striking resemblance to the whims of a lottery contestant. As such, permit me to remark-this is a game best suited to the brave-hearted. 🎲

Read More

- Gold Rate Forecast

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- HSR 3.7 story ending explained: What happened to the Chrysos Heirs?

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- ETH PREDICTION. ETH cryptocurrency

- When Wizards Buy Dragons: A Contrarian’s Guide to TDIV ETF

- Here Are the Best TV Shows to Stream this Weekend on Paramount+, Including ‘48 Hours’

- The Best Actors Who Have Played Hamlet, Ranked

- The Labyrinth of Leveraged ETFs: A Direxion Dilemma

- Games That Faced Bans in Countries Over Political Themes

2025-09-10 12:07