As the new year unfurls its parchment of possibilities, the investor’s mind, that most fickle of creatures, turns its gaze toward the horizon of 2026. A peculiar creature, this market, with its capricious moods and penchant for sudden tempests, yet it whispers promises to those who dare to listen.

Behold, the survey of the American Association of Individual Investors, that most solemn of oracles, reveals a third of its acolytes shivering in the shadows of a looming bear market. A curious spectacle, this collective dread, as if the very air had been infected by a phantom recession, invisible yet palpable, like the ghost of a forgotten tax.

Yet history, that old chronicler of folly and triumph, offers a tale both grim and glorious. For though the future may be a riddle wrapped in a mystery inside an enigma, the stock market-this capricious beast-has a habit of rewarding those who dare to dance with its uncertainties.

The Paradox of Timing

To wait, one might argue, is to court the devil’s bargain. For if the market ascends like a phoenix, the patient investor’s hand may wither in inaction. Yet to leap headlong into the fray, as the sages caution, is to risk becoming a pawn in the game of unseen forces.

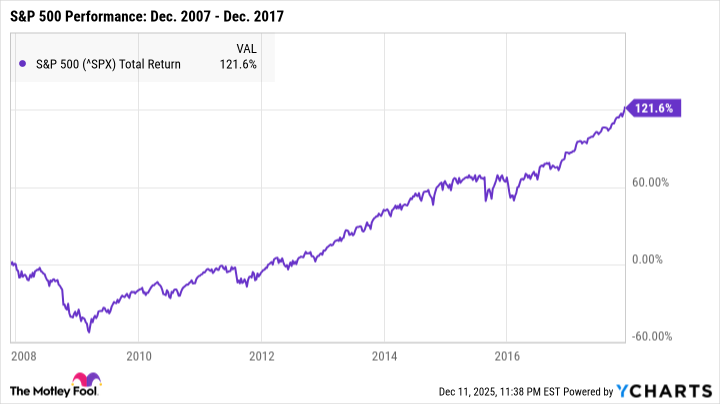

Consider, if you will, the year 2007, when the S&P 500, that sleek, silver beast, stood on the precipice of its own undoing. The Great Recession, that most insidious of plagues, descended upon the land, reducing fortunes to ash and dreams to dust. Yet lo! After a decade of toil, the index rose again, a phoenix reborn, its wings outstretched toward the heavens.

Thus, the lesson is clear: the market, that most mercurial of entities, cares little for the whims of mortal timing. A long-term gaze, steadfast and unyielding, shall prevail over the fleeting anxieties of the moment.

Imagine, if you will, a man who invested $5,000 in the S&P 500 in December 2007. A fool’s errand, some might say, yet by today’s reckoning, that sum has grown to a princely $33,000. A tale of triumph, yes, but also of patience-a virtue as rare as a well-timed tax break.

This is not to prophesy another Great Recession, for even the most learned of economists are but blind men feeling the elephant of the future. Yet the market, that eternal dance of hope and despair, shall continue its waltz, and those who remain steadfast shall find their rewards.

The Alchemy of Resilience

To thrive in tumult, one must choose wisely. The weak, those stocks of flimsy constitution, shall crumble like bread in a storm. But the strong-those stalwart enterprises with unshakable foundations-shall rise, phoenix-like, from the ashes of adversity.

Consider the industries, that most peculiar of beasts. Some flourish in the darkest hours, while others falter. Yet even the most volatile of sectors, if anchored by capable hands and a competitive edge, shall find their way to the light.

Thus, the investor’s creed: seek strength, not spectacle. For in the end, it is not the size of the bet, but the wisdom of the choice that determines the outcome.

And so, the market continues its endless ballet, a spectacle of chaos and order, of despair and hope. Whether 2026 brings a tempest or a calm, the investor must remain a steadfast voyager, charting their course with the compass of long-term vision.

For in the grand tapestry of finance, even the most tangled threads may weave a masterpiece, if one has the patience to see it through.

📈

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- Banks & Shadows: A 2026 Outlook

- Gemini’s Execs Vanish Like Ghosts-Crypto’s Latest Drama!

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- ETH PREDICTION. ETH cryptocurrency

- HSR 3.7 story ending explained: What happened to the Chrysos Heirs?

- Top gainers and losers

- The Weight of Choice: Chipotle and Dutch Bros

2025-12-14 00:47