The current market preoccupation with glucagon-like peptide-1 (GLP-1) receptor agonists, notably from Novo Nordisk and Eli Lilly, is understandable, given the potential for significant revenue generation. However, focusing exclusively on pharmaceutical competition may obscure opportunities within the broader healthcare technology landscape. Intuitive Surgical (ISRG +0.47%), a pioneer in surgical robotics, presents a compelling case for investors seeking diversification and exposure to a distinct growth trajectory.

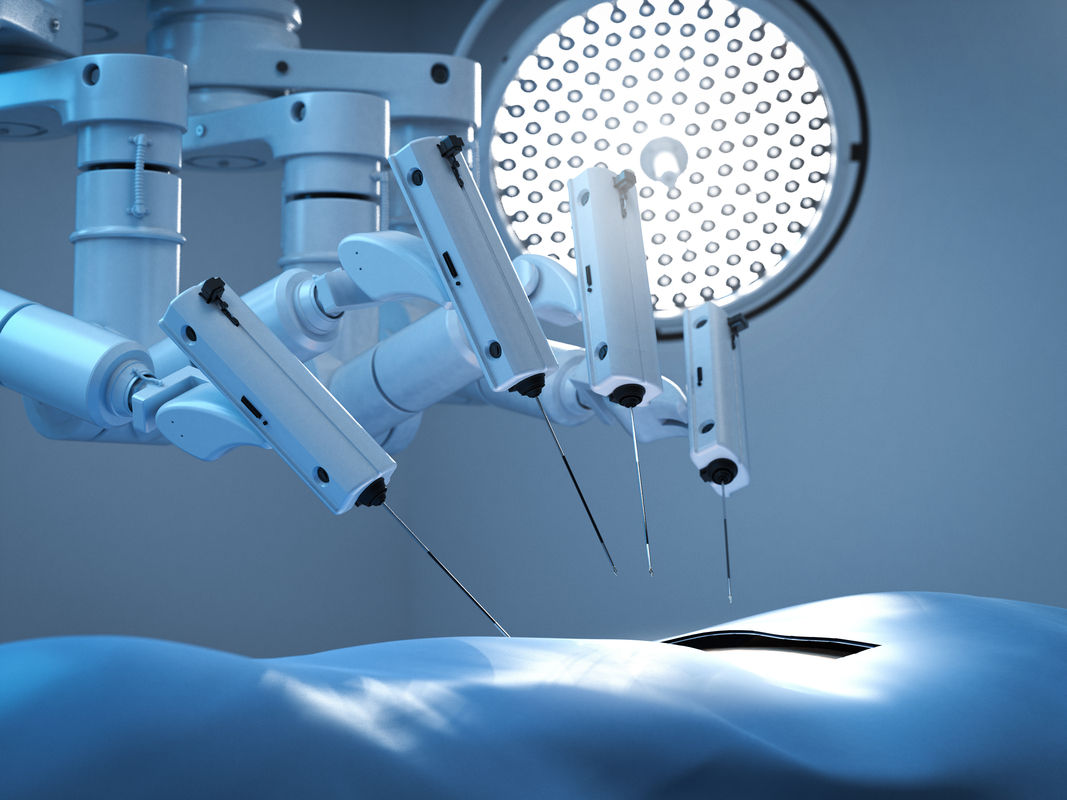

Surgical Robotics: A Parallel Growth Avenue

While GLP-1 drugs address a specific metabolic pathway, Intuitive Surgical facilitates procedural innovation across a wide range of surgical specialties. As of year-end 2025, the company reported 11,106 installed da Vinci surgical systems globally, representing a 12% increase from the 9,902 units in operation at the end of 2024. Concurrently, the volume of procedures performed utilizing the da Vinci system rose 18% year-over-year, indicating sustained demand from both surgeons and patients. The less invasive nature of robotic surgery, coupled with the potential for improved clinical outcomes, continues to drive adoption.

Valuation and Risk Considerations

Despite demonstrable growth, Intuitive Surgical’s valuation warrants scrutiny. The current price-to-earnings ratio of 61, while elevated, is below its five-year historical average of 71. This suggests that, relative to its own historical performance, the stock may not be as expensively priced as a cursory analysis might indicate. However, investors should acknowledge the premium valuation reflects expectations for continued high growth, which introduces inherent risk.

Potential downside risks include increased competition from other surgical robotics manufacturers, evolving reimbursement models, and the possibility of unforeseen technological disruptions. Furthermore, the capital-intensive nature of acquiring and maintaining robotic surgical systems could present a barrier to entry for smaller healthcare facilities.

Long-Term Growth Catalysts

Looking beyond the immediate term, several factors support a positive long-term outlook for Intuitive Surgical. The increasing prevalence of minimally invasive surgery, coupled with an aging global population, is likely to drive continued demand for robotic surgical solutions. Moreover, the company’s ongoing investment in artificial intelligence (AI) and machine learning holds the potential to further enhance surgical precision, efficiency, and clinical outcomes.

The integration of AI into the da Vinci system could ultimately pave the way for autonomous surgical procedures, although such a development remains contingent upon significant technological advancements and regulatory approvals. Given the substantial installed base of da Vinci systems, Intuitive Surgical is well-positioned to capitalize on such a paradigm shift, should it materialize.

Investment Thesis

Intuitive Surgical represents a growth-oriented investment opportunity within the healthcare technology sector. While not immune to broader market fluctuations or company-specific challenges, the company’s established market leadership, robust growth trajectory, and exposure to secular trends suggest a favorable risk-reward profile. Investors seeking diversification beyond the pharmaceutical space, and willing to accept a premium valuation in exchange for long-term growth potential, may find Intuitive Surgical a compelling addition to their portfolios.

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- Wuchang Fallen Feathers Save File Location on PC

- Gold Rate Forecast

- Banks & Shadows: A 2026 Outlook

- HSR 3.7 breaks Hidden Passages, so here’s a workaround

- Gemini’s Execs Vanish Like Ghosts-Crypto’s Latest Drama!

- QuantumScape: A Speculative Venture

- ‘Peacemaker’ Still Dominatees HBO Max’s Most-Watched Shows List: Here Are the Remaining Top 10 Shows

- Elden Ring’s Fire Giant Has Been Beaten At Level 1 With Only Bare Fists

2026-02-20 21:22