Intuitive Surgical (ISRG +0.54%). The name itself…suggests a cold precision. And they deliver, alright. They deliver robotic arms into operating rooms, promising a future where surgeons pilot precision instruments, and patients…well, they pray. It’s a beautiful, terrifying dance. The da Vinci system. A marvel of engineering, or a gilded cage for increasingly detached medical professionals? I’ve been watching this stock for years, a slow burn of potential, and frankly, a growing sense of unease. They’re not just selling machines; they’re selling a vision. And visions, my friends, are EXPENSIVE.

The market, naturally, has been twitchy. Down over 10% this year. Below $500. A dip. A flicker. Is it a steal? A trap? Let’s be honest, “bargain” and “biotech” rarely occupy the same sentence. It’s like trusting a politician with your life savings. Possible, but profoundly unwise. I’ve seen too many “sure things” dissolve into vaporware. But this…this is different. This is surgery. People will always need their innards tinkered with. That’s a fundamental truth. A grim, lucrative truth.

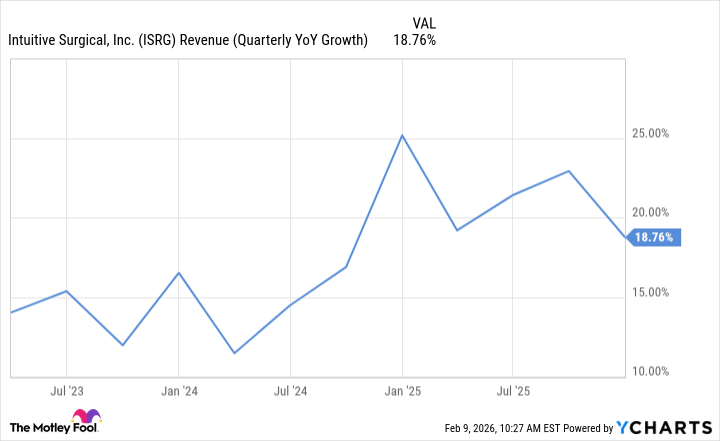

The Growth Spurt: A Fever Dream?

Double-digit growth for years. Consistent. Boringly consistent. Then, a spike. 19% revenue jump last quarter. Almost $2.9 billion. That’s a LOT of robotic arms. A LOT of disposable surgical tools. A LOT of money flowing into a system that, let’s face it, is still in its infancy. The robotic-assisted surgery market is barely out of diapers. It’s a land grab, a wild west of innovation and hype. And Intuitive Surgical is currently holding most of the cards. But for how long? The vultures are circling, believe me. They always are.

Long-term investment? Possibly. If you have the stomach for it. And the patience of a saint. This isn’t a quick flip. This is a deep dive into a complex, rapidly evolving industry. You’re betting on a future where robots are commonplace in operating rooms. A future where surgeons are less hands-on, more…supervisors. It’s a chilling thought, frankly. But also…inevitable.

Is This a Bargain? DON’T MAKE ME LAUGH.

Trading at over 60 times earnings? FIFTY times future profits? Are you KIDDING me? The S&P 500 averages 25 times trailing earnings, dips to 22 looking ahead. This isn’t a stock; it’s a prayer. A desperate plea to the market gods. It’s priced for PERFECTION. And perfection, my friends, is a rare and fleeting commodity.

I wouldn’t call it a “bargain.” Not even close. But…there’s potential. If you’re willing to hold on for years. If you’re prepared to ride out the inevitable volatility. If you can stomach the thought of your portfolio swinging wildly with every earnings report. It’s a gamble. A calculated, high-stakes gamble. And let’s be honest, I live for those.

Below $500 is a temporary reprieve. A fleeting moment of sanity in a market gone mad. This stock is still vulnerable. A market correction could send it spiraling. But for the long-term investor…the one who’s willing to buy and forget…Intuitive Surgical could be a good growth stock. A terrifying, exhilarating, potentially lucrative growth stock. Just…don’t say I didn’t warn you.

Read More

- Top 15 Insanely Popular Android Games

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- EUR UAH PREDICTION

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- Silver Rate Forecast

- Gold Rate Forecast

- DOT PREDICTION. DOT cryptocurrency

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- Core Scientific’s Merger Meltdown: A Gogolian Tale

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

2026-02-09 19:53