Alright, settle in, folks! We’re talkin’ chips. Not the kind you eat with a dip, though I wouldn’t object to a little French onion right now. No, we’re talkin’ silicon. And let me tell ya, this whole tech scene? It’s a vaudeville act with transistors. Now, everyone’s been makin’ a fuss about Intel (INTC +4.91%). They were the big kahuna, the headliner. Back in the early 2000s, they were slingin’ innovation like a crazed pie thrower. But they lost their mojo. Their foundry business? Let’s just say it’s lookin’ for work. They’re like a washed-up comedian tryin’ to get a gig at a bar mitzvah.

Then along comes Nvidia (NVDA +8.01%), struttin’ like a peacock with a pocket full of cash. They drop five billion dollars on Intel – a lifeline, sure, but also a little like givin’ a life raft to the Titanic. They’re gonna embed Intel’s CPUs into some of their stuff. It’s a partnership, they say. I say it’s a hostage situation, but with more soldering. Intel’s stock has gone on a tear, up over 100% since the announcement. A hundred percent! That’s practically a miracle, folks! Or, you know, a really good PR campaign. Look, I’m not sayin’ Intel won’t turn it around, but I’d rather put my money on the horse that’s already winnin’ the race. And that horse, my friends, wears green and black.

Intel’s Stock Isn’t Exactly a Bargain

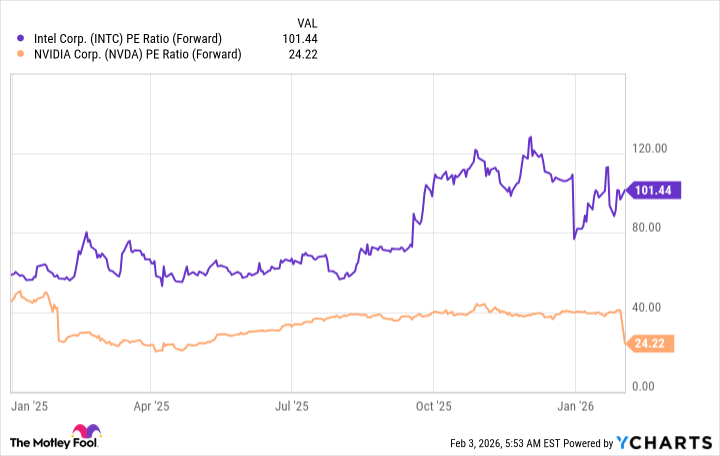

For a while, Intel was the stock market’s equivalent of a clearance rack. Dirt cheap. But those days are gone. Now it’s trading at over 100 times forward earnings. One hundred times! That’s like payin’ a million dollars for a hot dog. Nvidia, on the other hand? A mere 24 times. That’s a steal, folks! A genuine bargain! It’s the difference between buyin’ a used car and a Rolls Royce. Both get you from point A to point B, but one does it with a lot more style…and a smaller dent in your wallet.

The market is clearly hopin’ Intel can pull a rabbit out of its hat. They’re givin’ ’em the benefit of the doubt. Which is nice, I guess. But hope doesn’t pay the bills. I’m tellin’ ya, this turnaround could take a long, long time. And there’s no guarantee it’ll even happen. It’s like waitin’ for Godot. You could be waitin’ a very long time.

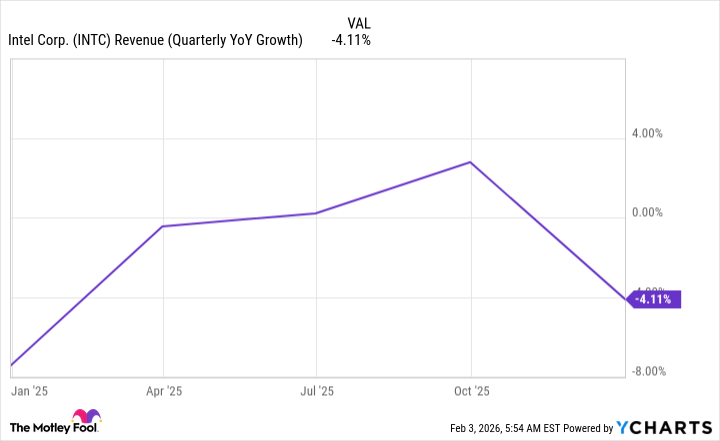

Intel’s Growth Isn’t Exactly Set the World on Fire

Wall Street analysts? They’re skeptical. And frankly, they’re usually right. They’re expectin’ about 2% revenue growth for Intel in fiscal 2026. Two percent! That’s barely enough to cover inflation. Fiscal 2027? A whopping 8%. Nvidia? 52%! Fifty-two percent! That’s not growth, folks, that’s a rocket ship. It’s like comparin’ a tricycle to the Space Shuttle. There’s really no contest.

Now, let’s talk about what’s drivin’ this whole AI boom. It’s not CPUs, folks, it’s GPUs. CPUs are fine, they do their thing. But GPUs are the real workhorses. They’re like a thousand little chefs, all choppin’ vegetables at the same time. CPUs are one chef, painstakingly preparin’ a single soufflé. The AI workloads are perfect for that parallel processin’ power. CPUs direct traffic, but GPUs do the cookin’.

Here’s the bottom line: Nvidia’s gonna dominate the data center landscape, regardless of whether Intel can pull off a miracle. So, if you want a piece of the action, buy Nvidia. It’s the smart money. The really smart money.

Some folks are worryin’ about an AI bubble. They think it’s all gonna burst. I don’t buy it. Generative AI companies might be overvalued, sure. But that has nothin’ to do with Nvidia. The hyperscalers – those big data center operators – are committed to spendin’ billions on computin’ infrastructure every year. And Nvidia’s gettin’ a healthy slice of that pie.

We’re still years away from knowin’ if generative AI will actually change the world. But even if it doesn’t, the hyperscalers will still need to build out that computin’ capacity. And Nvidia’s primed to benefit. It’s like sellin’ shovels during the gold rush. You don’t need to strike gold yourself to make a fortune.

So, yeah, there might be a bubble among those generative AI companies. But I don’t think investors need to worry about Nvidia gettin’ caught in it. As long as data centers keep bein’ built at a rapid pace, Nvidia’s gonna be a top stock to own. An Intel turnaround would be great for America, sure. But I don’t think it’s worth investin’ in right now. Now, if you’ll excuse me, I have a hot dog to eat.

Read More

- Top 15 Insanely Popular Android Games

- Gold Rate Forecast

- EUR UAH PREDICTION

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- Silver Rate Forecast

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- DOT PREDICTION. DOT cryptocurrency

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

- Core Scientific’s Merger Meltdown: A Gogolian Tale

2026-02-08 03:42