Intel Corporation (INTC) has exhibited a notable resurgence in recent periods, prompting renewed investor interest. Year-to-date performance in 2026 currently reflects a gain of 19%, a figure that warrants closer examination beyond initial enthusiasm.

Recent commentary from governmental sources, coupled with a meeting between Intel CEO Lip-Bu Tan and President Trump, appears to have temporarily catalyzed market sentiment. While such interactions can provide short-term boosts, a sustainable trajectory requires substantiation through fundamental performance metrics.

Advanced Process Nodes and Market Share Recapture

Intel’s unveiling of the Core Ultra Series 3 processors, fabricated on the Intel 18A process node, represents a critical juncture. The claim of achieving “the most advanced semiconductor process ever developed and manufactured in the United States” is ambitious, and its validation through independent benchmarks will be crucial. The 2-nanometer architecture is positioned to challenge Taiwan Semiconductor Manufacturing’s dominance, a contest with significant implications for the semiconductor landscape.

Early indications suggest potential performance and power efficiency advantages for the 18A process. However, the actual realization of market share gains hinges on successful high-volume production and competitive pricing. Reports indicate a potential lead over TSMC’s 2nm production timeline, a factor that, if sustained, could provide a temporary competitive advantage.

The integration of Panther Lake processors into over 200 AI-capable PC designs, and expansion into edge AI applications, presents a tangible growth opportunity. However, the proliferation of AI-capable devices is contingent upon consumer demand and the development of compelling use cases.

Intel’s historical performance has been challenged by Advanced Micro Devices (AMD) in the PC market. While AMD’s adoption of TSMC’s 4nm process provided a competitive edge, Intel’s 18A process offers a potential countermeasure. The efficacy of this countermeasure remains to be seen, particularly in light of AMD’s anticipated transition to a 2nm process.

Positive reception within the gaming community, coupled with projected growth in advanced AI PC shipments (52% increase anticipated by Counterpoint Research), further underscores the potential for revenue generation. However, these projections are subject to macroeconomic conditions and competitive pressures.

The Client Computing Group (CCG), accounting for 62% of Q3 2025 revenue, remains Intel’s primary revenue driver. Sustained growth within this segment is contingent upon successful design wins for the 18A process and effective product differentiation.

Valuation and Sustainability of Gains

Intel’s stock has experienced a substantial increase (130%) over the past year, driven by improving liquidity, a strategic partnership with Nvidia, and cost optimization initiatives. This rapid ascent warrants careful consideration, particularly in light of current valuation multiples.

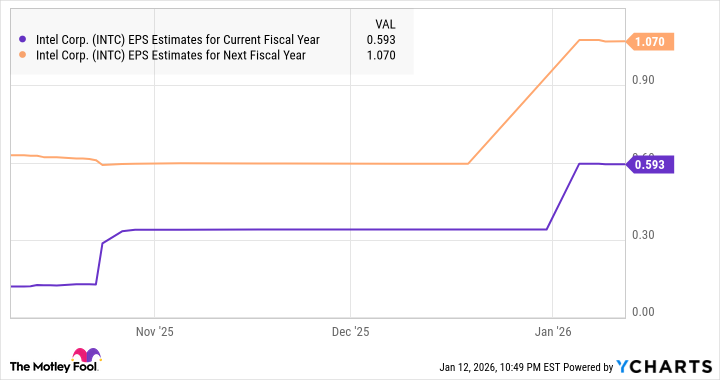

Consensus estimates project a transition from a 2024 non-GAAP loss to earnings of $0.34 per share in 2025, with continued growth anticipated in 2026 and 2027. However, the sustainability of this growth trajectory is contingent upon maintaining competitive advantages and navigating potential macroeconomic headwinds.

Currently trading at 77 times forward earnings, Intel’s valuation premium exceeds that of the Nasdaq-100 index (26 times forward earnings). While this premium may be justifiable given projected earnings growth, it introduces a degree of risk should growth expectations not be fully realized.

Potential catalysts for sustained growth include increased demand in the data center segment and the commencement of custom AI processor manufacturing for Microsoft, utilizing the 18A process. However, these developments are contingent upon successful execution and ongoing collaboration.

Maintaining a premium valuation will require continued innovation, effective cost management, and consistent execution of strategic initiatives. Investors should carefully monitor these factors to assess the long-term sustainability of Intel’s gains.

Read More

- Gold Rate Forecast

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- HSR 3.7 story ending explained: What happened to the Chrysos Heirs?

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- ETH PREDICTION. ETH cryptocurrency

- Uncovering Hidden Groups: A New Approach to Social Network Analysis

- The Labyrinth of Leveraged ETFs: A Direxion Dilemma

- Best Ways to Farm Prestige in Kingdom Come: Deliverance 2

- The Best Actors Who Have Played Hamlet, Ranked

- Here Are the Best TV Shows to Stream this Weekend on Paramount+, Including ‘48 Hours’

2026-01-16 15:34