When the good folk of Wall Street turn their gaze toward artificial intelligence (AI) stocks, they oftentimes forget the not-so-humble giant known as Intel (INTC). No, instead, the limelight dances upon the likes of Nvidia, Advanced Micro Devices, and Palantir Technologies as if they were the shimmering stars of a grand ball.

Yet here’s the curious truth: Intel trades at a price-to-sales (P/S) ratio of merely 2.4, fluttering below the peaks of its own 10-year history like a bird that’s lost its way. In a world awash with inflated valuations, Intel’s numbers seem about as old-fashioned as a three-piece suit at a summer picnic.

Let’s take a gander at the state of affairs with Intel and ponder whether this stock is merely a classic value trap, or perhaps a wily little investment hiding in the rosemary bushes.

What’s Put Intel Behind the Eight Ball?

The crux of Intel’s tribulations lies nestled deep within its foundry division, once a titan in the semiconductor manufacturing realm. Alas, like a once-mighty oak, it has been gnawed at steadily by competitors abroad, such as Taiwan Semiconductor Manufacturing and Samsung. This erosion of market share has led to two major consequences, each as stark as a winter’s night.

First off, Intel has had more hiccups on its foundry roadmap than a cow on a slippery slope, leading to delays in rolling out next-generation GPUs and CPUs. This struggle has dulled its luster in the eyes of the industry’s leading lights. Now, giants like Apple, Nvidia, and AMD have taken to relying almost exclusively on Taiwan Semi for their most sophisticated fabrication, like a sailor tethered to the most reliable ship in a storm.

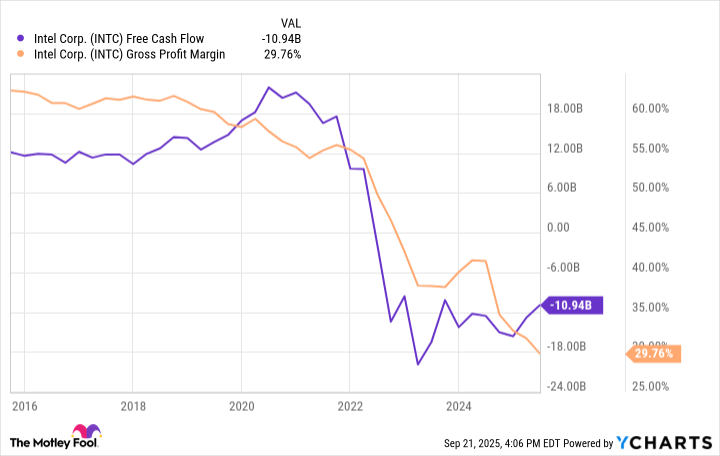

Second, these delays have scratched a visible toll on Intel’s financial standing. In its mad dash to catch up, the company has set off on a bold and costly turnaround journey. A bevy of capital expenditures threatens to rattle the foundations of both profit margins and free cash flow like a rickety old bridge in a downpour.

Thus, Wall Street seems to be pricing in this uncertainty with a discerning eye, like a farmer eyeing the skies for rain. While trading at a modest 2.4 times sales may paint a picture of opportunity, Intel’s steep discount is less a bargain and more a glaring testament to investors’ skepticism about the company’s chances of a genuine comeback in an arena where missteps have cost more than a clean pair of boots on a muddy day.

Good Tidings for Intel Investors

In today’s AI-dominated playground, semiconductors have transformed from mere baubles into vital cogs of our societal machinery. In stark contrast to yesterday’s run-of-the-mill hardware, these components now represent critical infrastructure.

To add a curious twist to this tale, the U.S. government has recently taken a 10% stake in Intel, casting its vote of confidence for the company as a cornerstone for national security and domestic supply chains. Such backing from Washington suggests that Intel is simply too vital to be left in the dust like an old pair of shoes.

Moreover, in a perplexing turn of events, Nvidia has also decided to invest a staggering $5 billion into Intel. Now that’s a twist worthy of a city slicker’s summer read, considering these two are oft considered rivals. This move only serves to underscore just how robust the demand is for advanced foundry capacity.

If Intel can rise from its slumber and reclaim its stance as a credible alternative to TSMC, its addressable market could unfurl like a road stretching toward the horizon. Even a smattering of market share regained would translate into a bounty of incremental revenue.

Why Intel May Just be the Hidden Treasure

These promising developments hold substance. A government-backed turnaround plan, bolstered by validation from Nvidia, solidifies a floor beneath Intel’s stock and weaves a compelling narrative for the firm. Simply put, it’s too important a player to be dismissed entirely, leaving room for an upside that glimmers like a dime on a summer night.

However, let’s keep expectations tethered to reality. Intel isn’t going to sprout wings and soar into the sky as the next AI darling overnight. The firm still lags behind in the advanced foundry game, and clawing back a meaningful foothold could take years, just like convincing a mule to budge.

Even so, it trades at some of the most reasonable valuations in the semiconductor domain. For those contrarian souls willing to wager on improvements and the winds of AI-driven progress, Intel may indeed represent one of the most overlooked – and potentially lucrative – avenues to partake in the AI revolution.

So, despite all the hullabaloo, Intel might not be the falling knife that many bears reckon it to be. 🌟

Read More

- Gold Rate Forecast

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Top 15 Insanely Popular Android Games

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- Why Nio Stock Skyrocketed Today

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- The Weight of First Steps

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

2025-09-25 11:57