One really must say, Intel – INTC +3.39% – has been having a distinctly trying time of it. For years, one observed with a certain detached amusement as AMD, Nvidia, and, of course, Taiwan Semiconductor – TSMC – rather effortlessly eclipsed it. Previous management, shall we say, lacked a certain… panache. A dreadful business, really.

However, things appear to be shifting. With Mr. Lip-Bu Tan now at the helm, one detects a glimmer of something approaching competence. Technical improvements, and – dare one say – a coherent strategy regarding this artificial intelligence business, are beginning to alter perceptions. It’s all rather refreshing, actually.

The question, naturally, is whether this constitutes a viable long-term investment. One wouldn’t want to be caught out, you understand.

Intel’s Improvements

Mr. Tan, as one gathers, made a considerable name for himself at Cadence Design. A stock increase of 2,650%? Remarkably good show. He even graced Intel’s board for a couple of years – 2022 to 2024 – before resigning, reportedly over disagreements. A bit of boardroom drama, always amusing. One suspects he found them rather tiresome.

Since March 2025, he’s been steering the ship at Intel. It’s a bit early to predict a repeat of the Cadence success, naturally. However, even in this brief period, a discernible AI strategy has emerged. One does appreciate decisiveness.

The partnership with Nvidia – a rather clever move – to develop data center and PC products is particularly noteworthy. Tying one’s fortunes to the leader in AI accelerators? A sound piece of business, really.

And the new data center GPU, Crescent Island, designed for AI inference, with its high memory capacity and energy efficiency? Admirable. Though one does wish they’d come up with a more imaginative name. Still, one can’t have everything.

The debut of their first AI PC platform, built on the 18A process technology at CES? Apparently, it offers a slight performance edge over TSMC. A small victory, perhaps, but one must take what one can get.

Effects on Intel Stock

Investors, it seems, are impressed. The stock has risen almost 110% over the last year. Not bad, not bad at all.

The financials, admittedly, haven’t quite caught up. Revenue fell by 0.5% in 2025, to $53 billion. A surge in interest income partially offset the operating loss, but they still managed a loss of $267 million. A bit clumsy, really.

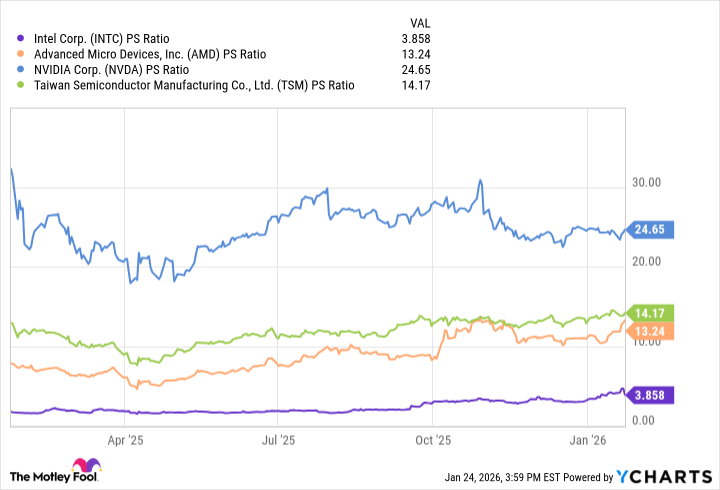

This leaves them without a meaningful P/E ratio. However, the price-to-sales ratio, hovering just under 4, remains considerably lower than its peers. Assuming this optimism proves justified by rising sales, it might not be too late to consider adding Intel to one’s portfolio.

Is Intel a Smart Long-Term Bet as AI Scales?

The company did lose its way under previous leadership, but Mr. Tan’s success at Cadence, combined with these early indications of progress, suggest a promising direction.

With new AI products and technical breakthroughs emerging, the stock has surged. There are, of course, still unknowns and variables. However, based on Mr. Tan’s track record and the stock’s still-modest valuation, one suspects a purchase at current levels might prove rather rewarding. One always appreciates a bit of sensible risk, don’t you think?

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Wuchang Fallen Feathers Save File Location on PC

- Gold Rate Forecast

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- Crypto Chaos: Is Your Portfolio Doomed? 😱

- HSR 3.7 breaks Hidden Passages, so here’s a workaround

- ‘Bad Guys 2’ Tops Peacock’s Top 10 Most-Watched Movies List This Week Again

- 20 Movies That Glorified Real-Life Criminals (And Got Away With It)

- MicroStrategy’s $1.44B Cash Wall: Panic Room or Party Fund? 🎉💰

- Is Taylor Swift Getting Married to Travis Kelce in Rhode Island on June 13, 2026? Here’s What We Know

2026-01-28 16:42