Institutional Investors Are Betting Big on Bitcoin‘s Undervaluation Despite the Chaos

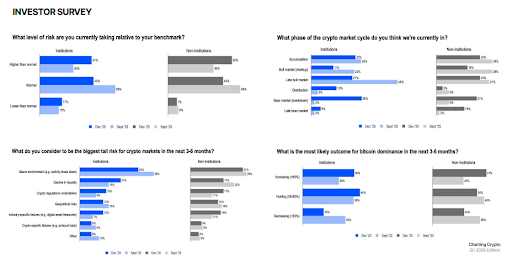

- Approximately 70% of the sharp-suited, number-crunching professional investors believe Bitcoin is secretly undervalued – as if they have some secret crystal ball or a very expensive psychic on retainer.

- The herd mentality persists: most of these financial titans plan to snap up more or hold tight if the price drops another 10%, probably dreaming of buying low and selling high-an ancient, almost mystical concept.

- Reasons for optimism include expected interest rate cuts and a GDP that’s plastered not with band-aids, but with gold leaf-likely boosting digital assets later this year, or so the well-informed hope.

The crypto market, like a teenager going through a rebellious phase, is currently in a bit of a funk, with Bitcoin’s price stumbling downward since its all-time high in October. Meanwhile, gold and silver are shining brighter than a Hollywood appraisal-probably causing some investors to wonder if they’ve missed the boat.

But never fear, because the big players seem blissfully unfazed, or at least they’re pretending to be. A new report from Coinbase reveals that most major firms are quietly (or not-so-quietly) convinced that Bitcoin is undervalued right now – perhaps they’re imagining it as a sleeping giant waiting for its moment.

Major Firms See Bitcoin as Undervalued Amid Market Stress

Their analysis hints at a price range between $85,000 and $95,000 where, interestingly, 71% of them say, “Hey, this doesn’t really capture Bitcoin’s true worth.” Perhaps they’re a bit optimistic, or maybe they’re just good at pretending to be optimistic until the market catches up.

Only a tiny handful thought Bitcoin was too expensive-because who doesn’t love a good bargain? This confidence comes amid record-breaking gold prices, crossing the $5,000 threshold (really making gold look shiny and grand, even if it’s just metal), so puzzles abound.

Meanwhile, Bitcoin has tumbled about 30% from its jaw-dropping high of $126,080-a number that makes most people’s heads spin. This downward spiral followed a market crash on October 10, which wiped out billions of dollars in leveraged positions – talk about a bad day at the casino.

Since then, the crypto world has mostly tiptoed sideways or gracefully descended, with external annoyances like trade tensions and geopolitical squabbles in the US, China, and the Middle East adding to the general unease. Coinbase even raised the alarm about energy market troubles, implying that the turbulence might stick around like a bad smell.

Yet, shockingly, many professional investors still believe Bitcoin is undervalued. Independent investors are a tad more cautious, but a solid 60% still agree that the digital gold has potential. Only 4% think the market is totally overcooked – which means most are just waiting for the right moment to jump in, probably while whistling a tune.

Institutional Plans to Buy the Dip

Asked what they’d do if Bitcoin’s price dipped another 10%, a whopping 80% of these institutional giants said they’d hold tight or buy more-because who doesn’t love a good sale?

These investors aren’t interested in panic selling; instead, they see these dips as opportunities-like a Black Friday sale for crypto enthusiasts. Since October’s chaos, over 60% have actually increased their holdings, perhaps dreaming of a future where they can brag about their foresight.

This shows some serious conviction-these firms believe the current market dip is just a temporary blip in the grand supercycle of Bitcoin’s inevitable rise, even if retail traders are panicking and looking for a shoulder to cry on.

Economic Factors That Could Help Prices

The economy, despite all the shouting and hair-pulling in headlines, appears relatively stable. Inflation is holding just around 2.7%, and the gross domestic product grew by over 5% in late last year, showing that the financial ship isn’t sinking-more like sailing with a slightly leaky hull but a strong crew.

Coinbase’s crystal ball suggests this economic steadiness could help crypto find its footing again. Central bank decisions add spice to the mix, with many experts expecting the Federal Reserve to cut interest rates twice this year-probably to make borrowing cheaper and encourage more risk-taking (or irrational exuberance, depending on your perspective).

Lower interest rates tend to turn risky assets like crypto into the life of the party. So, if money becomes cheaper to borrow, perhaps more will flow into the digital gold rush-and everyone loves a good party, even if it’s in the markets.

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Here Are the Best TV Shows to Stream this Weekend on Paramount+, Including ‘48 Hours’

- Top 15 Celebrities in Music Videos

- Top 20 Extremely Short Anime Series

- Where to Change Hair Color in Where Winds Meet

- 20 Films Where the Opening Credits Play Over a Single Continuous Shot

- Top gainers and losers

- 50 Serial Killer Movies That Will Keep You Up All Night

- 20 Must-See European Movies That Will Leave You Breathless

2026-01-26 18:07