Large-scale investors appear to have bought around $3.2 billion in Bitcoin following a significant market drop that occurred post-Bitcoin’s price peak of over $108,000 on December 17, 2024, as suggested by data from Blocktrends and CryptoQuant.

December Sell-Off: A Calculated Move?

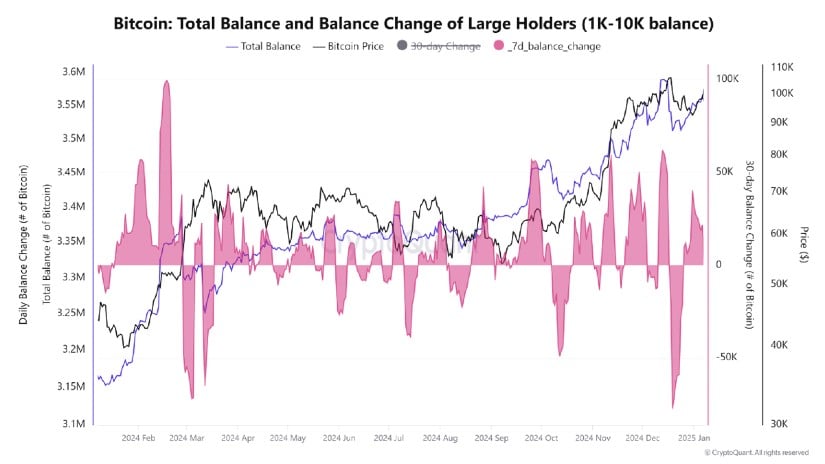

Following Bitcoin’s high point, entities possessing 1,000 to 10,000 Bitcoins collectively offloaded approximately 79,000 BTC, leading to a 15% drop in value. As per Cauê Oliveira, head of research at Blocktrends, this selling spree occurred concurrently with the U.S. Federal Reserve’s decision to lower interest rates. Interestingly, these institutional investors re-entered the market, seizing the opportunity to buy at prices below $95,000 and gradually rebuild their positions through numerous, smaller transactions.

Oliveira clarified in a CryptoQuant post on January 8 that this calculated amassment emphasizes the strategic method adopted by major players, who take advantage of market mergers to increase their holdings.

Market Signals: A Shift Toward Recovery

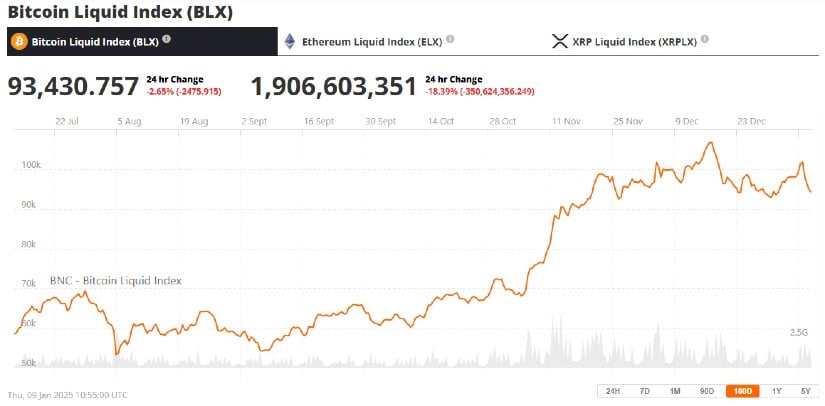

After the December sell-off towards the end of the year, Bitcoin’s seven-day balance change has reversed to a positive trend, suggesting increased buying interest that might aid in market stabilization. As of January 7, Bitcoin was being traded at approximately $94,900, marking a 2.3% decline for the day due to overall market weakness stemming from unfavorable U.S. economic data.

Shrinking liquidity often indicates a period approaching equilibrium.

Pro-Crypto Policies Fuel Optimism

Under the new U.S. presidency led by President-elect Donald Trump, there’s a strong expectation for pro-cryptocurrency policies, which could significantly enhance market trust. Fidelity Digital Assets predicts that more central banks, government funds, and treasuries may start viewing Bitcoin as a crucial asset for their strategic portfolios.

According to a recent study by Fidelity analyst Matt Hogan, it’s expected that more large-scale investors will start including Bitcoin in their investment portfolios. This could potentially lead to an increase or rally in the value of Bitcoin.

Price Predictions: Can Bitcoin Reach New Heights?

As an analyst, I’m closely monitoring the potential future trajectory of Bitcoin in 2025. Notably, Blockware analysts have posited an intriguing scenario: should the U.S. government decide to establish a Bitcoin reserve, we might witness prices soaring anywhere between $150,000 and $400,000.

Despite some pessimistic signals, certain bearish factors persist. Bitcoin has created a bearish engulfing pattern following its brief touch of $100,000, suggesting potential adjustments below the $90,000 level. Analysts caution that past trends indicate a mere 20% chance of quick rebound after drops surpassing 5%.

Stablecoins and Market Liquidity

Miles Deutscher, a crypto expert, pointed out the increasing availability of stablecoins, suggesting they might boost market fluidity. He also remarked that when stablecoins are determining their value, it’s usually followed by substantial changes in Bitcoin’s price.

In the meantime, Jamie Coutts highlighted Bitcoin’s ability to withstand a strong US dollar, suggesting a high level of interest in it. However, there are still worries about short-term fluctuations as investors watch for potential support around the $90,000 and $92,000 price ranges.

Looking Ahead

The latest fluctuations in Bitcoin’s value highlight its unpredictable and ever-changing character. Although institutional investments are helping to boost its recuperation, skeptical technical indicators and wider market influences warrant a degree of caution.

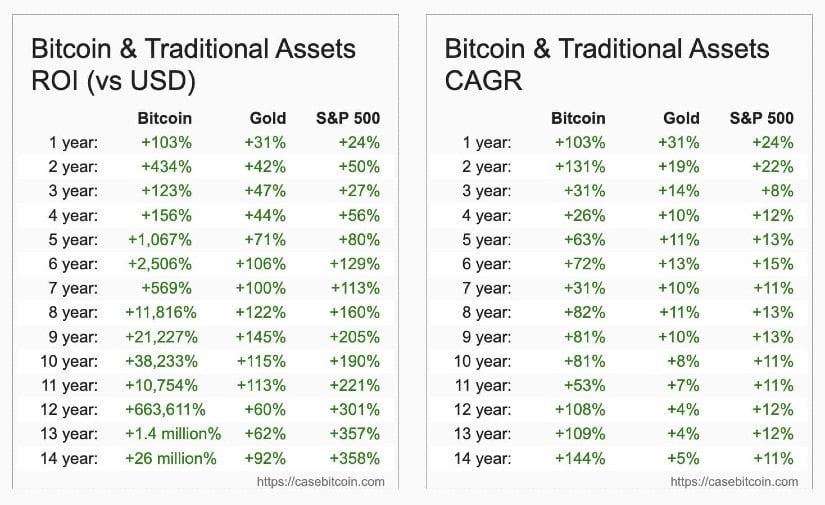

With favorable cryptocurrency policies and growing institutional involvement driving market trends, Bitcoin’s future prospects in 2025 look optimistic, as we near Trump’s inauguration. However, traders should stay alert for possible price fluctuations over the coming weeks. For those new to crypto investing, particularly those seeking a current investment option, Bitcoin continues to be the most secure choice, especially if your investment timeline extends ten years or more.

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Gold Rate Forecast

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Batman and Deadpool Unite: Epic DC/Marvel Crossover One-Shots Coming Soon!

- Who was Peter Kwong? Learn as Big Trouble in Little China and The Golden Child Actor Dies at 73

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- Hunter Schafer Rumored to Play Princess Zelda in Live-Action Zelda Movie

- Every Fish And Where To Find Them In Tainted Grail: The Fall Of Avalon

- SEGA Confirms Sonic and More for Nintendo Switch 2 Launch Day on June 5

- 30 Best Couple/Wife Swap Movies You Need to See

2025-01-10 13:54