As a seasoned crypto investor with several years of experience in this volatile market, I find the recent institutional buying spree of Bitcoin despite the price drop quite encouraging. The accumulation process of over 100,000 BTC by institutional investors in a single week is a clear indication of their strong conviction and long-term view on the digital asset. This trend continued even as sentiment plunged to its lowest level in more than a year and entered the “extreme fear” territory.

The price of Bitcoin dipped below $53,000 for a brief period before rebounding, but despite this setback, institutional investors have bought over $5.8 billion in Bitcoin during the last week – their second largest purchase volume this year.

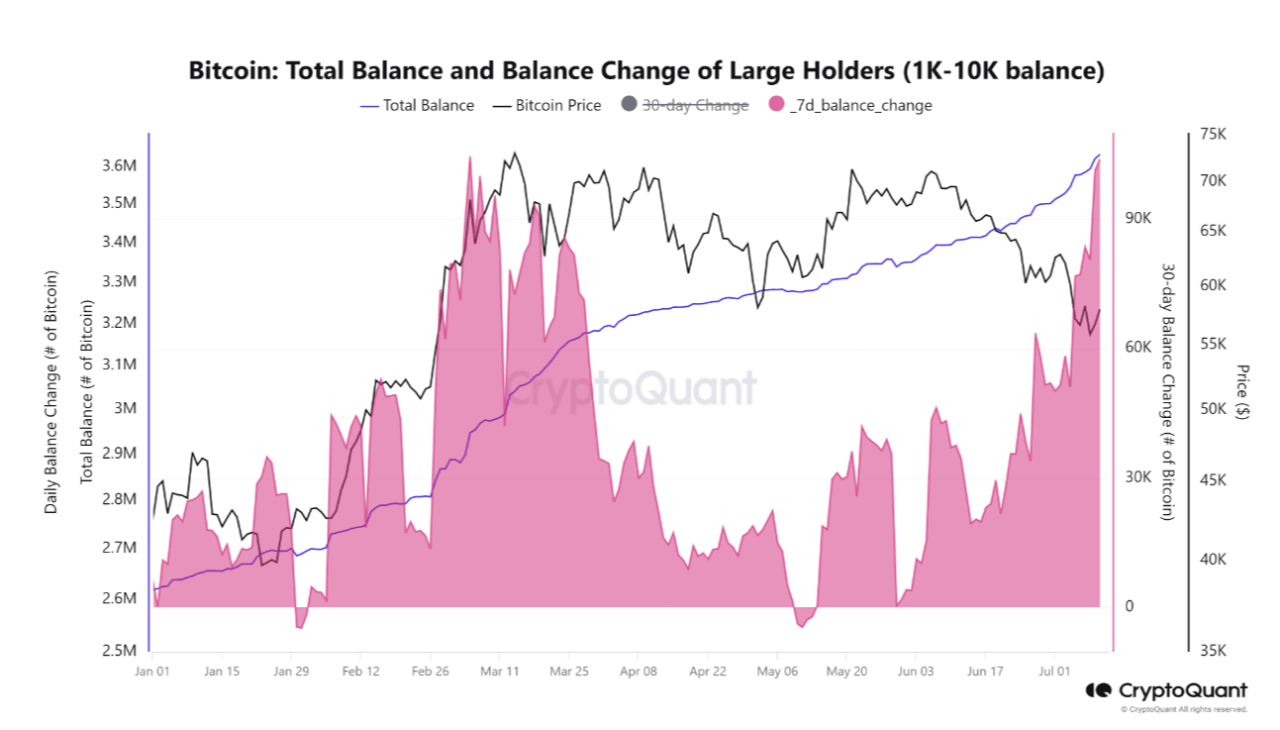

As an analyst, I’ve been closely monitoring the cryptocurrency market using various analytical tools. One such tool is CryptoQuant, a popular on-chain analytics platform. According to their latest blog post, institutional investors have made a significant move by accumulating an impressive 100,000 Bitcoin within a week. On the other hand, it seems that many novice investors have experienced losses and surrendered during this period.

The recent surge in institutional purchases suggests a robust belief among these market heavyweights, despite Bitcoin’s 13% price decrease within the past month.

CryptoQuant analyst Cauê Oliveira’s study examined the shift in balances for entities holding between 1,000 and 10,000 Bitcoins – a group often associated with institutional investors. Remarkably, this accumulation persisted despite Bitcoin prices reaching their lowest point since February, implying these large-scale investors may hold a long-term perspective.

Last week, Oliveira observed a “significant buildup” of around 101.6 thousand BTC, with minimal activity in Bitcoin exchange-traded funds (ETFs). As the price decreased, this institutional accumulation during the month represented a “genuine ‘buying the dip” behavior from major investors,” rather than just a temporary investment tactic.

Significantly, the sentiment in the cryptocurrency sector has dropped dramatically to its lowest point in over a year, reaching the “extreme fear” threshold for the initial time since January 2023. Currently, the sentiment stands at 25, which is a considerable decrease from the previous level of over 72.

As a researcher studying the cryptocurrency market, I’ve found that the price of Bitcoin experienced a significant decline earlier this month due to several contributing factors. Firstly, Bitcoin miners were compelled to sell off some of their BTC holdings following the halving event in April. Additionally, the German government sold a large quantity of Bitcoin, and creditor repayments began at the defunct cryptocurrency exchange Mt. Gox. These events combined to put downward pressure on the price of Bitcoin.

Important to mention, yet, Germany’s Bitcoin sell-off is approaching its conclusion. The country had approximately 49,000 Bitcoins confiscated from the administrators of a movie piracy site, but so far, around 40,000 have been disposed of in this sale.

Experts warn that Germany’s Bitcoin reserves might run out soon if the current selling trend persists. Critics in the German parliament, who are Bitcoin advocates, have expressed their disapproval towards the government’s decision to sell the digital currency, urging them to keep hold of the precious asset rather than exchanging it for euros.

According to Bitfinex’s report, there are indications of a possible bottom in the market. The report emphasized that even though the German government is offloading significant amounts of Bitcoin, these transactions represent only a minimal portion of the total Bitcoin trading activity over the past year.

As a researcher studying market trends, I’ve observed that the volatility metrics are starting to indicate some level of stabilization. The shrinking gap between implied volatility and historical volatility is a clear sign that the market expects a more stable phase ahead. This means that Bitcoin’s price might hover around its current value or exhibit less extreme fluctuations in the near future.

Read More

- Margaret Qualley Set to Transform as Rogue in Marvel’s X-Men Reboot?

- DC: Dark Legion The Bleed & Hypertime Tracker Schedule

- Thunderbolts: Marvel’s Next Box Office Disaster?

- To Be Hero X: Everything You Need To Know About The Upcoming Anime

- Clair Obscur: Expedition 33 ending explained – Who should you side with?

- Does Oblivion Remastered have mod support?

- DODO PREDICTION. DODO cryptocurrency

- Summoners War Tier List – The Best Monsters to Recruit in 2025

- Oblivion Remastered: How to get and cure Vampirism

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

2024-07-13 04:08