- USDT, the kingpin with $144B, holds court over 63% of the stablecoin realm.

- Stablecoin coffers swelled 9.61% from January to April ’25, a tale of triumph.

Amid the frosty Siberian winds of regulatory scrutiny, the stablecoin sector bloomed like a defiant daisy in the first quarter of 2025.

Data from IntoTheBlock reveals a shocking revelation: the total stablecoin supply soared to dizzying heights of $220 billion by April 2025, only to reach the stratosphere at $233.47 billion by the first week of April. Three lessons emerge from this avalanche of numbers.

Institutional players, hungry for on-chain liquidity, have flocked to the stablecoin market like moths to a flame. And who reigns supreme? None other than Tether (USDT) and USD Coin (USDC), the twin titans of the stablecoin universe.

USDT: The Unshakeable Pillar of Crypto Liquidity

USDT, with its gargantuan $144B+ market cap, stands tall, claiming 63% of the stablecoin supply. USDC, while playing second fiddle, has reclaimed its throne with a $59B market cap and a 27% share. Together, they wield an iron grip on over 90% of the market—a duopoly that would make even Stalin envious.

Circle’s Bid for Wall Street Glory

As Circle gears up for its IPO, the timing couldn’t be more fortuitous. With the stablecoin market on a tear, the stage is set for a grand entrance into the hallowed halls of the NYSE. Despite a 42% dip in net income, the allure of the stablecoin boom may just be enough to ignite a fresh wave of institutional fervor.

The stablecoin market expanded from $206B in January to $225.8B in April—a 9.61% leap in mere months. But not all stablecoins are created equal. DAI, FRAX, and TUSD languish in the shadows, clinging to a meager 10% market share. 🐢…

Ethereum vs. Tron: A Tale of Two Platforms

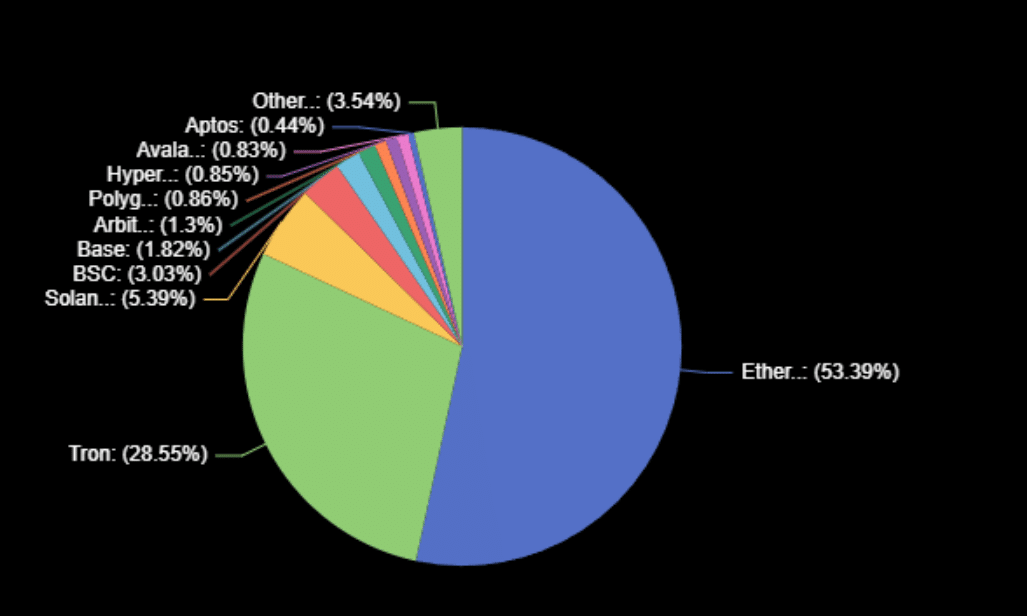

Ethereum maintains its stronghold, housing 53.39% of all stablecoins. Tron, ever the challenger, stakes its claim at 28.55%. This division suggests a subtle bifurcation, with Layer 1 and Layer 2 chains carving out their own niches.

While stablecoin supply balloons, exchange activity tells a different story. February 2025 saw record inflows and outflows, only to be followed by a staggering -$2.9B net outflow in March—the largest quarterly decline. April brought a chill to the market, with inflows and outflows plummeting over 80% from March.

The Future of Stablecoin Oligarchy

Will the sector see a broader decentralization, or remain shackled to the whims of USDT and USDC? Only time will tell if the stablecoin market will embrace change or continue dancing to the tune of its two puppet masters.

Read More

- Gold Rate Forecast

- Tom Cruise Bags Gold: Mission Impossible Star Lands Guinness World Record for Highest Burning Parachute Jumps

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Tom Hiddleston and Wife Zawe Ashton Announce Second Pregnancy, Know Couple’s Relationship Timeline

- Are Billie Eilish and Nat Wolff Dating? Duo Flames Romance Rumors With Sizzling Kiss in Italy

- Is Justin Bieber Tired of ‘Transactional Relationship’ with Wife Hailey Bieber? Singer Goes on Another Rant Raising Concerns

- Justin Bieber Tells People to ‘Point at My Flaws’ Going on Another Rant, Raises Alarm With Concerning Behavior

- INCREDIBLES 3 Will Be Directed by ELEMENTAL’s Peter Sohn, Brad Bird Still Involved

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Resident Evil 9: Requiem Announced: Release Date, Trailer, and New Heroine Revealed

2025-04-05 18:19