The Injective price, once a timid wallflower at the ball of markets, has now pirouetted into the spotlight with a 20% intraday crescendo. No, dear reader, this is not the random gasp of a market drunk on caffeine and delusion. This is capital waltzing in, wearing a top hat and monocle-real capital, with a ledger to prove it.

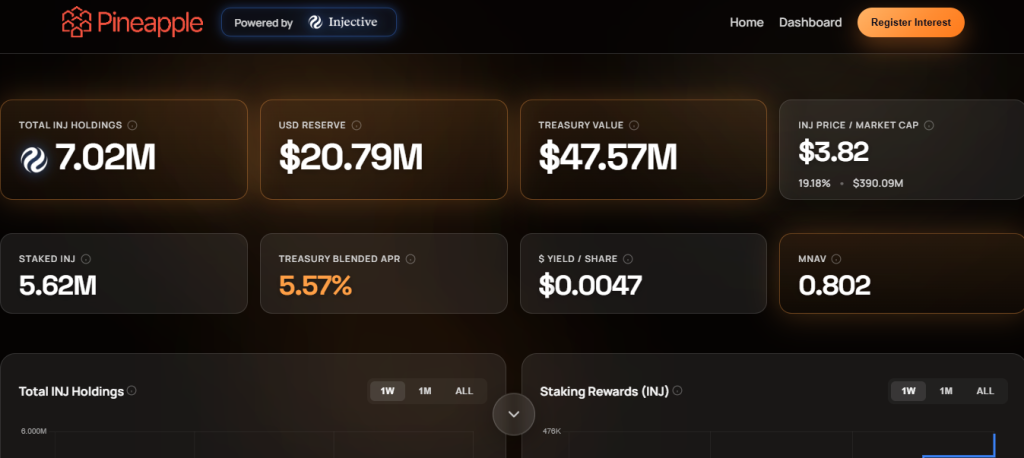

Pineapple Financial (NYSE: PAPL), that paragon of fiscal audacity, has escalated its INJ acquisition spree, splurging $2 million on February 19, 2026, under its market cash purchase program. One might call it a treasury play, but let us call it what it is: a Shakespearean love affair with Injective’s ecosystem. This is no fleeting infatuation; it is a marriage of conviction, sealed with $20.79 million in reserves. The DAT dashboard whispers of 7.02 million INJ tokens-proof, if one needed it, that Pineapple’s heart is not merely in the game, but buried in it.

Pineapple’s Injective Obsession: A Treasury Strategy or a Midlife Crisis?

Let us not feign ignorance. Public treasuries buying crypto is not new. But Pineapple? Oh, it is not merely dabbling in digital assets-it is conducting an open-market seduction, one INJ token at a time. Its strategy is not passive; it is a tango, a calculated dance around the INJ blockchain, with reserves suggesting the music will play for years to come.

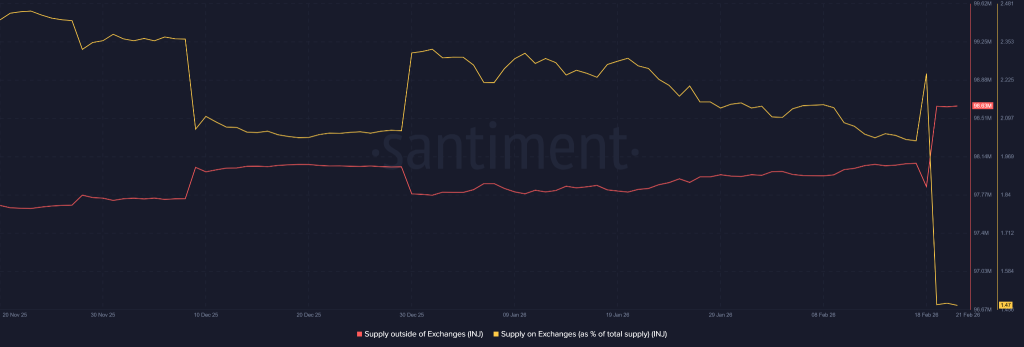

Meanwhile, the supply dynamics have taken a turn for the dramatic. Exchange balances are vanishing like a bad pun at a poetry slam, while the supply outside exchanges has swelled to 98.63 million INJ. One might call it accumulation, but I call it a plot twist. The coins are fleeing exchanges, and the market is watching with bated breath-like a Victorian novel where every page is a cliffhanger.

Injective’s Burn and Buybacks: A Pyrrhic Victory?

Ah, the sweet symphony of destruction! This week’s INJ community BuyBack ceremony saw 54,999 tokens vanish into the ether, a deflationary ballet worthy of a standing ovation. But let us not forget the supporting act: IIP-620, that most elegant of blockchain upgrades. Dynamic gas fees, now caged within a logically aligned range-what a marvel! No more wild fee spikes to disrupt your crypto tea parties. Predictability, they say, is the spice of life. Or, as Injective Core might put it:

A new proposal with a technical blockchain upgrade has just been approved in the Injective ecosystem. Now the dynamic gas fee will not be able to increase beyond a logically allowed level aligned with the minimum gas price.

Fees are becoming more stable and predictable, limiting…

– Injective Core (@Injective_Core) February 20, 2026

Stable fees, indeed. A welcome respite from the chaos, though one suspects the market’s appetite for drama is far from sated. At $3.86, the INJ/USD pair dances on, its $386 million market cap a modest trinket in this grand opera. And that 20% surge? A mere prelude to the encore.

Falling Wedge: A Technical Breakout or a Market’s Fancy Hat?

Technically speaking, the 24-month falling wedge pattern has sprouted wings. Should it breach its upper boundary, the short-term target of $8.00 awaits like a siren’s song. Some, with visions of $20 dancing in their heads, whisper of longer-term possibilities. But let us not confuse ambition with reality-this is a slow burn, not a fireworks display.

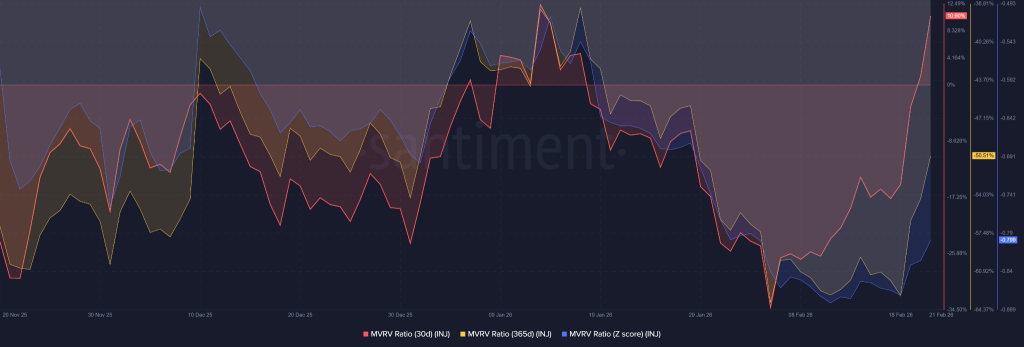

On-chain metrics? A mixed bag, but with a hint of optimism. The 30-day traders are back in profit, while the 365-day holders remain adrift in a sea of red. The MVRV Z-score, at -0.799, is a melancholic waltz, but its upward curve suggests recovery mode, not euphoria. It is a masquerade ball of metrics, where hope and caution share a glass of champagne.

And so, where does this leave us? In a realm where disciplined accumulation meets technical potential. If the wedge cracks and treasury buying persists, the $8 test may arrive sooner than skeptics’ sighs. For now, Injective’s price is finally dancing to the bulls’ tune-a performance that depends, as all great finales do, on the audience’s continued applause.

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- Gold Rate Forecast

- Wuchang Fallen Feathers Save File Location on PC

- Banks & Shadows: A 2026 Outlook

- HSR 3.7 breaks Hidden Passages, so here’s a workaround

- Gemini’s Execs Vanish Like Ghosts-Crypto’s Latest Drama!

- Exit Strategy: A Biotech Farce

- QuantumScape: A Speculative Venture

- MicroStrategy’s $1.44B Cash Wall: Panic Room or Party Fund? 🎉💰

2026-02-21 17:48