The latest vote by the Injective community to decrease the supply of INJ tokens has ignited a surge in their value. Currently trading at $26.29 per token, its price has climbed an impressive 33% over the last week.

Although this rally is taking place, INJ futures traders have chosen to bet that its price will fall. Yet, if the token continues to grow, these short traders could encounter a possible short squeeze situation.

Injective’s Transition Boosts Market Interest

On January 5th, a governance decision to progress from Injective 2.0 to Injective 3.0 was endorsed by an overwhelming majority (99.99%) of community members. This transition is expected to decrease the total number of INJ tokens in circulation, making it one of the most deflationary assets as time goes on.

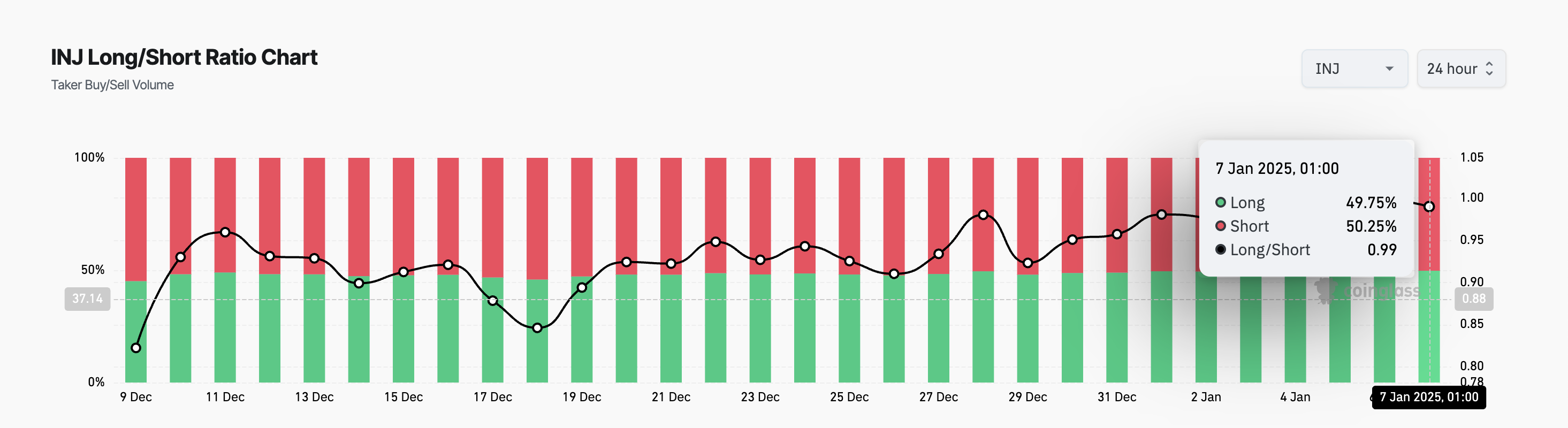

At present, an optimistic buzz surrounding the latest update is propelling the increase in INJ prices, with its value jumping by 18% over the past two days. Interestingly, while this is happening, traders of INJ’s future contracts show no enthusiasm and are still asking for additional short positions, as indicated by the current Long/Short Ratio of 0.99 for INJ at the moment of press.

In simpler terms, this ratio shows how many bullish (long position) and bearish (short position) bets on a market’s price direction exist. If the number of short positions exceeds long positions (ratio is less than 1), it suggests that traders are more pessimistic about the market’s growth, implying a bearish outlook.

Rising Demand for INJ Puts Short Traders at Risk

Consequently, as interest in INJ rises, these traders face the possibility of a ‘short-covering rally’. This happens when an asset increases in value, compelling short sellers to purchase shares to minimize their losses. The increased buying activity can further boost the price, leading to a self-reinforcing cycle that intensifies the upward trajectory.

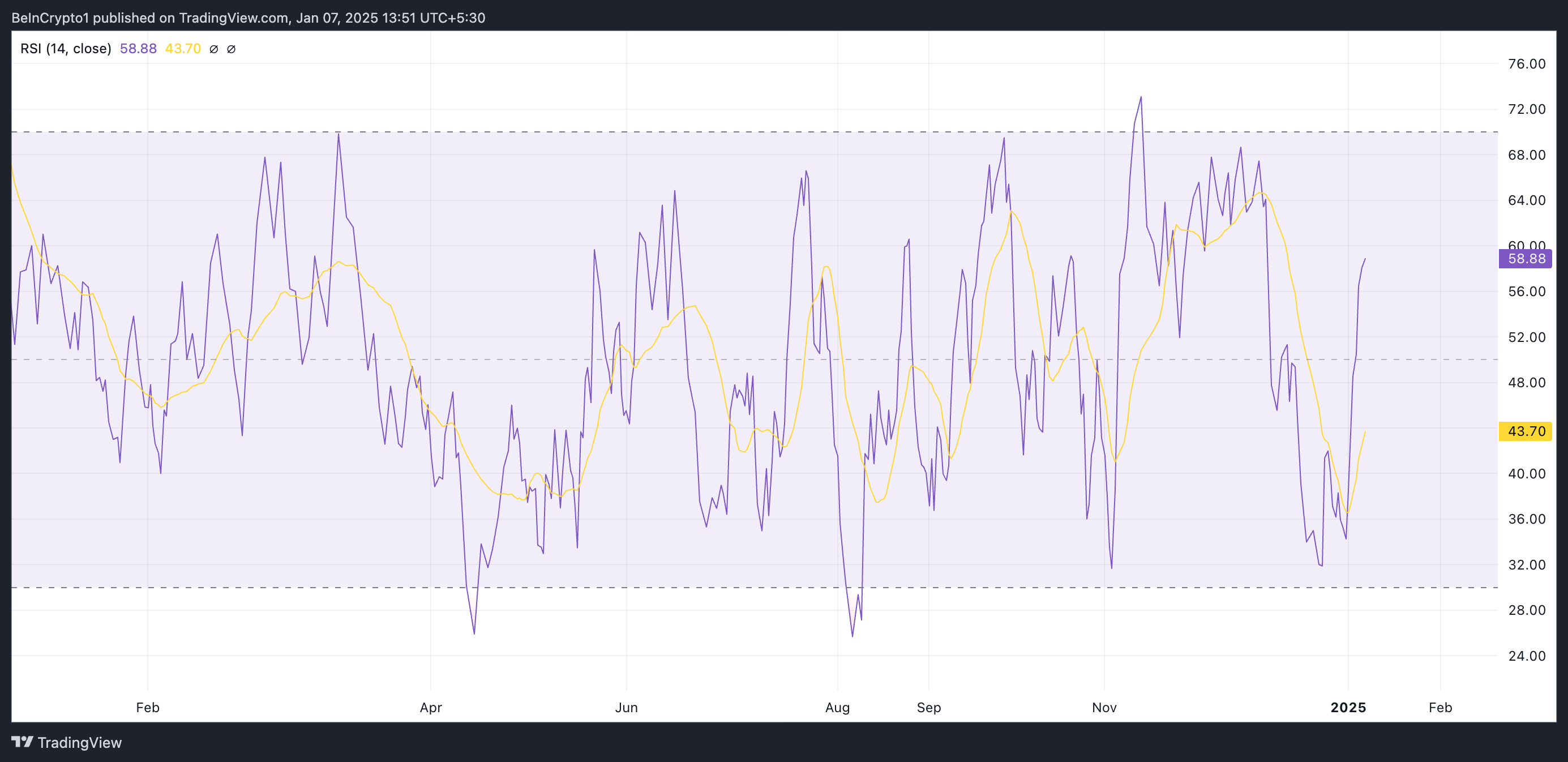

The Increased Relative Strength Index (RSI) of the company is noteworthy at present. Currently, this momentum indicator shows an upward trend at 58.88.

The RSI (Relative Strength Index) tool evaluates whether an asset’s market conditions are excessively bought or sold. This indicator operates on a scale from 0 to 100, where numbers over 70 suggest the asset is overbought and could require a price adjustment. Conversely, figures below 30 imply that the asset might be oversold and may experience a price increase.

As a crypto investor, I find myself in a rather promising position with Injective (INJ) at 58.88. The Relative Strength Index (RSI) suggests that the asset is hovering in a neutral-to-slightly bullish zone, indicating potential growth ahead. Moreover, the price momentum shows a higher demand for buying rather than selling, yet it’s not quite overbought, which could mean further upward movement without excessive exuberance.

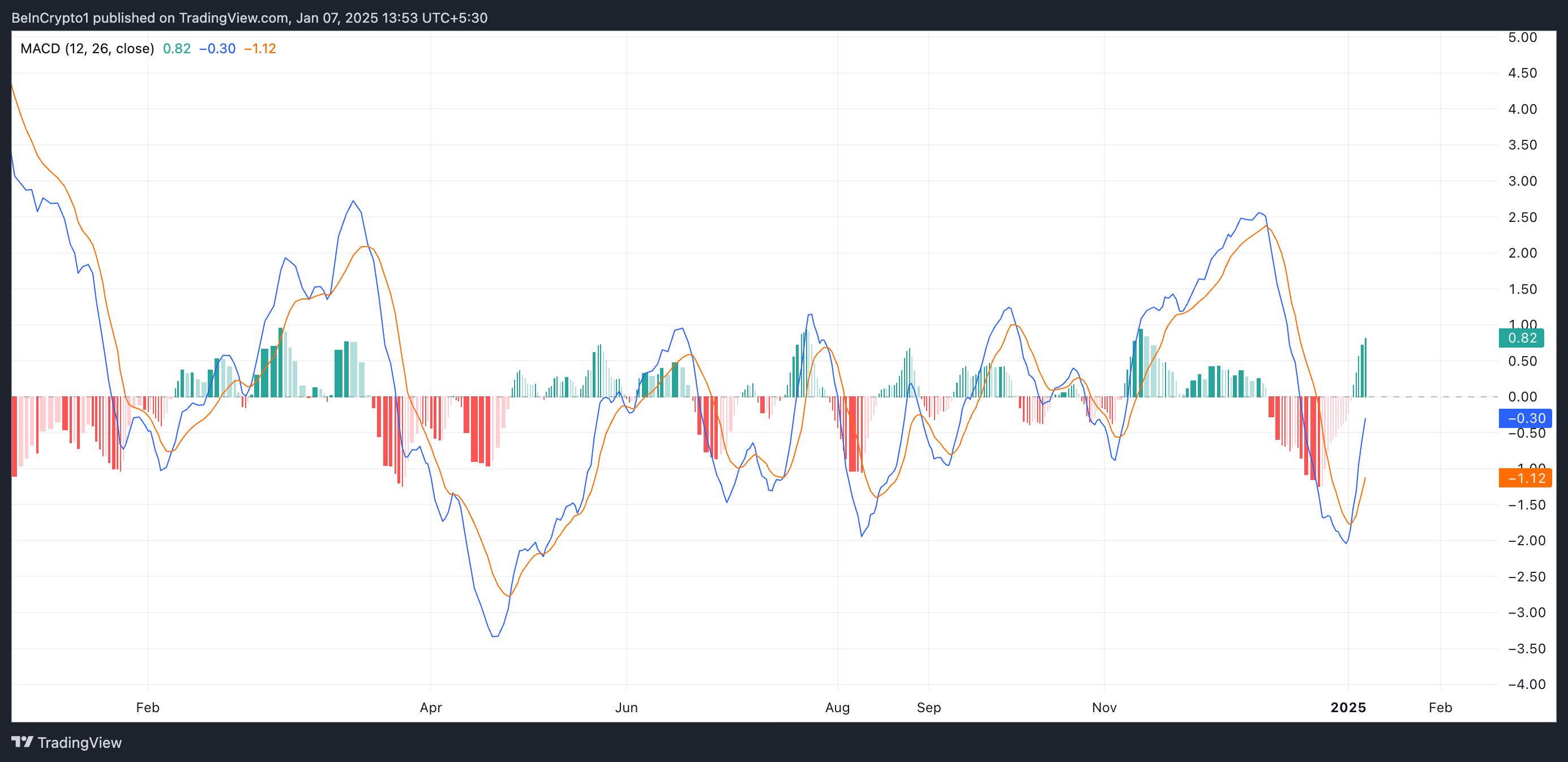

Additionally, the Moving Average Convergence Divergence (MACD) reading from INJ indicates a positive outlook. Presently, the MACD line, which is represented by blue, sits above the orange signal line.

Setting up this indicator in such a manner suggests optimistic market movement (bullish momentum). If the current trend remains, there’s a possibility that the price of Injective token could potentially keep increasing.

INJ Price Prediction: Can Momentum Push the Price Above $30?

From my perspective as a researcher, as buying pressure escalates, there’s a potential for INJ’s price to surpass the resistance established at $28.72. If this bullish momentum holds steady, INJ might regain its footing above $30 and possibly revisit its multi-month high of $35.26.

Conversely, should the short bets be successful and the Injective token’s price changes direction, it might fall to $24.44 instead.

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Gold Rate Forecast

- Batman and Deadpool Unite: Epic DC/Marvel Crossover One-Shots Coming Soon!

- Who was Peter Kwong? Learn as Big Trouble in Little China and The Golden Child Actor Dies at 73

- Hunter Schafer Rumored to Play Princess Zelda in Live-Action Zelda Movie

- 30 Best Couple/Wife Swap Movies You Need to See

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- Gachiakuta Chapter 139: Rudo And Enjin Team Up Against Mymo—Recap, Release Date, Where To Read And More

- Summer Game Fest 2025 schedule and streams: all event start times

2025-01-07 16:08