The shareholder who encounters Impinj (PI) for the first time might liken the experience to discovering a cryptic clause buried in an endless contract. Here stands a company whose trailing price-to-earnings ratio of 695 and price-to-sales ratio hovering near 15 appear as mathematical incantations, conjured by some spectral bureaucracy to test the resolve of mortal investors. Its RFID technology, indispensable for tracking inventory in an age obsessed with logistical precision, becomes irrelevant to the casual observer drowned in these vertiginous figures-a Sisyphean spectacle of digits rolling ever upward.

Yet the analysts, those scribes of the financial realm, scrawl unanimous verdicts of “buy” upon their parchment. Their average price target aligns with the stock’s present trajectory, as if guided by an invisible hand manipulating both market and metric. How reconcile this with the grotesque ratios? How explain the dissonance between the numbers’ screaming faces and the quiet confidence of those who parse them?

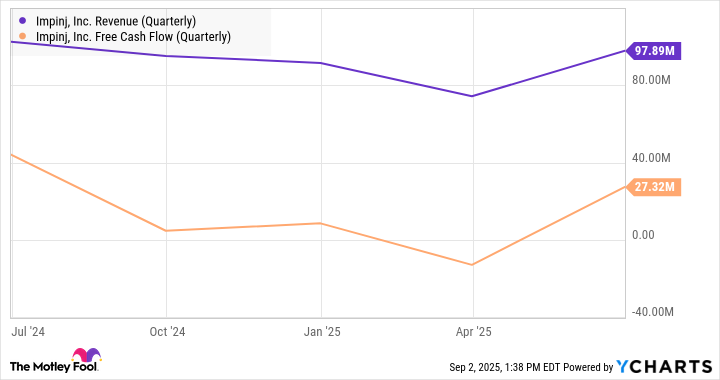

Consider the following chart-a cartographer’s map through this fog of valuation:

Observe: sales and free cash flows ascend like fugitives escaping the gravitational pull of the company’s core markets, themselves mired in the quicksand of economic stagnation. Retailers and shipping firms report revenues shrinking like shadows at noon, yet Impinj’s order books swell. Gross margins reach numerals once thought theoretical. It is as though the firm has unearthed a hidden tributary feeding the mainstream of commerce, unseen by those downstream.

This tributary widens into a river. Management’s projections for the coming quarter and fiscal year resemble prophetic scrolls, inked with optimism. Demand for RFID tags and their attendant data systems grows not as a trend but a necessity-a tax imposed by the modern era upon those who would misplace their inventory. The implication gnaws: Impinj’s present valuation, so grotesque in its proportions, may prove merely a temporary station in a longer pilgrimage toward normalized metrics.

The P/E ratio, that gaunt specter haunting headlines, derives its menace from a technicality. Earnings hover near breakeven, a tightrope walker’s pause between ascent and collapse. Should Impinj cross this chasm-and the momentum suggests it might-the ratio’s current monstrosity dissolves into mere abstraction. By 2026, the numbers may look back with the mildness of forgotten nightmares.

Impinj’s Inevitable Ascent

The market’s machinery grinds forward, indifferent to human discomfort. Impinj’s clients, retailers and shippers bound by chains of their own making, now require the company’s tracking solutions with the desperation of drowning men clutching life preservers. Precision in unit-tracking has become less a tool than a commandment, etched into the tablets of contemporary commerce.

Thus, the valuation ratios-those grotesque gargoyles perched atop the cathedral of finance-will erode. Not through intervention, but through time’s passive solvent. Growth, relentless and unfeeling, will dilute the P/E and P/S into docility. Investors who recoil today may find themselves spectators to a metamorphosis they refused to anticipate.

Read More

- Top 15 Insanely Popular Android Games

- Gold Rate Forecast

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- EUR UAH PREDICTION

- Core Scientific’s Merger Meltdown: A Gogolian Tale

- Why Nio Stock Skyrocketed Today

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- Silver Rate Forecast

2025-09-04 15:53