Well, here we are-another year, another wave of anxious whispers about the impending market apocalypse. No one really knows if the stock market will stumble, tumble, or do some dramatic pretzel move in 2026, but a good investor-especially one with a penchant for feeling both clever and terrified-knows that downturns are just part of the performance art. The trick is: is your portfolio wearing the right armor or just a fancy but useless chainmail?

If the worst does happen, and the market decides to take its existential nap, it’s crucial to keep your wits-and your investments-intact. Companies wobbling on shaky legs are destined for the dustbin when the storm hits. Conversely, the ones with grit, gumption, and enough cash reserves tend to rebound faster than you can say “buy low, sell high.” And, in that unlikely event, there’s one ETF from Vanguard I intend to cling to like a life raft-because I’ve learned, after enough missteps and market tantrums, that there’s value in steady, quiet resilience.

A Fortress ETF That Also Won’t Make You Feel Too Nervous

If you fancy an ETF that’s meant to trim your risks but still leaves you with a glimmer of hope for future riches, the Vanguard S&P 500 ETF (VOO 0.75%) is a good starting point. It’s like that friend who’s been around the block-reliable, a bit battered, but fundamentally sound.

This ETF doesn’t pick favorites; it mimics the S&P 500 (^GSPC 0.78%), meaning it’s pretty much a mirror image of the entire top-tier US corporate oligarchy-those 500 giants who make the economy look like a well-oiled machine. Or a charismatic parade that could turn ugly at any moment-your call. By tracking the index, it offers a kind of rough decay into the American Dream, with enough giants to cushion the blow when the landscape shifts beneath us.

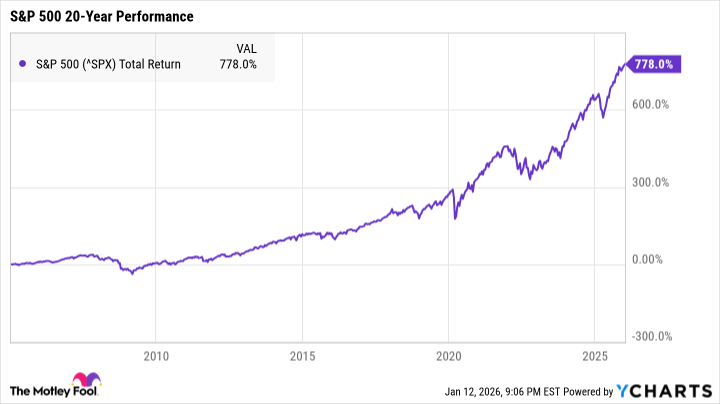

Here’s the thing: the S&P 500 has survived pretty much everything short of alien invasion-recessions, crashes, political chaos-you name it. It’s weathered this mental rollercoaster, and historically, it’s delivered positive total returns over the long haul. Whether you’re a risk-averse soul or just in it for the long game, riding this index generally means you won’t lose your shirt, even when the world appears to be ending.

Long-term investors-bless their brave hearts-rarely see the inside of a losing streak with this kind of investment. Crestmont Research examined these rolling 20-year returns, and-surprise-they all end with a smile, not tears. The line is: if you buy an S&P 500 ETF at some point, and stick around for a couple of decades, you’re pretty much guaranteed to come out with a profit. Not a guarantee of a smooth ride-oh no, there will be bumps, bruises, maybe a few screaming matches with the market-but the overall trend is upward, like that stubborn weed that refuses to be eradicated.

So, if you could stomach the volatility-if you’re the sort who can look into the abyss and still believe that something good might come of it-then this ETF is your best bet to fight the slow grind of inflation and the chaos of inevitable downturns.

Building Wealth While You Sleep (or Pray)

If you’re the sort of person who’s actually planning for a future where you don’t have to work until your bones turn to dust, here’s a nugget of truth: starting with just $5,000 invested in Vanguard’s S&P 500 ETF ten years ago and leaving it to do its thing would’ve turned that into a tidy $21,000-more than quadrupling. And that’s just the beginning. Small, disciplined contributions-$200 a month-can turn this into a genuine nest egg, a backup plan, or a middle finger to inflation and uncertainty.

Since its launch in 2010, the ETF has averaged roughly 15% annual returns-if you’re feeling lucky, and maybe a little reckless. But, borrowing from history, the S&P 500’s true essence is around 10% yearly growth-steady, unglamorous, and dependable in an unpredictable world. If you invest that $200 monthly, here’s what could happen:

| Years | With 10% Returns | With 15% Returns |

|---|---|---|

| 15 | $76,000 | $114,000 |

| 20 | $137,000 | $246,000 |

| 25 | $236,000 | $511,000 |

| 30 | $395,000 | $1,043,000 |

| 35 | $650,000 | $2,115,000 |

And here’s the brutal truth-if the ETF keeps earning an average close to its 10-year pace, a million bucks isn’t some distant pipe dream but a near certainty in just a few short decades. Even if returns are a bit subdued, it’s still a pretty neat little peace of mind-you know, if you like having a safety net that doesn’t look like a joke.

Nobody really has a crystal ball for 2026, but I know this: Vanguard’s S&P 500 ETF has proven it can survive all sorts of chaos. Time, a teensy bit of patience, and regular contributions might just surprise you. Because in the end, the market’s a rogue, unpredictable beast-your job isn’t to tame it but to keep your head down and keep betting on the long game.

And that’s how you quietly, stubbornly, build your empire-one uncertain step at a time. 💼

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- Banks & Shadows: A 2026 Outlook

- ETH PREDICTION. ETH cryptocurrency

- HSR 3.7 story ending explained: What happened to the Chrysos Heirs?

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- Gay Actors Who Are Notoriously Private About Their Lives

- 9 Video Games That Reshaped Our Moral Lens

- The Weight of Choice: Chipotle and Dutch Bros

2026-01-14 23:24