As a seasoned crypto investor with a background in finance and technology, I find ICBC’s research report on Bitcoin and Ethereum insightful and well-researched. The report highlights the unique characteristics of each cryptocurrency and their respective roles within the market.

As an analyst at a financial institution, I had the opportunity to delve into the intricacies of the digital currency market with my colleagues Cheng Shi, Dorothy Zhou, and Andy Zhang at ICBC on June 6, 2024. Our insightful research report, entitled “Macro Economy In-Depth Analysis: The Division and Integration of Digital Currency,” sheds light on the current landscape of Bitcoin and Ethereum within this burgeoning sector.

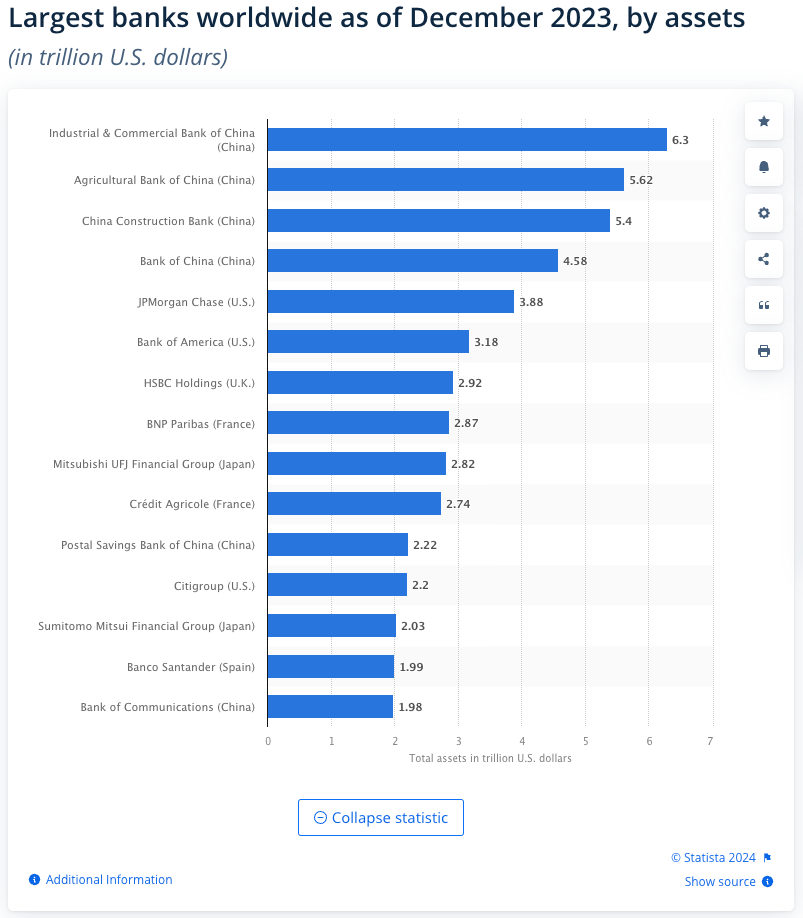

ICBC, or Industrial and Commercial Bank of China, holds the title as the largest bank globally in terms of total assets, with an estimated value of around 6.3 trillion US dollars as of late 2023, based on data from Statista.

I, as an analyst, would describe ICBC as follows: Established in 1984 with its headquarters in Beijing, I am referring to ICBC, a state-owned commercial bank. This financial institution provides an extensive array of services for both individuals and corporations. These offerings encompass investment banking, retail banking, asset management, insurance, and wealth management.

ICBC, the bank, boasts an extensive global presence with branches and subsidiaries in many countries. Through this network, they offer financial solutions to countless individuals and corporations around the world. ICBC has earned a solid reputation for its innovative technology and exceptional customer service. This financial powerhouse significantly contributes to China’s economic growth by providing an array of financial products such as loans, credit cards, and international trade financing.

ICBC stands out in China’s economic landscape, making substantial impacts in key sectors like infrastructure development, manufacturing industries, and international commerce. By skillfully incorporating advanced financial technologies and adhering to rigorous risk management protocols, this bank has earned a prominent role within the global banking sector.

As an analyst at ICBC, I would express it this way: In our latest research, we’ve underlined Bitcoin’s unrivaled position in the cryptocurrency sphere, often likened to digital gold. This is due to its inherent scarcity, created by mathematical restrictions similar to gold, which makes it a highly valuable digital asset. However, we acknowledge that Bitcoin faces certain challenges as a currency. Its volatility, difficulty to authenticate transactions, and inconvenience in making payments are significant drawbacks. Nevertheless, the asset qualities of Bitcoin are becoming more solidified, underscoring its importance as a store of value.

ICBC points out that Bitcoin holds a dominant position in the cryptocurrency market due to being the original and best-known digital currency. The bank emphasizes that Bitcoin’s function as a speculative investment and a shield against inflation drives its popularity. The report stresses that Bitcoin’s market behavior continues to be shaped by these aspects, underlining the importance of clear and consistent regulation for the cryptocurrency.

As a researcher, I’ve noticed that ICBC places significant importance on Ethereum, referring to it as the “digital oil” of the cryptocurrency landscape. In contrast to Bitcoin, Ethereum was engineered as a multifaceted platform. It offers developers the ability to construct an extensive range of decentralized applications (dApps) through its Turing-complete programming language, Solidity, and its virtual machine, EVM. ICBC highlights that this adaptability has been instrumental in Ethereum’s emergence as a crucial component within the decentralized finance (DeFi) sector and non-fungible tokens (NFTs).

ICBC points out that Ethereum’s capability to safely execute smart contracts, encompassing both aggressive and defensive programming, markedly diminishes weaknesses and bolsters the entire network’s security. This essential feature is vital as it forms the foundation for trust and dependability in the Ethereum platform.

ICBC observes that the intricacy of smart contracts demands considerable computational power, leading to restricted transaction processing capabilities and heightened expenses. However, Ethereum network is persistently working on resolving these constraints through different scaling methods. Notably, the shift to Ethereum 2.0, featuring the Proof of Stake (PoS) consensus mechanism, represents a substantial advancement in enhancing scalability and energy efficiency.

ICBC’s report underscores Ethereum’s dedication to sustainability as it transitions from PoW to PoS, with ICBC pointing out that this mechanism consumes less energy than the former. Moreover, ICBC highlights advancements in Layer 2 technologies like state channels and side chains, which are designed to improve network scalability while preserving a delicate equilibrium between sustainability, security, and efficiency.

Chinese state-owned banks continue to express strong interest towards Bitcoin and Ethereum, with ICBC specifically labeling them as the “digital equivalent of oil.”

— matthew sigel, recovering CFA (@matthew_sigel) June 10, 2024

Read More

2024-06-11 18:05