Ah, Hyperliquid (HYPE), the darling of the crypto world, soared like a kite in a tempest, achieving a staggering 326% rally from the depths of despair in early April to a dizzying peak of $39.93 on May 26. Yet, as the sun sets on this bullish trend, the shadows of short-term indicators whisper of waning momentum. Now, the price dances precariously in the $30–$35 zone — a veritable battlefield for the beleaguered bulls.

Key Highlights

- HYPE, in its audacious ascent, gained 326% since April, reaching an ATH of $39.93 before retreating to $34.74. Quite the dramatic turn, wouldn’t you say?

- Open interest shattered the $10.1B ceiling, a clear signal of the high-stakes game being played.

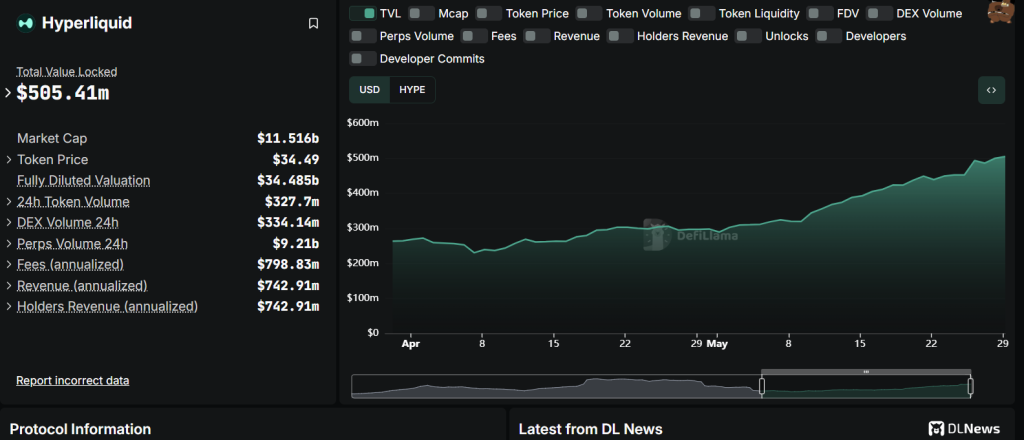

- TVL, that elusive metric, surged from $268.9M in early April to over $500M by May 29. Who knew money could grow on trees?

- While momentum remains bullish, the RSI and MACD indicators are waving red flags near the $35.50 resistance. Caution, dear traders!

Why HYPE Hit ATH — And Why It’s Cooling Now

According to the ever-reliable TradingView News, Hyperliquid’s meteoric rise to $39.93 was fueled by institutional activity and a surge in engagement. Who doesn’t love a good party?

As a premier DeFi platform for perpetual trading, the weekly volume reached a staggering $78.67B (May 11–18), with a record-breaking $17.73B on May 21. Talk about a busy week!

High-profile trader James Wynn, with his billion-dollar positions, drew attention like a moth to a flame, pushing open interest past $10.1B, as confirmed by Blocmates. The platform also raked in $5.6M in daily fees, a testament to the heavy trading demand. 💰

This surge in on-chain activity reflects a broader trend as traders increasingly favor decentralized venues that offer deep liquidity, transparent execution, and non-custodial control over their precious assets. Freedom, at last!

However, the RSI and MACD now signal a cooldown, suggesting consolidation unless the bulls can muster the strength to reclaim resistance. 🐂

Hyperliquid Surpasses SUI in Market Cap.

Between May 25–26, HYPE’s market cap peaked at $13.04B, overtaking SUI Coin’s $12.27B. The rally was supported by over $460M in daily volume, catapulting HYPE into the top 12 crypto assets by market cap. Quite the achievement!

As of May 29, HYPE trades at $34.74 with a market cap of $11.46B, still ahead of SUI’s $12.03B, but the momentum is clearly cooling. A classic case of “what goes up must come down.”

HYPE/USD Ichimoku Cloud Analysis: Bulls Hold the Line — For Now

The daily Ichimoku Cloud reveals a bullish structure, with price hovering above the Kumo. However, Tenkan-sen ($33.0) is feeling the pressure, while Kijun-sen ($31.3) lurks below. A break under the 20 EMA ($30.41) could shift the tides of short-term momentum.

Additional support lies at the 100 EMA ($27.38) and 50 EMA ($25.08). While the bullish stack remains, it shows signs of vulnerability. A precarious position, indeed!

Momentum Indicators: Cooling, But Not Reversing

- RSI (14): Down from 73.30 to 66.94 — still bullish, but no longer in overbought territory. A sobering thought!

- MACD: Still above the signal line, but the histogram has begun to fade — a sign of slowing momentum. Time to hold your breath!

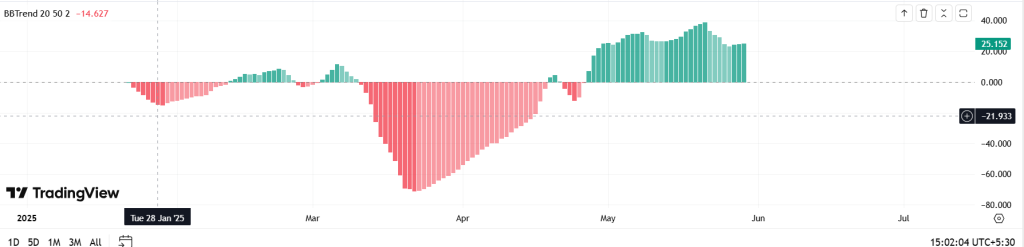

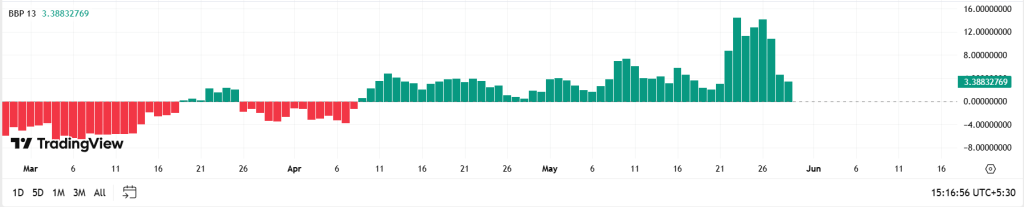

- BBTrend: Flattening near 25.15 from 38.863, indicating that the breakout momentum is cooling. A moment of silence, please.

- BBP (Bulls Bears Power): Reading at 3.038 down from 13.972 during ATH and declining, suggesting waning buy pressure. The bears are stirring!

Momentum remains positive but shows signs of exhaustion. A decisive break below $30.41 would mark a short-term sentiment shift. Hold onto your hats!

HYPE TVL Hits 2-Month High, Reinforcing Fundamentals

DeFiLlama data reveals that TVL has risen from $268.9M (April 1) to over $500M by May 29. This increase suggests continued long-term investor confidence. A glimmer of hope!

Protocol Strength: Revenue & Fee Dominance Back the Rally

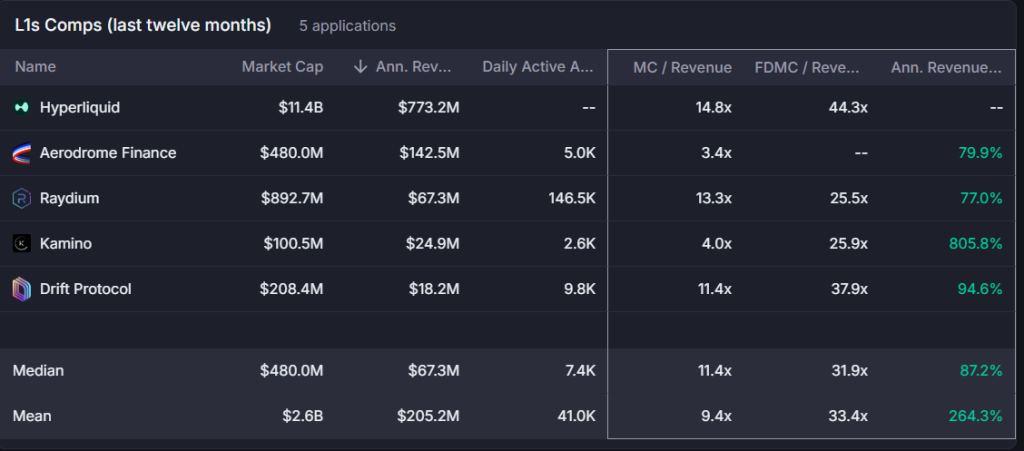

Over the past 12 months, Hyperliquid generated $773.2M in revenue with a market cap of $11.4B — outperforming peers like Raydium and Aerodrome. Despite a 14.8x MC/Revenue ratio, its growth justifies the premium. A true underdog story!

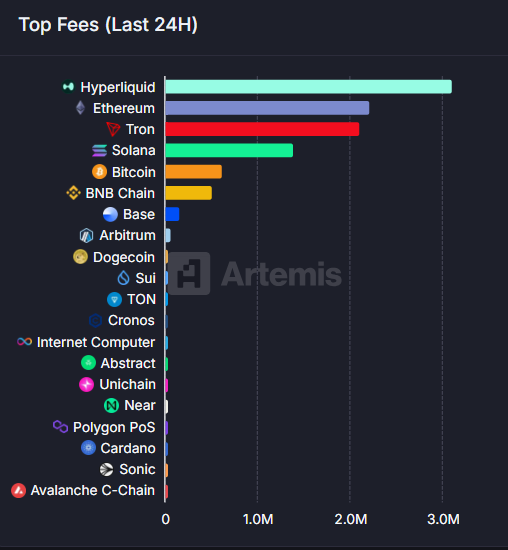

In the last 24 hours, Hyperliquid led all blockchains in fee generation, with $3.1M in protocol fees, according to Artemis. The numbers speak for themselves!

These metrics highlight strong usage and a sustainable growth model. A beacon in the storm!

HYPE Price Levels to Watch

Support levels: $33.00 (Tenkan-sen), $30.41 (20 EMA), $27.38 (100 EMA). Resistance levels: $35.50 (minor ceiling), $39.93 (ATH), $42.00 (target). Keep your eyes peeled!

HYPE Price Prediction: Can Bulls Reclaim $39.93?

Hyperliquid remains in a strong uptrend despite recent cooling, supported by high open interest and robust trading activity. The recent pullback appears healthy within the broader parabolic structure. A moment of reflection!

Short-Term Forecast (May 29 – June 5):

- Possible short-term pullbacks to $30.41–$31.30. Brace yourselves!

- Holding above $30 would preserve the current bullish arc. Fingers crossed!

- A breakout above $35.50 could send HYPE toward $39.93. The thrill of the chase!

Mid-Term Outlook (June 5 – June 14):

- If $39.93 breaks with volume, the next resistance lies at $42.00. The stakes are high!

- Continued strength above $42 may target $46–$48. The sky’s the limit!

- The bullish structure remains valid as long as $30 holds. Failure below this could lead to a deeper correction toward $27.38. A cautionary tale!

Traders should monitor volume confirmation, RSI trends, and MACD signals to validate directional momentum. The game is afoot!

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- 30 Best Couple/Wife Swap Movies You Need to See

- USD ILS PREDICTION

- Everything We Know About DOCTOR WHO Season 2

- DC: Dark Legion The Bleed & Hypertime Tracker Schedule

- 9 Kings Early Access review: Blood for the Blood King

- Summoners War Tier List – The Best Monsters to Recruit in 2025

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- 10 Shows Like ‘MobLand’ You Have to Binge

- All 6 ‘Final Destination’ Movies in Order

2025-05-29 16:35