Welcome to the US Crypto News Morning Briefing-your essential rundown of the most important developments in crypto for the day ahead.

Grab a coffee and settle in, dear reader, for a tale of how a decentralized derivatives exchange (DEX) is not just disrupting Wall Street’s efficiency metrics but doing so with a side of irony and a pinch of sarcasm. 🌟

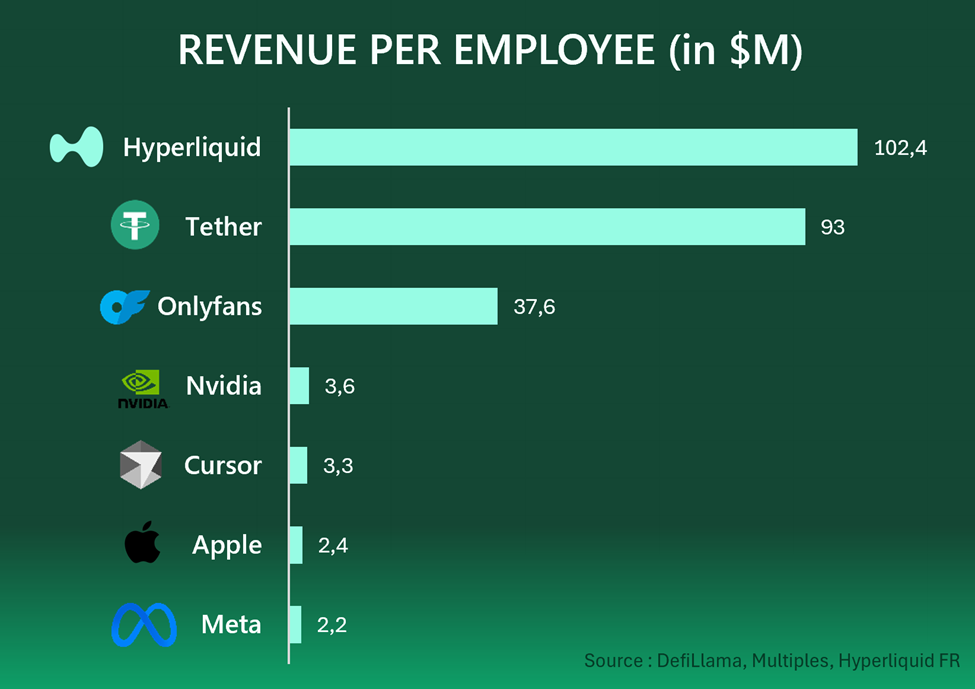

According to data compiled by DeFiLlama, Hyperliquid, a DEX with just 11 core contributors, generates an estimated $1.127 billion in annual revenue. That translates to a staggering $102.4 million in revenue per employee, making it the highest figure globally. 🤯

To put this in perspective, Tether’s per-employee revenue stands at a mere $93 million. Even the mighty Apple, despite its $400 billion annual sales, manages a modest $2.4 million per employee. 🍏

This success story is a testament to the power of crypto’s lean operational models. While traditional firms bloat their headcounts, Hyperliquid’s small team of developers and contributors generates revenue that rivals some of the largest corporations. 🚀

Jeff Yan, CEO and co-founder of Hyperliquid, recently confirmed that the protocol’s team numbers just 11. When asked about his management model, Jeff admitted that while the team has its strengths, there is still room for improvement. 😅

Jeff Yan remains deeply involved in the technical work, maintaining oversight of the overall architecture and performance. But here’s the kicker: Hyperliquid turns down venture capitalists, preferring self-funding. Jeff argues that traditional VC financing creates an illusion of progress by inflating valuations. 💸

Hyperliquid Founder: Why We Turned Down All Venture Capital?

Jeff said Hyperliquid has been entirely self-funded and was not created for profit. He criticized traditional VC financing for creating an “illusion of progress” by inflating valuations, stressing that true progress…

– Wu Blockchain (@WuBlockchain) August 18, 2025

With DeFiLlama estimating Hyperliquid’s annualized revenue at $1.127 billion, the platform’s lean 11-person team sets a new benchmark for efficiency. This aligns with a 2022 study that found DeFi platforms routinely achieve 50-70% higher revenue efficiency than traditional firms. 📈

Hyperliquid’s success is not just a niche achievement; it’s a clear example of a decentralized exchange rivaling mainstream enterprises. 🌐

Hyperliquid Dominates Blockchain Revenue

The decentralized exchange’s dominance is evident at the ecosystem level. According to DeFiLlama, just nine protocols generated 87% of all distributed protocol revenue last week. Hyperliquid, along with Solana meme coin launchpad Pump.fun and Aerodrome, accounts for 75% of the total. Hyperliquid alone captured 37% of blockchain revenue in July, highlighting its outsized role in the DeFi economy. 📊

87% of protocol revenue distributed to token holders over the past week came from only 9 protocols.

75% of all revenue distributed to token holders came from only 3 protocols: Hyperliquid, Pump, and Aerodrome.

– DefiLlama.com (@DefiLlama) August 18, 2025

BeInCrypto reported that July’s record-breaking run was fueled by soaring demand for simple, high-volume derivatives trading. Open interest, USDC inflows, and active trading volumes surged, even as the exchange faced temporary outages that tested its scalability. 🚨

Looking ahead, Hyperliquid is preparing for its HIP-3 upgrade, which will transform the platform from a derivatives exchange into a full Web3 infrastructure layer. This upgrade is designed to support decentralized applications and “smart derivatives,” extending the protocol’s role in the broader DeFi space. 🛠️

This ambition puts Hyperliquid on a collision course with centralized exchanges and established DeFi hubs. If successful, it could cement the exchange as both a trading venue and a foundational layer for decentralized finance (DeFi). 🌠

By surpassing Apple, Tether, and Nvidia in per-capita efficiency, Hyperliquid forces a rethink of traditional corporate metrics. Critics may argue that comparisons with firms like OnlyFans or tech giants overlook structural differences, but the numbers speak for themselves. 📊

Chart of the Day

Byte-Sized Alpha

Crypto Equities Pre-Market Overview

| Company | At the Close of August 19 | Pre-Market Overview |

| Strategy (MSTR) | $336.57 | $339.75 (+0.94%) |

| Coinbase Global (COIN) | $302.07 | $304.34 (+0.75%) |

| Galaxy Digital Holdings (GLXY) | $24.10 | $23.99 (-0.44%) |

| MARA Holdings (MARA) | $15.17 | $15.15 (-0.13%) |

| Riot Platforms (RIOT) | $11.96 | $11.98 (+0.17%) |

| Core Scientific (CORZ) | $14.35 | $14.32 (-0.21%) |

Read More

- Gold Rate Forecast

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- HSR 3.7 story ending explained: What happened to the Chrysos Heirs?

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- ETH PREDICTION. ETH cryptocurrency

- Uncovering Hidden Groups: A New Approach to Social Network Analysis

- Here Are the Best TV Shows to Stream this Weekend on Paramount+, Including ‘48 Hours’

- Games That Faced Bans in Countries Over Political Themes

- ‘Zootopia+’ Tops Disney+’s Top 10 Most-Watched Shows List of the Week

- The Labyrinth of Leveraged ETFs: A Direxion Dilemma

2025-08-20 17:20