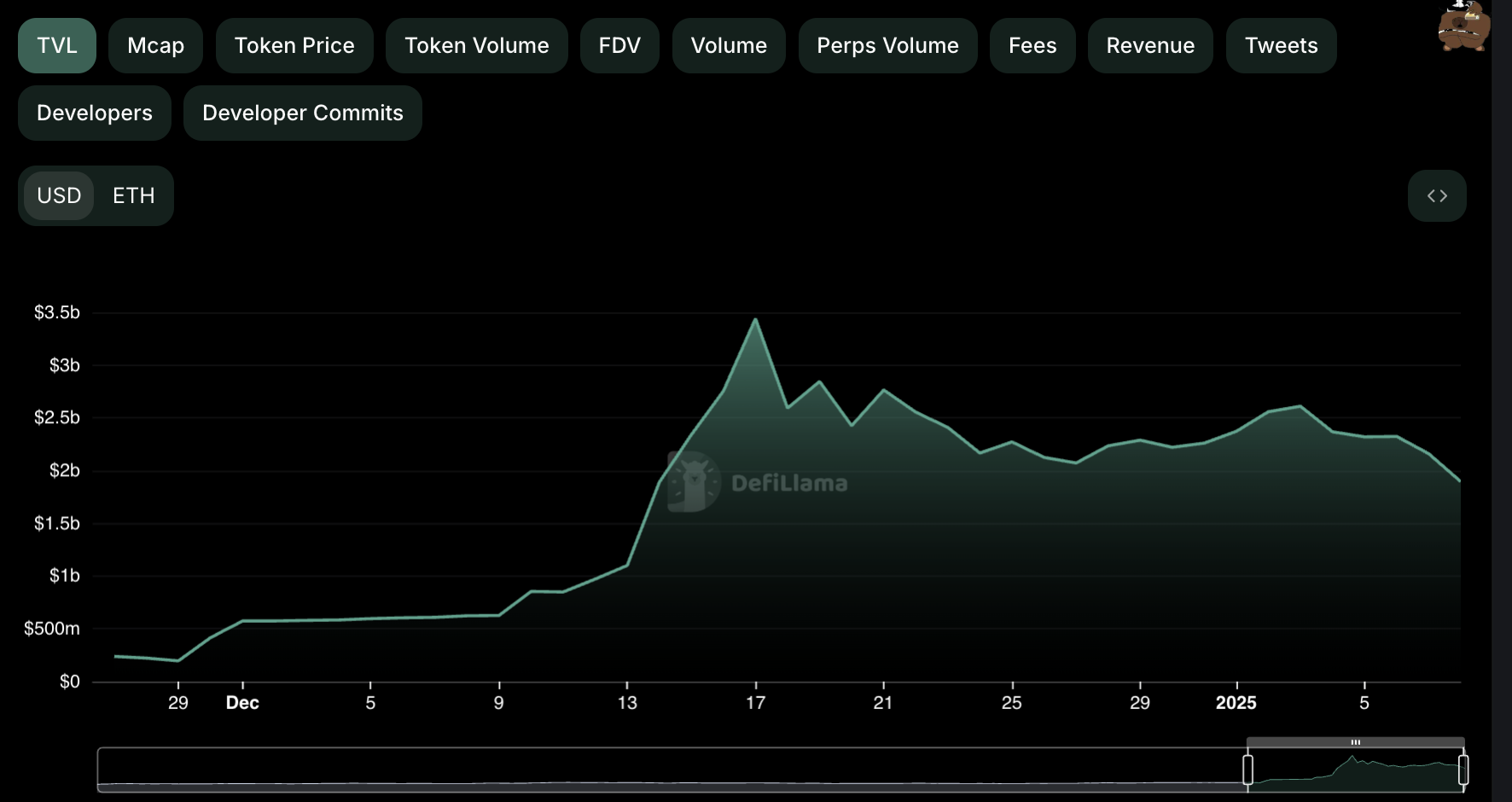

The decentralized derivatives exchange on the Layer-1 blockchain, Hyperliquid, has observed a decrease in its Total Value Locked (TVL) starting from the beginning of this year. Interestingly, this decline occurred even as there was a general upward trend in the TVL within the decentralized finance (DeFi) market since January 1.

The decrease in Total Locked Value (TVL) has led to a reduction in interest for Hyperliquid’s native token, HYPE. As purchasing enthusiasm dwindles, it seems likely that HYPE may experience an additional drop.

Hyperliquid’s TVL Falls 20%

Based on DefiLlama’s data, the Total Value Locked (TVL) in Hyperliquid has declined by approximately 20% since the start of the year. At present, the TVL stands at $1.89 billion, which is its lowest point since early January.

This drop has happened even though there’s been an overall increase in Total Value Locked (TVL) within Decentralized Finance (DeFi) across the wider market. According to data from a blockchain analytics provider, the current TVL of the crypto market’s DeFi stands at approximately $120 billion, showing a 1% growth over the last week.

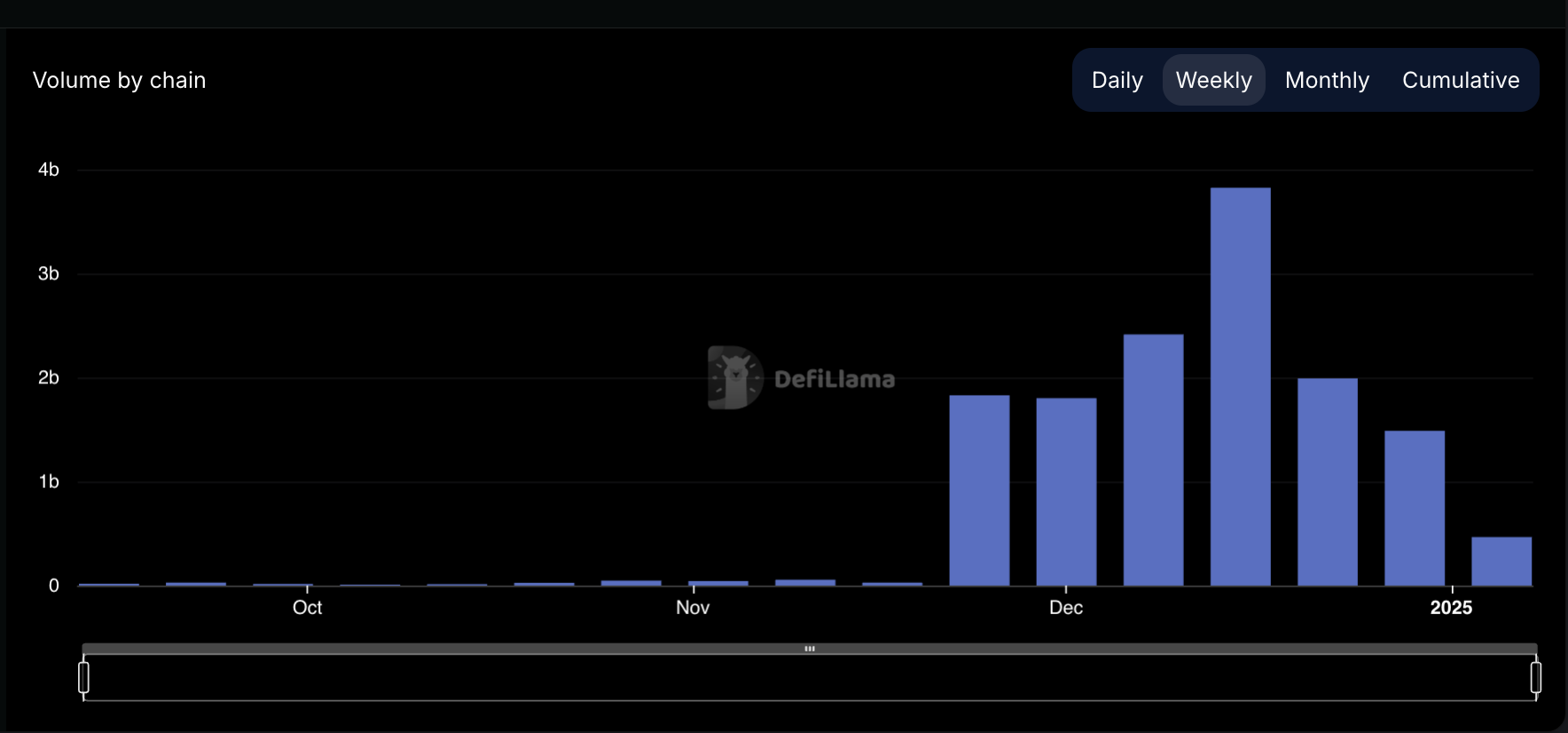

A decrease in a protocol’s Total Value Locked (TVL) frequently suggests less user involvement, which is mirrored by the consistent decline in Hyperliquid’s trading activity. To be more specific, DefiLlama data shows a 19% drop in trading volume for Hyperliquid over the past week.

The HYPE Token Reacts

A drop in a protocol’s Total Value Locked (TVL) suggests that less capital is being invested or staked on the platform, which typically means lower user engagement. Consequently, this can cause a fall in the worth of its native token because reduced capital usually leads to decreased demand for the token.

Over the last week, HYPE’s value has decreased by 10%. This downward trend is corroborated by its Relative Strength Index (RSI), which on a four-hour chart reads 35.72. The RSI, used to identify overbought or oversold market conditions, indicates that there’s considerable selling pressure at this point, suggesting a potential continuation of the current trend.

Additionally, the HYPE token’s price remains below the red line, which is the Super Trend indicator that monitors both the direction and intensity of its market trend. This line can be seen on the price chart and changes color to signal the trend: green for when it’s rising (uptrend) and red when it’s falling (downtrend).

When an asset’s cost falls beneath its Super Trend line, it suggests a downturn in market sentiment and could indicate a possible decrease in its price.

HYPE Price Prediction: What To Expect?

Right now, HYPE is valued at approximately $22.18. If the selling trend continues, there’s a possibility that the token’s value might drop below $20, and it could be traded at around $17.34 instead.

Conversely, a favorable change in market opinion might drive the HYPE token’s price up to $31.04.

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Gold Rate Forecast

- Batman and Deadpool Unite: Epic DC/Marvel Crossover One-Shots Coming Soon!

- Who was Peter Kwong? Learn as Big Trouble in Little China and The Golden Child Actor Dies at 73

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- Hunter Schafer Rumored to Play Princess Zelda in Live-Action Zelda Movie

- SEGA Confirms Sonic and More for Nintendo Switch 2 Launch Day on June 5

- 30 Best Couple/Wife Swap Movies You Need to See

- Every Fish And Where To Find Them In Tainted Grail: The Fall Of Avalon

2025-01-08 19:38