As a seasoned crypto investor with battle-hardened nerves and a wallet that’s seen its fair share of market volatility, I find myself cautiously optimistic about Hyperliquid (HYPE). The platform’s recent recovery from oversold RSI levels is encouraging, but the key resistance at $28.95 looms large.

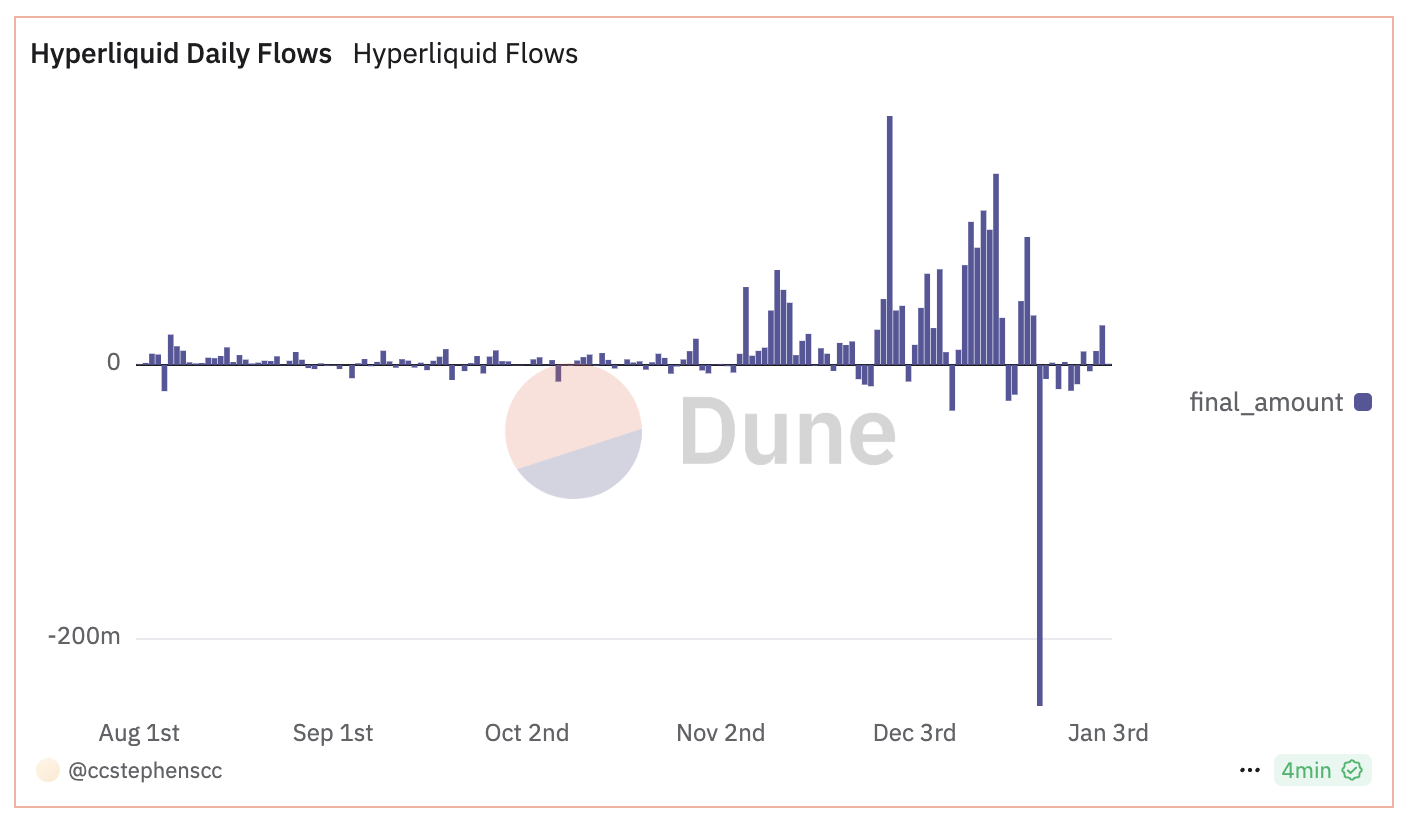

The daily flows have stabilized after hitting a negative record on December 23, which suggests that the market sentiment is balancing out. However, I’ve learned in this game that nothing is ever certain, and a significant shift in market sentiment could always occur unexpectedly.

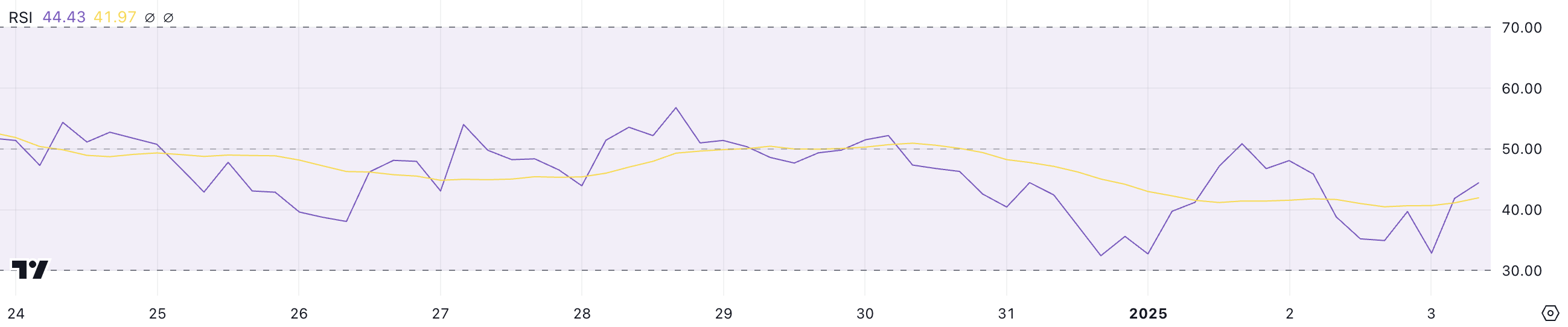

The HYPE RSI has been neutral since December 15, suggesting a lack of strong momentum in either direction. This consolidation could continue unless we see a breakout into more bullish territory above the critical threshold of 50.

Looking back at my journey as an investor, I’ve learned to never underestimate the power of a good joke to lighten the mood during these volatile times. So here goes: Why did the crypto investor cross the road? To get to the other side of the market volatility! But remember, always do your own research and never invest more than you’re willing to lose. Happy trading!

The cost of Hyperliquid (HYPE) is trying to rebound as market action becomes more stable after a bumpy December. Currently, HYPE has moved up from oversold RSI levels, which are now at 44.4, hinting at the possibility of short-term consolidation.

Since reaching a record low of $-243 million on December 23, the platform’s daily fluctuations have been more consistent, ranging between $-18 million and $28 million. This indicates a more settled market outlook. As significant resistance lies at $28.95 and support is found at $22, the upcoming days should clarify whether HYPE can continue its recovery or potentially experience a further drop.

HYPE RSI Has Been Neutral Since December 15

2024’s major airdrop event, HYPE, is currently exhibiting its Relative Strength Index (RSI) at 44.4, marking a significant rise from its previous level of 32.8 in recent days. The RSI, a commonly used indicator to gauge momentum, ranges from 0 to 100 and measures the rate and intensity of price changes.

In simpler terms, if the Relative Strength Index (RSI) is less than 30, it might hint at oversold conditions, which could lead to a price increase. Conversely, an RSI greater than 70 suggests overbought conditions that may lead to a correction or decrease. Currently, HYPE’s RSI stands at 44.4, positioning it in the neutral zone, implying a balance between buying and selling forces.

Based on my extensive experience as a trader and analyst, I have observed that when the Relative Strength Index (RSI) of Hyperliquid remains consistently within the neutral range for an extended period like it has since December 15, it often indicates a lack of strong momentum in either direction. This neutral positioning suggests to me that HYPE may continue to consolidate in the near future unless there is a significant shift in market sentiment. I have seen similar patterns before, and they usually precede periods of volatility or trend reversals. Therefore, it would be prudent for investors to exercise caution when considering entering into new positions with HYPE until we see clear signs of a breakout from this consolidation phase.

Currently, a slight rise in buying pressure can be seen due to the increase in the Relative Strength Index (RSI), but it’s still below the significant level of 50, suggesting that bullish power is not yet strong. For HYPE to exhibit stronger upward movement, its RSI needs to surge past the 50 mark and into more bullish zones, which could trigger further price activity.

Hyperliquid Flows Reached a Negative Record

On November 29, 2024, Hyperliquid achieved an impressive milestone of $181 million in transactions, showcasing high trading activity and strong investor attention. After this record-breaking day, the platform saw flows that varied, but from December 11 to December 16, it consistently recorded daily flows over $70 million.

The movement of funds (flows) shows the overall capital coming in or going out from the platform, offering valuable information about market opinion and accessibility to funds. When these flows are positive, it usually means increased curiosity and trust, which can contribute to price consistency or expansion.

On December 23rd, Hyperliquid experienced a sudden drain of approximately $243 million, reaching a negative milestone. Since this event, the flows have remained relatively consistent, oscillating between a loss of $18 million and a gain of $28 million. This consistency indicates that market opinion is leveling off following the substantial outflows, neither heavy accumulation nor intense selling pressure appears to be overwhelmingly dominant at present.

For now, it’s possible that the cost of HYPE might stabilize temporarily as the market finds balance. An increase in positive inflows could rekindle optimistic trends, whereas continuous outflows could hint at a potential danger on the downside.

HYPE Price Prediction: Will the Downtrend Continue?

At present, the HYPE price is trying to turn around its recent slide and resume its uptrend. If this recovery persists, it may challenge the resistance level at $28.95, suggesting that the earlier surge was not solely due to the airdrop event.

If we manage to surge past this point, it might open up opportunities for even more growth. Should that happen, our sights will be set on $31.40 and $35.20 as our next objectives, which suggest an increasingly optimistic market trend.

If the negative trend continues and selling becomes more intense, the price of HYPE might be tested at its immediate support level of $22.00. If this support doesn’t manage to hold, there could be a further drop in price down to $14.99, representing a substantial 37% correction.

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Gold Rate Forecast

- Batman and Deadpool Unite: Epic DC/Marvel Crossover One-Shots Coming Soon!

- Who was Peter Kwong? Learn as Big Trouble in Little China and The Golden Child Actor Dies at 73

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Hunter Schafer Rumored to Play Princess Zelda in Live-Action Zelda Movie

- 30 Best Couple/Wife Swap Movies You Need to See

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- Gachiakuta Chapter 139: Rudo And Enjin Team Up Against Mymo—Recap, Release Date, Where To Read And More

- Summer Game Fest 2025 schedule and streams: all event start times

2025-01-03 22:52