In a dramatic twist worthy of a soap opera, Huma Finance’s native token, HUMA, has taken a nosedive of 45%, erasing all those post-launch gains like a magician’s disappearing act! 🎩✨ Yet, despite this plunge, the token still manages to attract attention, with trading volume strutting its stuff at over $600 million. Talk about a rollercoaster ride!

Currently, HUMA is trading at a mere $0.062, a far cry from its peak of $0.12 following the Token Generation Event on May 26. It seems the thrill of the launch has faded faster than a summer romance, but fear not! The trading volume remains robust, proving that while the price may be down, the excitement is still alive and kicking.

Launched via the illustrious Binance Launchpool, users had the chance to farm HUMA by staking Binance Coin (BNB), FDUSD, or USD Coin (USDC) between May 23 and May 26. As is the custom with Binance Launchpool projects, HUMA quickly found its way onto major exchanges like Bybit, OKX, Bitget, MEXC, Gate.io, KuCoin, and BingX. It’s like the popular kid in school who gets invited to all the parties! 🎉

During the TGE, Huma Finance opened the claim window for its Season 1 airdrop, generously allocating 5% of the total token supply to early adopters. The claim period will remain open for a month, so don’t miss out! A second airdrop, covering 2.1% of the total supply, is set to take place about three months after the TGE. Because who doesn’t love free money? 💰

What is Huma Finance?

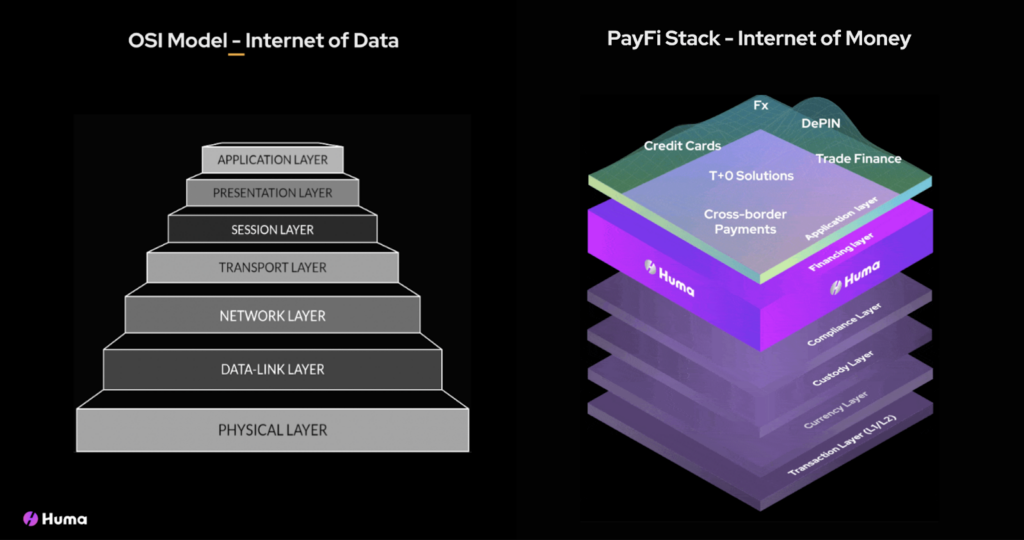

Huma Finance is on a mission to revolutionize financial infrastructure with its ambitious PayFi Stack, aiming to replace those dusty old TradFi systems with something faster, programmable, and globally accessible. Think of it as the superhero of financial applications, ready to save the day! 🦸♂️

At the foundation lies the transaction layer, utilizing Layer 1 and Layer 2 blockchains to ensure transactions are as speedy and cost-effective as a caffeinated squirrel. Above this, the currency layer manages digital currencies—especially stablecoins like USDC and PYUSD—ensuring price stability and regulatory compliance. Some even offer yield to offset transaction costs. It’s like having your cake and eating it too! 🎂

The custody layer is all about secure and efficient asset management, supporting various custody models from institutional solutions to decentralized smart contracts. Real-time settlements (T+0) are the name of the game, without compromising asset control or security. Who knew finance could be so thrilling?

Next up is the compliance layer, tackling regulatory requirements like KYC, AML, and stablecoin licensing. It integrates real-time compliance checks into the transaction flow, adapting to regional regulations like MiCA in Europe or frameworks in Singapore and Japan. Compliance has never looked so good!

The financing layer connects fund supply with demand, enabling on-chain capital markets and allowing the tokenization of real-world assets. Finally, the application layer sits atop this grand structure, allowing developers to create financial products like payment gateways, lending platforms, and investment tools. It’s a developer’s playground, emphasizing strong UX design and secure transaction handling.

HUMA is the beating heart of the Huma Finance ecosystem, serving as a governance token and a means for staking to secure the network. It’s also an incentive mechanism, distributed to liquidity providers, borrowers, and active users to drive ecosystem growth. Holding or staking the token can even make you eligible for future airdrops, with the second distribution scheduled to take place approximately three months after the TGE. Because who doesn’t love a little extra surprise? 🎁

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- 30 Best Couple/Wife Swap Movies You Need to See

- USD ILS PREDICTION

- DC: Dark Legion The Bleed & Hypertime Tracker Schedule

- Ncuti Gatwa Exits Doctor Who Amidst Controversy and Ratings Crisis!

- 9 Kings Early Access review: Blood for the Blood King

- Every Minecraft update ranked from worst to best

- Clair Obscur: Expedition 33 – All Act 3 optional bosses and where to find them

- Summoners War Tier List – The Best Monsters to Recruit in 2025

- 10 Shows Like ‘MobLand’ You Have to Binge

2025-05-27 15:51