Dearest reader, one cannot help but observe that the crypto market, much like a young lady of fashion caught in a windstorm, is presently in disarray, with its total valuation decreasing by a modest 2.54%, to the grand sum of $3.96 trillion. Meanwhile, the intraday trading volume has ascended by a sprightly 11.01% to $192.79 billion – a most curious phenomenon, indicating that despite the decline, activity chez la crypto remains spirited, if not somewhat frantic. ⚖️ Bitcoin’s dominance persists at 59.7%, while Ethereum has managed a little upward flourish to 13.1% – all quite the spectacle.

As to the sentiment of the market, it remains confidently in the “Greed” zone at 60 on the Fear & Greed Index, a state which suggests traders are perhaps more eager than prudent. This correction follows a gallant rally in the past month, occasioned by profit-taking, token unlocks that resemble uninvited balls at the estate, and cautious macroeconomic whispers that cause even the most hearty to reconsider their investments – quite the drama, indeed!

Profit-Taking Dominance Pressures Prices – How Delightfully Tragic!

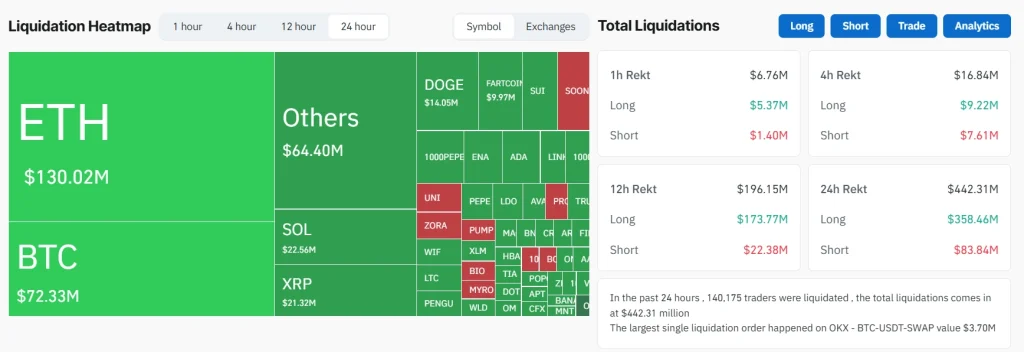

Our dear bitcoin, that often considered the belle of the ball, saw its price modestly retreat to $118,883, which precipitated a staggering $72 million in long liquidations, a rather unseemly number. In total, in the past twenty-four hours, the market has seen a grand liquidation tally of $442.31 million – quite an extraordinary spectacle. Ethereum was the hardest hit, with $130.02 million liquidated, followed by the noble Bitcoin at a distance.

Despite the alluring headlines, such as Metaplanet’s generous gift of $61 million worth of BTC, and the inflows into BlackRock’s promising ETH ETF, traders, ever the cautious souls, chose to profit from their gains after Bitcoin’s weekly ascension of 4%. The market now pauses near its yearly zenith of $3.98 trillion, with the RSI(7) reaching 88.6, signaling overbought conditions – a warning most literarily noted, even if ignored. The eager traders await the U.S. CPI report, which shall, like a decisive governess, dictate the next course of actions in this bustling estate.

Altcoin Supply Flood Deepens Losses – A Most Unhappy Chorus

This week’s colossal token unlocks, totaling $653 million, have put the weaker altcoins under considerable pressure, especially those in markets of thin liquidity, a scenario most unflattering. Dogecoin, that oft-misleadingly humorous coin, declined 5.81% following a $22 million DOGE unlock, accompanied by whales shifting one billion DOGE to exchanges – a feat most suspicious and perhaps a tad theatrical.

Meanwhile, Arbitrum succumbed to a 6.76% fall amidst a 37% increase in open interest, and Sui experienced a similar slide at 6.28%. These unlocks swell the supply, much like inviting uninvited guests to a very exclusive soirée, making stability quite unattainable under bearish conditions.

Weakness in Equity Markets and Macro Warnings – A Most Transparent Show of Caution

The U.S. equity markets, often a reliable mirror, continue to weaken. Following President Donald Trump’s most liberal extension of China tariffs, the Dow Jones slipped by 0.5%, the S&P 500 tripped downward by 0.2%, and the Nasdaq, never one to stay behind, fell 0.3%. Futures signals also dip-sending a clear message of market thoughtful hesitation.

Bitcoin’s 24-hour correlation with gold, surprisingly robust at +0.75, reveals that crypto is behaving more like a risk-on asset, trailing the tech stocks rather than seeking sanctuary in precious metals. Meanwhile, gold modestly rose by 0.75% to $3,355, fueled by inflation worries – quite the dramatic tale for a shiny rock.

The Grand Conclusion – Will the Market Rebound or Remain in Disarray?

Today’s decline might be likened to a natural pause after an impressive 8.27% rally over the past month. The famed $118k support level for Bitcoin and the upcoming CPI report appear to hold the keys to the game’s next chapter. If inflation cools, expect a new shopping spree; if it heats up, a swift descent toward the $3.2 trillion 200-day EMA could ensue. Such, my dear reader, is the ever-exciting drama of the crypto estate.

FAQs – The Curious and the Cautious

Why did the crypto prices fall today? Oh, just because the market fancied a little profit-taking after recent gains, token unlocks have inflamed supply, and cautions linger over the upcoming U.S. CPI, like an unwelcome guest at a dinner party.

Which coins suffered the most liquidations? Ethereum took the prize with $130M, followed by Bitcoin at $72M – quite the liquidation soirée.

What lies ahead for the market? The $118k mark for BTC is a key battleground. The CPI report will reveal whether the market takes a breath or plunges further into the abyss.

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- HSR 3.7 story ending explained: What happened to the Chrysos Heirs?

- Gay Actors Who Are Notoriously Private About Their Lives

- ETH PREDICTION. ETH cryptocurrency

- The Best Actors Who Have Played Hamlet, Ranked

- Games That Faced Bans in Countries Over Political Themes

- 9 Video Games That Reshaped Our Moral Lens

- Banks & Shadows: A 2026 Outlook

2025-08-12 09:23