The stablecoin market, once serene as an old samovar simmering gently on a countryside table, now rattles like a train out of Kursk-full of earnest competitors, cigar smoke, and the faint aroma of envy. USDT, known in the village as Tether, finds its share of the market shrinking, like Ivan Ivanovich’s faith in the local post office. The cause? Circle and a horde of other hopefuls, nibbling away, pastry-like, at its empire. 🍰

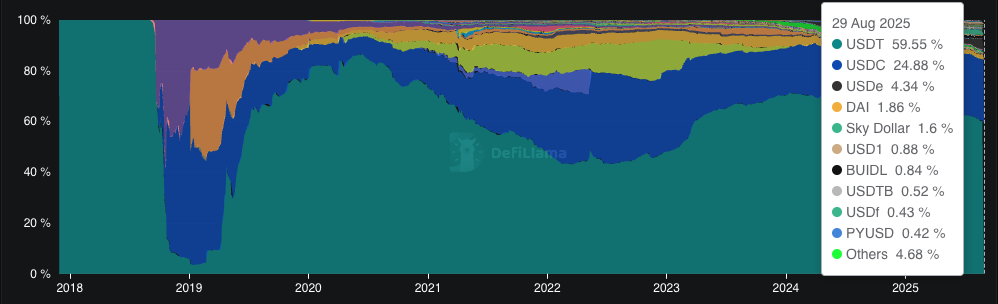

- The mighty Tether, dominant as a provincial tax collector, now with less than 60%-first time since 2023, which for some felt like yesterday.

- Circle’s USDC skulking just behind, nearly 30%-almost respectable, like a second cousin inheriting half a samovar.

- Some Act in the US-GENIUS, of all things-turns the currency pool into a wrestling pit at the local fair.

On a Friday as sullen as a Russian clerk in August, Tether’s reign slipped to 59.45%. DeFiLlama, presumably named after an animal with a penchant for spreadsheets, confirmed it. Not since March 2023! Tether’s grip loosens, and rumors flutter through the village-“Have you heard? The pie is shrinking!” Even Babushka is concerned, and she trusted stablecoins less than her neighbor’s beet soup.

Half of 2024, Tether was sitting pretty at 70%, like a mayor hoarding bread in winter. Circle’s USDC limped along at an 18% market share, now nearly 30%-a feat deserving a toast, if anyone had champagne. Meanwhile, DAI, with dreams as modest as a minor bureaucrat, shrank from 3.5% to just 1.86%. Such is life.

If you seek drama, look to Ethena’s USDe, strutting like a ballet dancer in December 2024, already at 4.34% dominance and a wallet hefty enough to shame provincial treasurers ($12.275 billion). But then, Trump World Liberty Financial’s USD1 makes a cameo, demanding attention with 0.88%-a figure generous for something named with such bravado. 👍

As if market anxiety weren’t enough, Tether finds itself battered by bureaucrats in both Europe and America (the West: famous for three things-incomprehensible laws, cold coffee, and stablecoin angst).

In Europe, Tether would rather wrestle a bear than comply with MiCA-so, unsurprisingly, it’s being shown the exit from major exchanges. “Delisting!” they cry, as though the stablecoin were an overzealous uncle at a wedding.

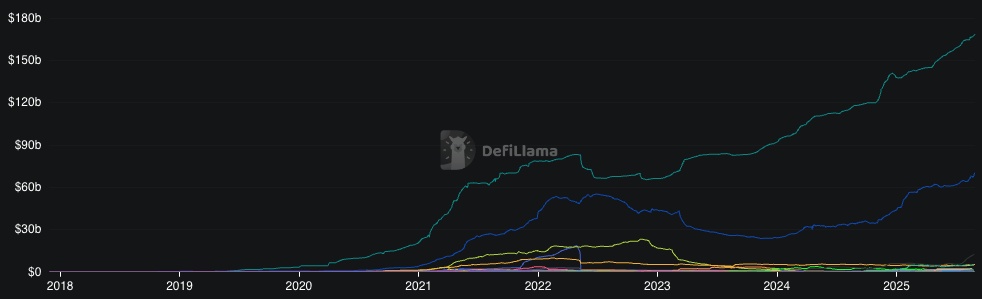

In the U.S., the freshly baked GENIUS Act wants stablecoin issuers to air their laundry in public, transparency and all. Tether stands at the door, muttering, weighing the market’s mood. Regardless, USDT and USDC still inflate their numbers to new heights-$168.43 billion and $70.378 billion. How does one say “capitalist feast” in stablecoin? 💸

Read More

- Gold Rate Forecast

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Top 15 Insanely Popular Android Games

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- Why Nio Stock Skyrocketed Today

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- Core Scientific’s Merger Meltdown: A Gogolian Tale

- EUR UAH PREDICTION

2025-08-29 20:28