As an experienced analyst with a deep understanding of the crypto market, I am closely monitoring the latest developments surrounding the potential approval of spot Ethereum ETFs by the U.S. Securities and Exchange Commission (SEC). The recent shift in tone from the SEC, as indicated by their request for stakeholders to update their 19b-4 filings, has sparked a frenzy of activity in the market.

As an analyst, I’ve been closely monitoring the developments at the Securities and Exchange Commission (SEC) regarding Ethereum Exchange-Traded Funds (ETFs). Recently, there have been indications that the SEC may be reconsidering its stance on these funds. This potential shift could mark a significant turn in the regulatory landscape for Ethereum ETFs.

Revised: JSeyff and I have raised our estimation of Ether ETF approval chances to 75% (previously at 25%). Recent rumors suggest the SEC may be reconsidering its stance on this contentious issue, leading to a flurry of activity among those affected. Previously assumed denial now seems less certain.

— Eric Balchunas (@EricBalchunas) May 20, 2024

Based on a recent blog entry from the CCData Research team, the Securities and Exchange Commission (SEC) is asking interested parties to revise their Form 19b-4 filings. This action could potentially indicate that the approval of these long-delayed investment vehicles may be forthcoming.

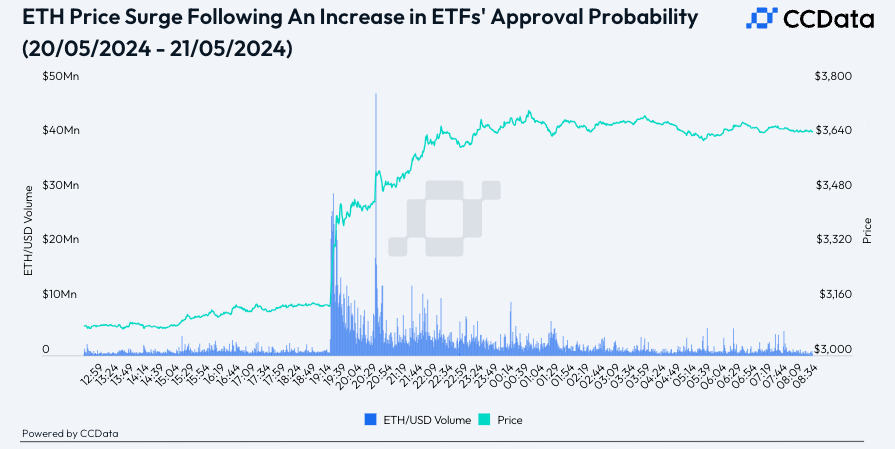

The breaking news has caused a significant and dramatic change in the market dynamics, leading to an extraordinary increase in Ethereum’s value, trading activity, and investor participation.

As a crypto investor, I’ve noticed some exciting developments with Ethereum lately. According to CCData, Ethereum experienced its most significant daily increase in market capitalization yet, as investors eagerly prepared for the potential approval of spot Ethereum Exchange-Traded Funds (ETFs). The decreasing discount on Grayscale Ethereum Trust (ETHE) from a high of 20.5% to the current 11.8% is a clear indication that investor confidence in Ethereum is rebounding, making me optimistic about its future prospects.

The competition for the United States Securities and Exchange Commission (SEC) approval of the first Ethereum exchange-traded fund (ETF) is intensifying, with nine hopefuls eagerly contending for this prestigious designation. According to CCData, VanEck, ARK/21Shares, Hashdex, and others have pending applications with imminent final decisions scheduled towards the end of this month. BlackRock’s iShares Ethereum Trust is also in the running, but its decision date is set for June 8. The SEC is expected to make simultaneous approvals to ensure fairness among all applicants. Among these contenders, Coinbase has gained popularity as the preferred custodian choice.

As a crypto investor, I’m closely watching the developments surrounding Ethereum ETFs and the recent decision by the SEC. The regulatory body has announced that staking will be prohibited in the initial ETFs. This means that entities managing potential Ethereum ETFs will forgo the annual yield from Ethereum staking.

In spite of Ethereum’s current slump in trading volume on exchanges and reduced on-chain activity compared to other cryptocurrencies and Layer 2 solutions, the green light for spot ETH Exchange Traded Funds (ETFs) could rejuvenate the Ethereum community. According to CCData, a surge in network usage combined with Ethereum’s deflationary supply structure may generate positive supply trends and potentially send Ethereum’s price soaring to unprecedented levels.

Based on CCData Research’s findings, there could be a considerable inflow of funds into Ethereum ETFs if they manage to draw a portion of the investments that have moved towards Bitcoin ETFs. According to CCData’s linear regression analysis, such a shift in funds might lead to a 30% increase in Ethereum’s value within the next 100 days. However, it is important to keep in mind that Ethereum may encounter short-term challenges due to withdrawals from the Grayscale Ethereum Trust. This issue mirrors what was previously seen following the approval of Bitcoin spot ETFs.

The CCData Research team further explores the distinct influences that may shape ETH ETF investment trends and values. Factors under consideration include orderbook liquidity, Ethereum’s deflationary supply mechanism, staked supplies, and Grayscale’s tactical leadership. These elements can magnify price fluctuations, lessen selling pressure, and potentially trigger larger net inflows, contributing to Ethereum’s price stability.

In anticipation of the SEC’s verdict, the approval of Ethereum spot ETFs may signify a pivotal moment for the crypto sector. Introducing these financial instruments could significantly boost Ethereum’s value while paving the way for other digital assets to emulate this trend, according to CCData Research’s analysis. Spot Ethereum ETFs might even draw attention away from Bitcoin spot ETFs, providing investors with a more attractive risk-to-reward proposition due to Ethereum’s relatively smaller market capitalization and unique value proposition.

Read More

- USD ILS PREDICTION

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- 30 Best Couple/Wife Swap Movies You Need to See

- Clair Obscur: Expedition 33 ending explained – Who should you side with?

- DC: Dark Legion The Bleed & Hypertime Tracker Schedule

- Everything We Know About DOCTOR WHO Season 2

- Honkai: Star Rail – Hyacine build and ascension guide

- Tyla’s New Breath Me Music Video Explores the Depths of Romantic Connection

- 50 Most Powerful Anime Characters of All Time (Ranked)

- Scarlett Johansson’s Directorial Debut Eleanor The Great to Premiere at 2025 Cannes Film Festival; All We Know About Film

2024-05-23 18:30