- Solana remains cautiously bullish despite market’s wobbly behavior. Oh, the drama!

- Long-term holders are suddenly questioning their life choices and selling off like there’s no tomorrow.

Well, well, well… if it isn’t the darling of the crypto world, Solana [SOL], taking a nosedive with a delightful 11.56% plunge over the last week. Looks like the bears have come to play and they’re not being shy about it. Hold onto your hats, folks!

In a twist of fate, long-term holders—the folks who believed in this crypto dream—are giving up the ghost and selling. But wait, there’s a twist in this plot! Accumulation activities are rising like a phoenix from the ashes. Could this save the day? Who knows! Grab some popcorn.

Despite the mass exodus, there’s hope on the horizon. Accumulation is up, bullish sentiment is in the air, and spot/derivative traders are still holding the fort. Will this prevent a major drop? Only time will tell. Stay tuned.

Long-term holders decide to say ‘adieu’ to their SOL

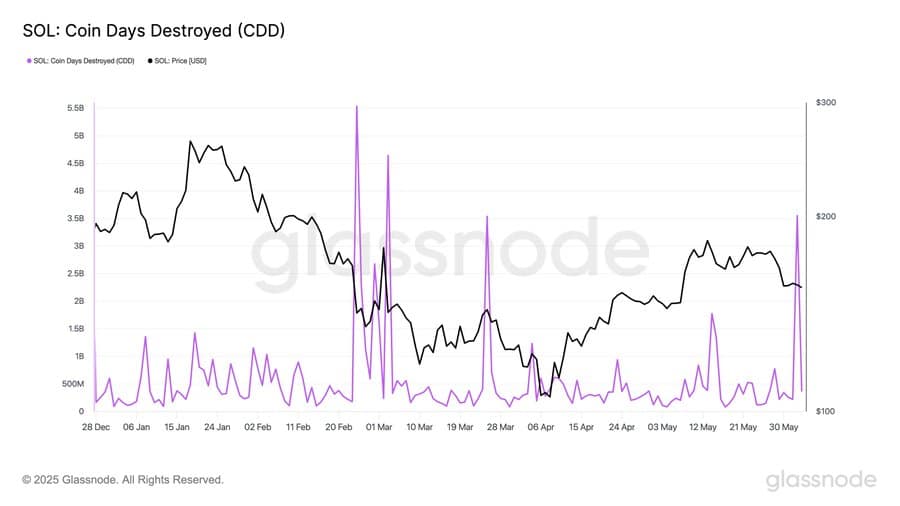

Coin Days Destroyed (CDD) data, which is like a gossiping crystal ball for long-term holders, is showing a rather *telling* trend—selling, my dear. When long-term holders start moving their assets after months of doing absolutely nothing, it’s usually a sign that they’ve had enough.

This is officially the third-largest CDD event in the history of SOL, with a jaw-dropping $3.55 billion worth of tokens on the move. Phew! The only two bigger events? A paltry $5.53 billion on February 26th and $4.64 billion on March 3rd. Big numbers, big drama.

Typically, when money moves like that, we’d be expecting fireworks in the price. Yet, Solana seems to be holding its ground—what a resilient little crypto. Looks like the traders who still believe in SOL are keeping it balanced, for now. How very noble of them.

Accumulation is the new black

Spot market activity is looking decidedly optimistic, if I do say so myself. The SOL inflows and outflows between exchanges and private wallets tell quite the tale—yep, it’s mostly bullish vibes. A little ‘tough luck’ for those selling, eh?

There’s been a pretty hefty outflow of SOL from exchanges, suggesting that people are buying and tucking away their SOL like it’s a vintage bottle of wine. Over $12 million worth of SOL moved in the last 48 hours alone! And it doesn’t stop there—this week, total purchases hit a respectable $71.70 million. Cheers to the believers!

Meanwhile, derivative traders are getting all giddy with an OI-Weighted Funding Rate that’s shooting up like a rocket. Apparently, everyone’s placing their bets on a price rally. I do hope they know what they’re doing.

Will Solana rally, or just throw in the towel?

Looking at the charts, SOL might be in the perfect spot for a rebound, courtesy of the Bollinger Band Indicator. This little beauty helps identify support (lower band) and resistance (upper band) levels. And guess what? SOL is just touching the lower band. Hold on tight, this could get interesting.

Last time SOL dipped to this level, it shot up by 79%. Talk about a comeback! If history repeats itself, we could see SOL catapulting back to a lovely $180-$200 range. Time for a victory dance?

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Gold Rate Forecast

- Batman and Deadpool Unite: Epic DC/Marvel Crossover One-Shots Coming Soon!

- Who was Peter Kwong? Learn as Big Trouble in Little China and The Golden Child Actor Dies at 73

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Hunter Schafer Rumored to Play Princess Zelda in Live-Action Zelda Movie

- 30 Best Couple/Wife Swap Movies You Need to See

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- Gachiakuta Chapter 139: Rudo And Enjin Team Up Against Mymo—Recap, Release Date, Where To Read And More

- Summer Game Fest 2025 schedule and streams: all event start times

2025-06-05 21:16