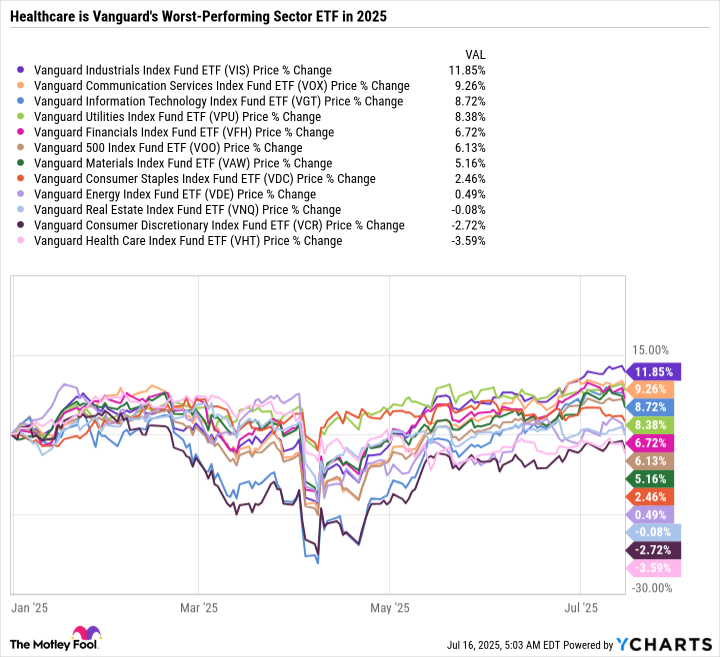

In just a few short months, the healthcare sector had been one of the top three sectors in the S&P 500, trailing only technology and financials. However, its performance has significantly faltered compared to the broader market, causing it to drop below both consumer discretionary and communication sectors.

Financial institution Vanguard provides sector-focused exchange-traded funds (ETFs) that offer budget-friendly methods to gain access to any sector that catches your interest. Here’s why the Vanguard Healthcare ETF (VHT) is a remarkable ETF worth considering for purchase at this time.

The sector is beaten down

Healthcare is the biggest sector laggard year to date.

The decline in value is influenced by a variety of reasons. Investors are moving towards industries that emphasize growth, particularly those that leverage artificial intelligence (AI), such as technology and communication sectors. Additionally, they’re favoring sectors that profit from economic expansion, including industrials and financials.

Investing in the healthcare sector is often considered secure and reliable, much like buying consumer necessities or utility services. When there’s economic instability, many investors prefer these sectors due to their resilience. However, when the market experiences upswings driven by optimism, healthcare stocks may not seem as appealing to short-term investors. Adopting a long-term perspective can be beneficial even when certain sectors or individual stocks are temporarily unpopular, enabling you to build wealth gradually over time.

A significant element affecting the healthcare industry is the substantial decline of UnitedHealth Group, one of the major health insurance providers in the U.S. This company, previously considered a reliable blue chip investment, has experienced a drop of more than 50% from its peak value due to escalating costs, shifting federal policies, and ongoing investigations by government authorities regarding the company’s fee structure. Although UnitedHealth Group remains a significant component in the Vanguard Healthcare ETF, it was previously the main holding. The steep decrease in the company’s stock price can cause ripples throughout the sector, as a corporation of such influence undergoing a dramatic sell-off has the potential to negatively impact the entire industry.

Beyond UnitedHealth encountering internal issues, there’s also a broader decrease in investor enthusiasm towards stocks focusing on weight loss drugs. For instance, Novo Nordisk, known for producing the widely used diabetes drug Ozempic and weight-loss drug Wegovy, has dropped by more than 50% from its peak over the past year. Similarly, Eli Lilly, a significant player in the healthcare industry, has decreased nearly 20% from its highest point within the same period.

Vanguard Healthcare ETF doesn’t hold Novo Nordisk shares because it primarily focuses on U.S. companies, being a Danish firm. If the fund did include Novo Nordisk, its decline would be more significant given that the company still maintains a market value exceeding $300 billion despite the recent sell-off.

In essence, the Vanguard Healthcare ETF is facing declines due to certain major investments that are influenced by industry-particular factors. Additionally, there’s a broader trend of moving away from secure and cautious sectors into more cyclical sectors.

Using ETFs to accomplish investment objectives

An essential investment guideline is to grasp what you possess and the reasons behind that possession. The ease or difficulty of understanding certain companies can vary based on one’s professional experience, expertise, and personal interests. However, there are numerous companies, such as Apple, Amazon, Walmart, and Visa, with which many of us regularly engage. Familiarity often stems from being a customer, making it simpler to comprehend their business models.

Healthcare is unique due to its intricate nature and the constant interaction between public and private entities. In the pharmaceutical industry, the path of clinical trials and strategy to introduce groundbreaking drugs with significant potential can significantly impact an investment strategy – sometimes positively, other times negatively. This complexity makes healthcare one of the most complex sectors to comprehend. At a minimum, it’s the area where I feel like so much can fluctuate, making it more challenging to create a long-term investment strategy. For instance, companies like Pfizer, Merck, and Johnson & Johnson – once highly valued stocks that have seen minimal growth for years – serve as clear examples of this volatility.

I strongly believe that the healthcare industry, with its unique characteristics, presents an appealing opportunity to invest via a low-cost Exchange Traded Fund (ETF). This strategy allows for a more stable return as it mitigates the extreme fluctuations among pharmaceutical companies due to diversification. Furthermore, in case of unforeseen catastrophic events like the one experienced by UnitedHealth, the risk is significantly reduced because the exposure is limited. Plus, this particular fund comes with an affordable expense ratio of only 0.09%, or just 90 cents per $1,000 invested, ensuring that hefty fees won’t be a concern.

A sector that’s worth a closer look

The Vanguard Healthcare ETF is currently undervalued with a low price-to-earnings ratio of 24.1, offering a dividend yield of 1.6%. This is quite attractive when you consider its top holding, Eli Lilly, has a P/E over 60 and a minimal dividend yield. If Eli Lilly was excluded from the ETF, it would be an even more compelling investment opportunity.

In essence, the healthcare industry is an excellent choice for investment, especially for those who want to diversify a portfolio dominated by growth stocks or for cautious investors aiming to increase their passive income.

Read More

- Gold Rate Forecast

- Top 15 Insanely Popular Android Games

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- EUR UAH PREDICTION

- Silver Rate Forecast

- DOT PREDICTION. DOT cryptocurrency

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- Core Scientific’s Merger Meltdown: A Gogolian Tale

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

2025-07-21 15:27