Oh, darling, Bitcoin just shattered the $90,000 mark Wednesday afternoon. It’s practically doing a pirouette, right alongside stocks that had their own delightful surge.

Pre-Holiday Pump: What’s Driving Bitcoin’s Latest Rally?

Once upon a time, Bitcoin was the darling of cyberpunks and those charming bearded libertarians who spent their days waving their arms and discussing freedom. But darling, now that Bitcoin’s been given the glamorous green light by ETFs-yes, exchange-traded funds-the new Bitcoin enthusiast could very well be a Wall Street executive in a crisply pressed navy suit. These ETFs now hold a stunning 1.5 million BTC, or a nifty 7.2% of the total supply. Meanwhile, public companies have also jumped on the bandwagon. This, my dear, might just explain why Bitcoin’s rally to $90K was practically dancing in lockstep with the stock market’s little Thanksgiving pre-party.

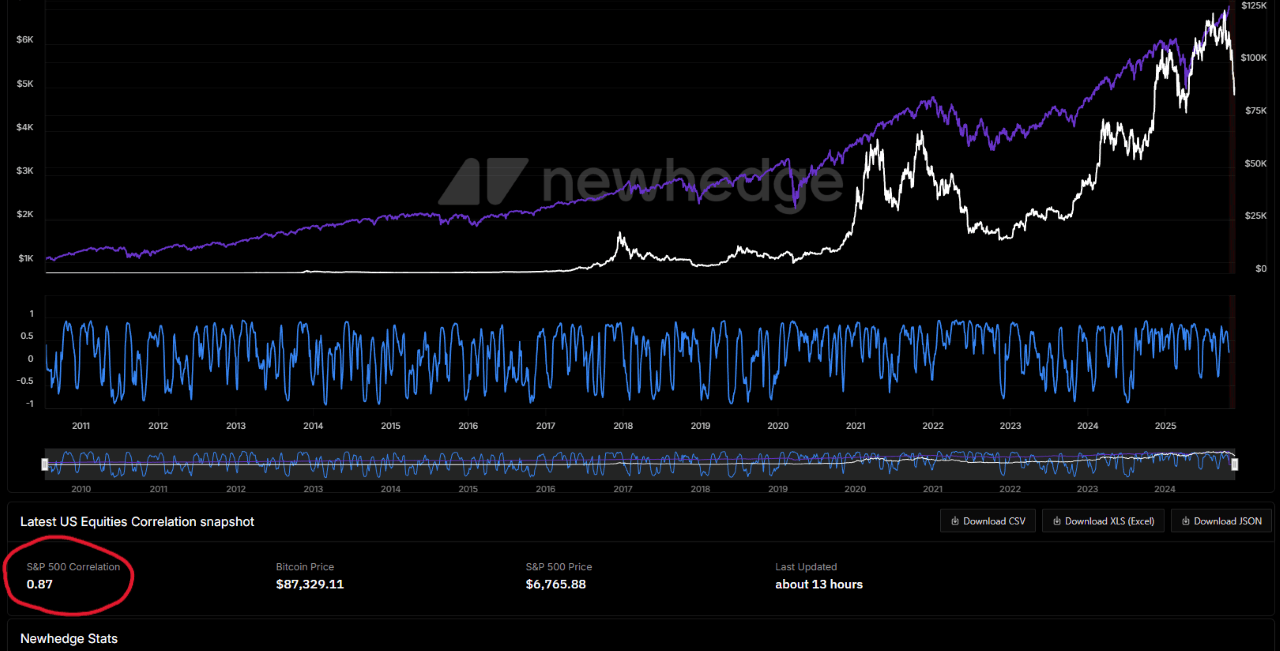

Here’s the scoop: Bitcoin and the S&P 500’s correlation skyrocketed to 0.87 on Wednesday, according to Newhedge data. In simpler terms, they were practically joined at the hip. So, when stocks had a little hop in their step, all courtesy of more AI hype, Bitcoin was right there with them. Case in point: Oracle, that cloud infrastructure juggernaut, pulled off a $300 billion deal with OpenAI in September, leading the charge in tech stocks. Much of this can be credited to Brad Zelnick from Deutsche Bank, who’s been practically singing the praises of Oracle’s AI revenue potential. Honestly, it’s like a love letter to the cloud.

“OpenAI backlog represents solid ROI business,” wrote Zelnick. I mean, who wouldn’t want some of that business magic? “And validates Oracle’s leadership in deploying AI cloud infrastructure at scale.” A bit much, darling, but we get the point.

Oracle shot up by 4%, and the S&P 500, Nasdaq, and Dow all saw delightful rises of 0.77%, 0.86%, and 0.80%, respectively. And just like that, Bitcoin rose 4%, crossing the $90K threshold just in time for the turkey to hit the table. Now, let’s be clear: Bitcoin doesn’t always tango so closely with stocks-sometimes it needs its space. But as more institutional money waltzes into the picture, Bitcoin’s going to be like, “Oh, fine, I’ll follow Wall Street,” because the cryptocurrency world knows where the real money’s at.

Overview of Market Metrics

As of the latest reports, Bitcoin had jumped 4.06% for the day, reaching a smashing $89,872.10. Weekly, it was up 1.21%, fluctuating between $86,171.48 and $90,389.93 in the last 24 hours. A rollercoaster, darling. A rollercoaster.

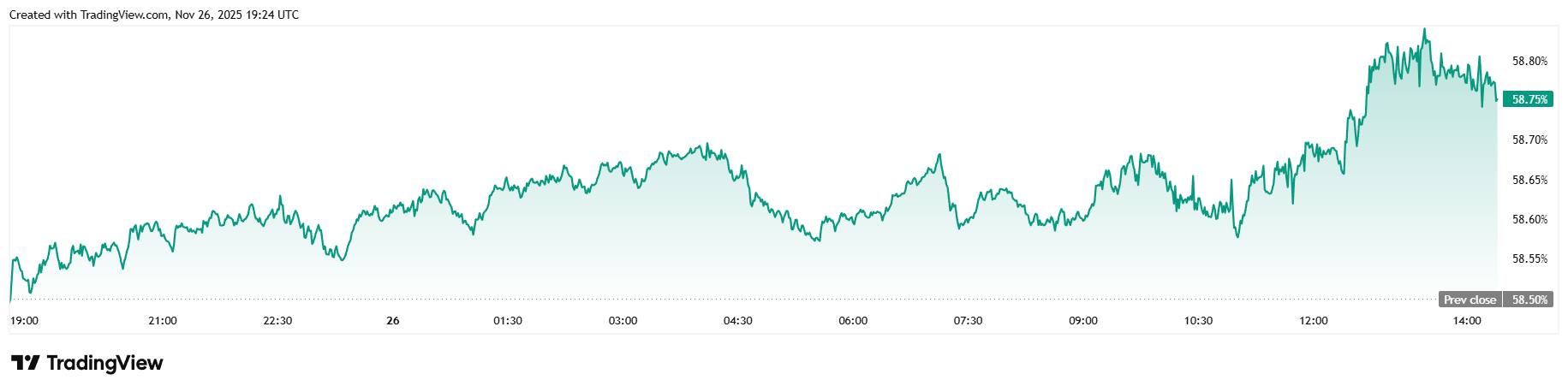

Daily trading volume remained largely flat at a respectable $65 billion, with market capitalization sitting pretty at $1.79 trillion. Meanwhile, Bitcoin dominance crept back up to 58.75%, a 0.41% increase as it reclaimed a bit of market share from those lesser cryptocurrencies. Go, Bitcoin, go!

Futures open interest increased by 2.24%, reaching $60.52 billion, while liquidations remained elevated at $119 million. Short sellers were the real losers, with $80.58 million wiped out, while long investors barely felt the pinch, with only $19.61 million liquidated. It’s a dangerous game, isn’t it?

FAQ ⚡

- Why did Bitcoin break above $90K before Thanksgiving?

Ah, darling, it’s all thanks to the stock market’s sharp rally, dragging Bitcoin up with it like a gleeful party guest. - What sparked the stock market surge influencing Bitcoin?

You guessed it-AI optimism, with a little sprinkle of Oracle’s AI cloud magic. - How correlated are Bitcoin and traditional markets right now?

According to Newhedge, Bitcoin is practically glued to the S&P 500 with a 0.87 correlation. They’re inseparable at this point. - Will Bitcoin continue reacting to Wall Street trends?

Oh, absolutely. As more institutional players enter, Bitcoin will just have to play nice and mirror the mood of Wall Street.

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- Banks & Shadows: A 2026 Outlook

- Gemini’s Execs Vanish Like Ghosts-Crypto’s Latest Drama!

- Wuchang Fallen Feathers Save File Location on PC

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- ETH PREDICTION. ETH cryptocurrency

- QuantumScape: A Speculative Venture

- 9 Video Games That Reshaped Our Moral Lens

2025-11-27 00:54