As a seasoned crypto investor with a decade of experience under my belt, I can’t help but feel a pang of deja vu when looking at Stellar (XLM) right now. The 10% decline over seven days and the struggle to maintain its $10 billion market cap is all too familiar.

Over the last week, the price of Stellar (XLM) has dropped by 10%, finding itself at a market capitalization of approximately $10.87 billion. Technical analysis tools like the Relative Strength Index (RSI) show a significant drop, suggesting increased selling activity and possible approach towards oversold territory.

The Ichimoku Cloud chart strengthens the bearish perspective, as XLM is currently trading below the cloud without any immediate indications of reversal. Attention is being paid to the support level at $0.351, since if it cannot be maintained, there could be more downward movement; however, a strong rebound from this level might initiate a path towards recovery, potentially reaching $0.40 and beyond.

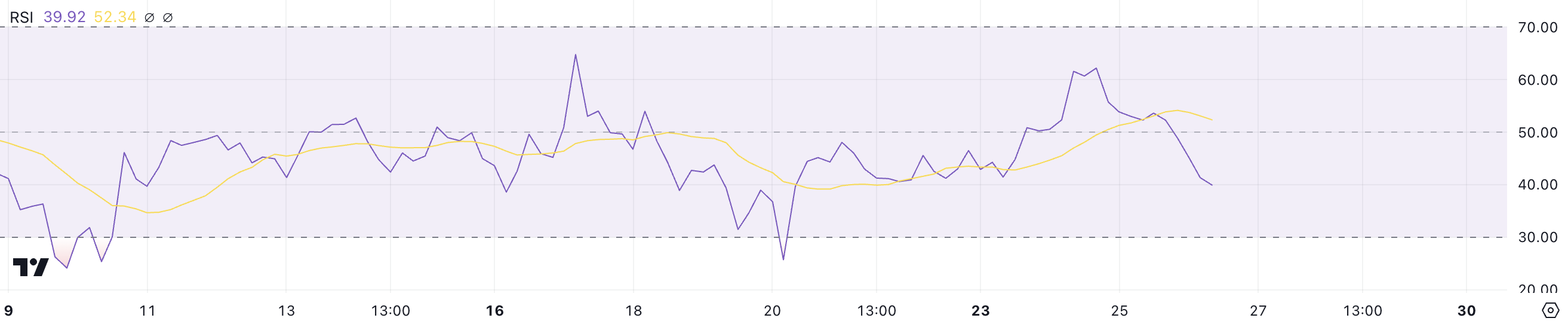

Stellar RSI Is Neutral, But Going Down

The Stellar RSI has significantly decreased from around 60 two days ago (December 24) to 39.9 now, suggesting a swift decrease in purchasing power and a transition towards a more pessimistic market outlook, implying a shift towards bearishness.

Moving from a historically robust neutral RSI level towards lower regions could indicate an escalation in selling activity, potentially pushing XLM towards oversold levels, but it hasn’t quite reached that point yet.

In simpler terms, RSI (Relative Strength Index) is an indicator used in trading that shows how fast the price of a financial asset is changing on a scale from zero to one hundred. A value more than 70 means the asset might be overbought and could soon experience a price decrease, while a value less than 30 indicates it might be oversold, possibly signaling an increase.

Based on the Rapid Strength Index (RSI) of XLM currently standing at 39.9 and swiftly dropping, the coin appears to be approaching bearish movement, hinting at potential short-term decreases. If selling pressure persists, XLM’s price might dip to lower points; however, if buyers reappear and steady the market, a possible recovery could help prevent additional losses.

XLM Ichimoku Cloud Shows a Strong Bearish Setup

For XLM, the Ichimoku Cloud chart suggests a pessimistic forecast since the current trading price falls beneath the cloud (marked by red and green zones). This indicates a strong trend moving downwards.

The graph shows the Tenkan-sen line, which is blue, lying beneath the Kijun-sen line, which is red. This indicates a prevailing bearish attitude, as sellers seem to be in control at the moment. Furthermore, the price has repeatedly failed to surpass the cloud during recent attempts, implying that the downward trend remains robust.

The green line, which represents the lagging span, sits beneath both the price and the cloud, underscoring the ongoing downward or bearish trend.

In simpler terms, if you look at the upcoming trend (red line), it indicates that the main section A (green edge) stays below another section B (red edge). This suggests that the market sentiment towards XLM will continue to be bearish for a while. The current indicators don’t show much sign of an immediate price increase, unless there’s a major change in the overall trend.

XLM Price Prediction: Will The $0.351 Support Hold Strong?

Stellar price is currently trading near a critical support level at $0.351.

As a researcher, if my analysis proves incorrect about the stability of the XLM price support, it might lead to additional downward pressure on its value. Consequently, I foresee a possible drop in the price, reaching as low as $0.31 under such circumstances.

Conversely, should XLM successfully maintain its position above the $0.351 support level and recover, it may regain positive momentum and attempt to break through the resistance at $0.40.

Overcoming this obstacle might pave the way for Stellar Lumens (XLM) to ascend higher, possibly reaching a significant milestone of $0.47 in the process.

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Gold Rate Forecast

- Batman and Deadpool Unite: Epic DC/Marvel Crossover One-Shots Coming Soon!

- Who was Peter Kwong? Learn as Big Trouble in Little China and The Golden Child Actor Dies at 73

- Hunter Schafer Rumored to Play Princess Zelda in Live-Action Zelda Movie

- 30 Best Couple/Wife Swap Movies You Need to See

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- Gachiakuta Chapter 139: Rudo And Enjin Team Up Against Mymo—Recap, Release Date, Where To Read And More

- Summer Game Fest 2025 schedule and streams: all event start times

2024-12-26 22:28