As a seasoned researcher with years of experience analyzing cryptocurrency markets, I find myself intrigued by the current state of SUI. With its impressive surge and nearing its all-time high, it’s hard not to be drawn into the excitement. However, as always, I remain cautious and diligent in my analysis.

As an analyst, I’ve noticed a intriguing pattern with SUI’s price movement. Despite a slight dip, it remains a mere 6.5% away from its peak value. The coin has experienced an extraordinary surge of 97.10% over the past month, which can be attributed to substantial expansion in its DeFi ecosystem. At present, the total value locked within this system amounts to a staggering $1.75 billion.

As a crypto investor, I’m keeping an eye on the technical indicators for SUI, and BBTrend is signaling some short-term caution. However, I’m also encouraged by the strong alignment of EMAs and the sustained Total Value Locked (TVL) levels above $1.4 billion, which suggests a robust foundation in SUI’s market structure. At this moment, SUI is facing a crucial test at $3.94. If the bulls can hold their ground, we could potentially see new highs surpassing $4.00.

SUI TVL Is Stabilizing Above $1.4 Billion

In a mere nine-day span, the total value locked on the SUI blockchain skyrocketed from $665 million to an impressive $1.75 billion. This rapid rise suggests robust investor trust and expanding use of the SUI ecosystem, as more users secure their assets within smart contracts for staking, lending, and liquidity provision.

The TVL, presently at $1.45 billion and now at $1.64 billion, indicates a steady rather than sporadic growth pattern. Consistently high TVL often aligns with increased demand, exerting upward pressure on prices due to the locked assets decreasing the circulating supply while enhancing network functionality.

As a crypto investor, I find myself optimistic about the potential of SUI’s price trend, given its robust platform usage and decreasing liquid supply. If this high TVL (Total Value Locked) level remains consistent, it could fuel sustained upward momentum for the SUI price.

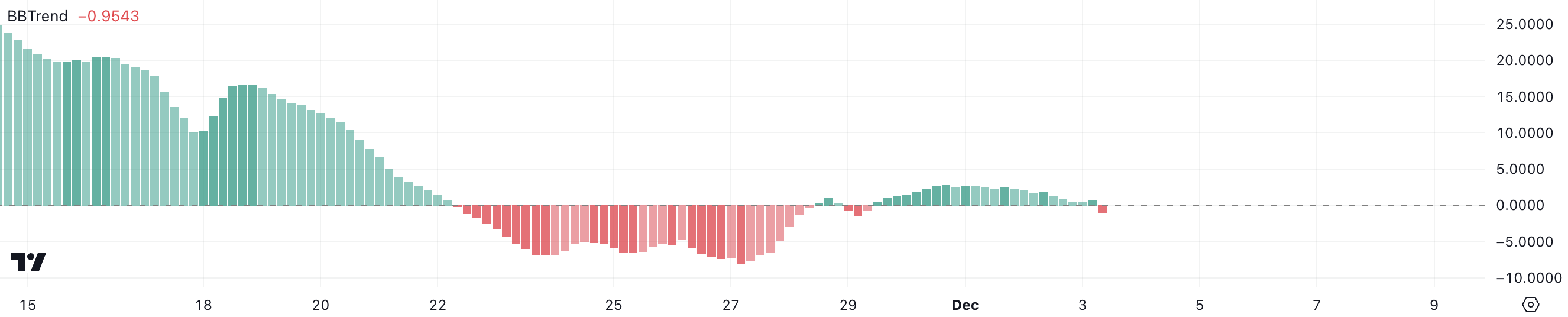

BBTrend Turned Negative After 4 Days

The SUI BBTrend (short for Bollinger Bands Trend) indicator has recently changed to negative and is moving towards the value of -1. This suggests a notable reversal in the market’s trend dynamics.

BBTrend assesses the movement of prices in relation to Bollinger Bands to determine volatility and direction trends. A positive value indicates an upward trend, while a negative value signals a downward trend.

As the change moves from a positive value towards almost -1, it signals that the Secure Utility Index (SUI) price is dipping beneath its Lower Bollinger Band, which typically means there’s growing selling force in the market.

This warning signal for the BBTrend indicator might trigger a temporary drop in prices due to the habit of traders using its crossover into negative zone as a sell indication. Yet, overly negative readings may suggest an oversold market which might be followed by a price rebound after selling has run out.

SUI Price Prediction: Is $4 the Next Target?

As a crypto investor, I’m excited to see the current bullish trend of the SUI price. The Exponential Moving Average (EMA) lines are aligning in a way that looks promising for potential gains, suggesting a potentially profitable ride ahead.

The cost could see a substantial increase, aiming firstly at the former record peak of $3.94, followed by a potential barrier at the round number $4.00. If achieved, this would set a new record high for SUI.

As a crypto investor, I’m closely watching key support levels for my SUI holdings. These levels are crucial in maintaining the current uptrend. If the market experiences a bearish reversal, it could lead to a series of tests at $3.32 and $3.10. The $2.97 level is particularly significant as it serves as a potential bottom for any price decline.

If prices drop beyond these points, it might intensify the urge for selling. However, the present Exponential Moving Average setup indicates that bulls are still dominating the market’s general direction.

Read More

- DC: Dark Legion The Bleed & Hypertime Tracker Schedule

- Summoners War Tier List – The Best Monsters to Recruit in 2025

- Elder Scrolls Oblivion: Best Battlemage Build

- To Be Hero X: Everything You Need To Know About The Upcoming Anime

- ATH PREDICTION. ATH cryptocurrency

- When Johnny Depp Revealed Reason Behind Daughter Lily-Rose Depp Skipping His Wedding With Amber Heard

- 30 Best Couple/Wife Swap Movies You Need to See

- ALEO PREDICTION. ALEO cryptocurrency

- Jennifer Aniston Shows How Her Life Has Been Lately with Rare Snaps Ft Sandra Bullock, Courteney Cox, and More

- Ein’s Epic Transformation: Will He Defeat S-Class Monsters in Episode 3?

2024-12-03 23:42