As a seasoned crypto investor with a knack for spotting trends and a keen eye for technical analysis, I can confidently say that the recent surge in Helium (HNT) price is a bullish sign. The CMF’s positive shift to 0.15 and the RSI’s climb to 58 indicate strong buying pressure and growing momentum, respectively.

This year, Helium (HNT)’s price has surged approximately 150%, and its market value just crossed the $1 billion mark. The Chaikin Money Flow (CMF) now stands at 0.15, a positive indicator suggesting robust buying activity that reinforces recent price increases.

If the ‘golden cross’ pattern emerges based on the moving average indications, Helium Network Token (HNT) may encounter resistances around $6.5 and $7.2. However, a potential reversal in trend could see it find support at $6 or even dip down to $5.28.

HNT CMF Is Now Positive

HNT CMF has surged to 0.15 from -0.06 in just one day, signaling a significant shift toward positive buying pressure. The CMF, or Chaikin Money Flow, measures the flow of capital into or out of an asset over a specific period, with values above 0 indicating net inflows (buying dominance) and values below 0 reflecting net outflows (selling pressure).

The significant surge suggests that buyers’ trust is increasing, which boosted HNT’s recent 5% price hike.

A CMF (Capital Movement Formula) of 0.15 signifies a robust optimism among investors, implying that the current growth phase is well-supported by capital investments. If the CMF keeps increasing, it might suggest more upward thrust for HNT, possibly leading to further price appreciation.

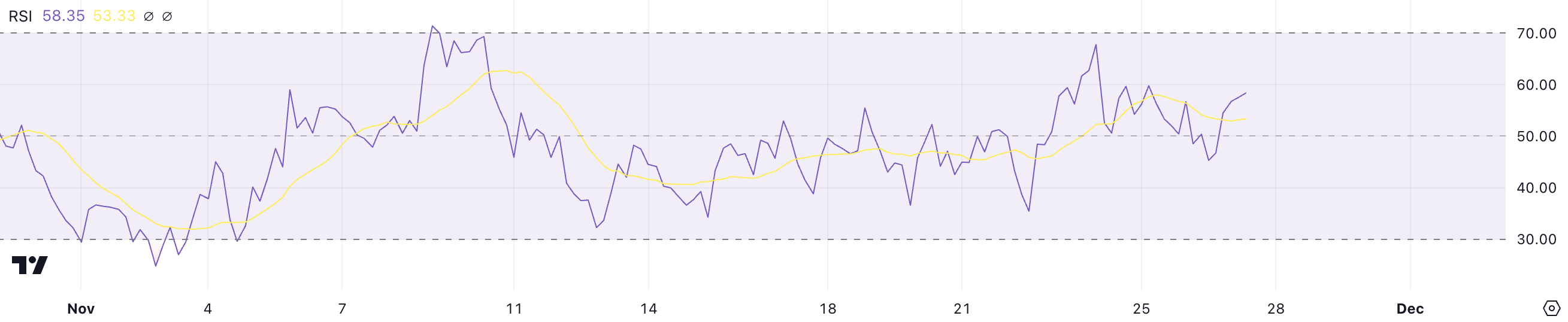

Helium RSI Shows Potential For More Price Increase

Helium RSI has climbed to 58 from 46 in just one day, reflecting growing bullish momentum. The RSI, or Relative Strength Index, measures the speed and magnitude of price changes on a scale from 0 to 100.

In simpler terms, when the value exceeds 70, it might suggest an overbought situation, which could result in a decrease or correction. On the flip side, values below 30 may indicate an oversold market, typically followed by a recovery. An RSI (Relative Strength Index) of 58 for HNT indicates that it’s currently experiencing a healthy growth trend but hasn’t yet reached overbought levels.

As the Relative Strength Index (RSI) remains under 70, it suggests that Helium Network Token’s (HNT) ongoing upward trend still has potential to expand without reaching oversold territory. This condition allows for additional price escalation as purchasing momentum gains traction.

If the Relative Strength Index (RSI) persists in rising, it’s likely that the HNT price may experience further increases in the immediate future, thanks to the existing positive market sentiment.

HNT Price Prediction: Can HNT Reach $7 Soon?

In simpler terms, when the Short-Term Exponential Moving Average (EMA) surpasses the Long-Term EMA on the HNT chart, it might suggest the emergence of a “golden cross.” This pattern is generally considered a positive sign, as it could signal the beginning of a prolonged upward trend.

If a golden cross pattern emerges and the upward trend persists, it’s plausible that the price of Helium could surpass the $6.5 barrier and possibly reach $7.2. This bullish movement would further validate its progression and recent achievement of a $1 billion market capitalization. Additionally, if this happens, Helium (HNT) might secure a place in the top 10 among DePIN (Decentralized Physical Infrastructure) coins.

However, if the current uptrend weakens and reverses, HNT price may face critical support levels.

The price could first test $6, and if that fails, it might drop to $5.57 or even $5.28.

Read More

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Gold Rate Forecast

- Tom Cruise Bags Gold: Mission Impossible Star Lands Guinness World Record for Highest Burning Parachute Jumps

- Justin Bieber Tells People to ‘Point at My Flaws’ Going on Another Rant, Raises Alarm With Concerning Behavior

- INCREDIBLES 3 Will Be Directed by ELEMENTAL’s Peter Sohn, Brad Bird Still Involved

- Is Justin Bieber Tired of ‘Transactional Relationship’ with Wife Hailey Bieber? Singer Goes on Another Rant Raising Concerns

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Are Billie Eilish and Nat Wolff Dating? Duo Flames Romance Rumors With Sizzling Kiss in Italy

- Tom Hiddleston and Wife Zawe Ashton Announce Second Pregnancy, Know Couple’s Relationship Timeline

- WrestleMania 42 Returns to Las Vegas in April 2026—Fans Can’t Believe It!

2024-11-28 00:55