Hedge Funds: The New Kings of Chaos? 🤯

It seems our old chum, Andrew Bailey, the chap in charge of the Bank of England, has been having a spot of bother. You see, there’s this whole new bunch of financial fellows, the non-bank types, who’ve been making a bit of a splash in the market. They’re like the boisterous cousins who show up at the family gathering and turn the place upside down.

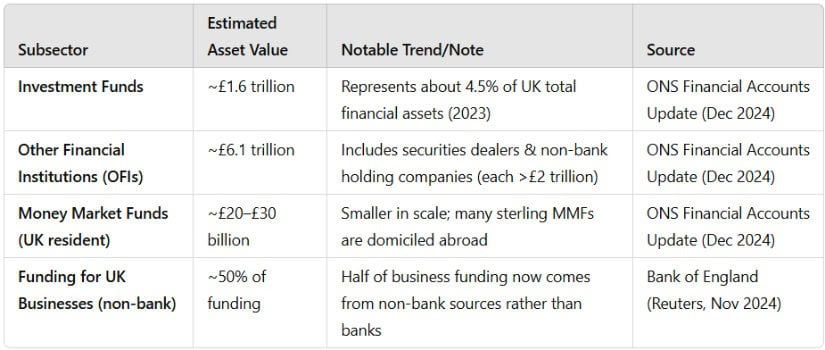

Now, before the whole financial kerfuffle of 2008, these chaps only held about 40% of the global financial assets. But these days, they’re practically running the show, holding a whopping 50% of the pie! It’s like the old guard, the banks, have been handed a rather large slice of humble pie, and they’re not too happy about it.

“With the non-bank sector now making up nearly 50% of global financial assets compared to 40% for the banking sector. And so for the last fifteen years we have increasingly seen the emergence of risks to financial stability originating in the non-bank system,” said Bailey.

The bloke’s got a point. These non-bank chaps, with their hedge funds and fancy trading strategies, are like a bunch of high-spirited greyhounds who haven’t had their breakfast. They’re fast, they’re complicated, and they’re quite prone to running around and making a right old mess!

The Rise of Hedge Funds and Systematic Trading

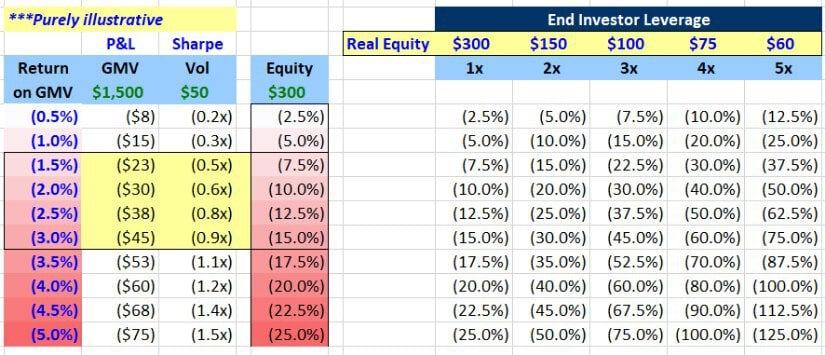

Bailey’s got a particular bone to pick with these hedge funds. They’re like a bunch of super-charged race cars, always looking for the next big win. They’re borrowing money left, right, and centre, and when things get a bit hairy, they can suddenly pull out, causing a massive panic. It’s a bit like a game of musical chairs, only with billions of pounds at stake.

Analyst Brett Caughran, a fellow who knows his way around a spreadsheet, thinks these funds have become the big cheese, the main movers and shakers in the market. They’re setting the prices, they’re calling the shots, and it’s all a bit too much for the old guard.

The thing is, these hedge funds are a bit like a pack of wolves, they all tend to do the same thing at the same time. If one starts to panic, they all panic, and the whole market goes into meltdown. Bailey’s worried about the whole thing turning into a domino effect, with everyone getting swept up in the chaos.

The real problem is that these non-bank fellows are pretty much operating outside the rules. The banks have been hit with loads of new regulations, but these chaps are living it up without a care in the world. They’re borrowing a fortune and no one really knows how much they’re owing, a bit like a cheeky chap at a pub who’s running up a rather large tab. It’s a bit of a risky game, and if things go south, it could cause a real financial storm.

Stress Testing a Changing Market

To try and get a handle on this whole non-bank business, Bailey’s brought in a new stress-testing system called the “SWES”. It’s like a giant microscope that allows him to see how financial shocks are spreading through the market. It’s a bit like trying to track a herd of elephants in a jungle, but it’s better than nothing.

Bailey has realized that the

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Gold Rate Forecast

- Batman and Deadpool Unite: Epic DC/Marvel Crossover One-Shots Coming Soon!

- Who was Peter Kwong? Learn as Big Trouble in Little China and The Golden Child Actor Dies at 73

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Hunter Schafer Rumored to Play Princess Zelda in Live-Action Zelda Movie

- 30 Best Couple/Wife Swap Movies You Need to See

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- Gachiakuta Chapter 139: Rudo And Enjin Team Up Against Mymo—Recap, Release Date, Where To Read And More

- Summer Game Fest 2025 schedule and streams: all event start times

2025-02-12 17:13