The price of Hedera’s cryptocurrency, HBAR, has dropped by 12% during the last week. At the moment of printing, it is being traded for $0.26, which is its lowest point over the past seven days.

As Hedera’s price falls, there has been a growing tendency among futures traders to take on short positions, indicating that they believe the price will continue to decrease.

Hedera Futures Traders Increase Short Bets

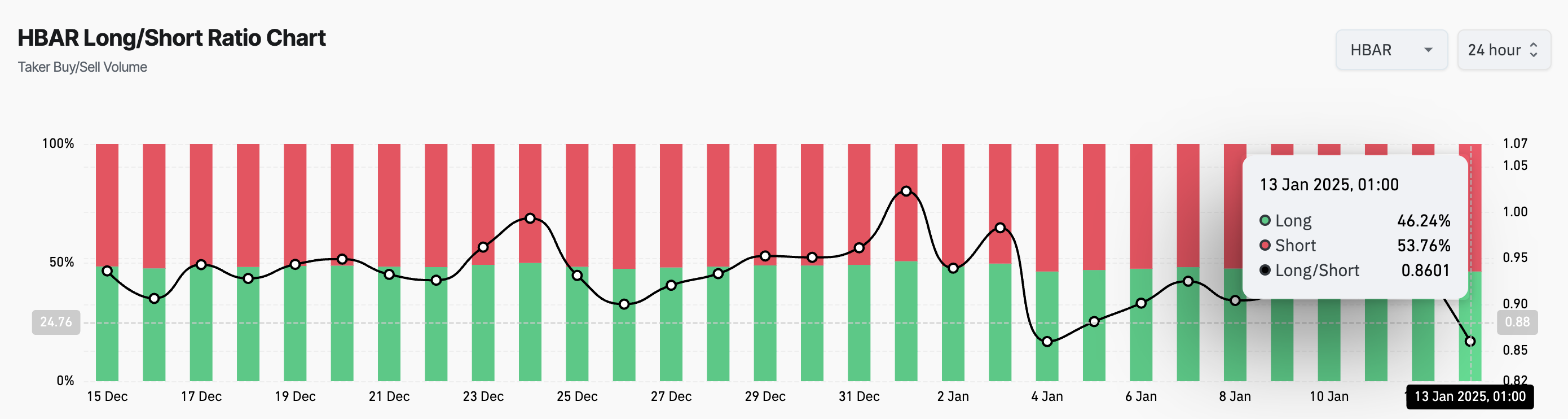

As reported by Coinglass, the current Long/Short Ratio for HBAR stands at 0.86. This ratio indicates the balance between long positions (positions taken with the expectation that the price will increase) and short positions (positions taken with the belief that the price will decrease) in this market. In simpler terms, it shows how many more long positions there are compared to short positions for HBAR.

In simpler terms, having 86 long positions (bets that the price will rise) for every 100 short positions (bets that the price will fall) indicates a greater number of traders anticipate HBAR’s price to decrease, reflecting a bearish outlook.

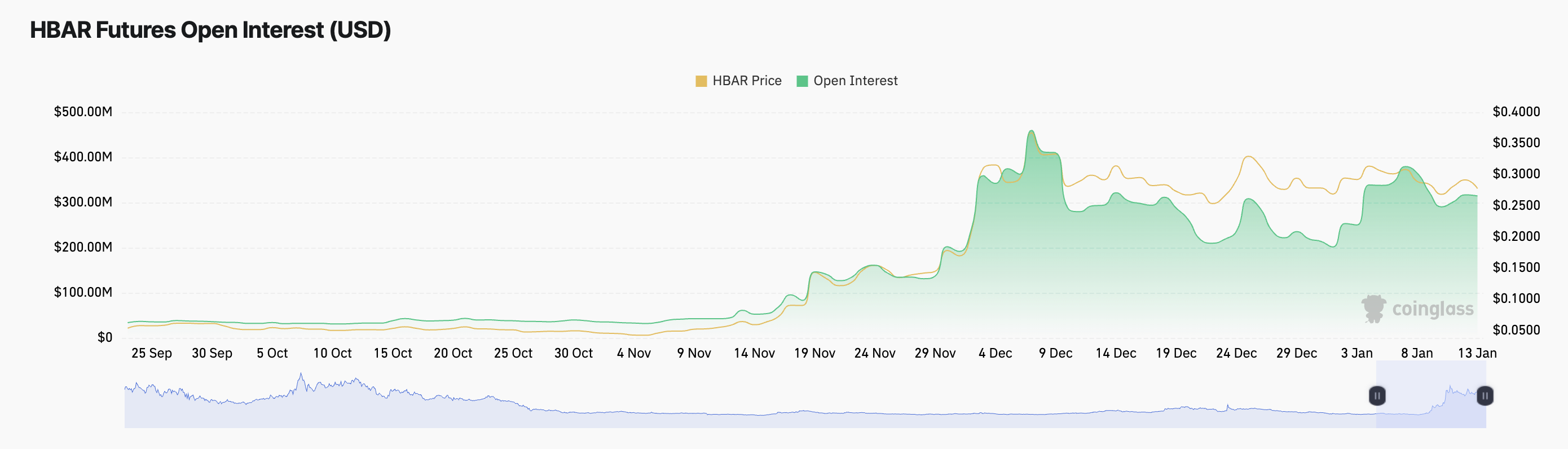

As an analyst, I’m observing a decline in activity within the HBAR futures market, which is clearly reflected in the dropping open interest. At present, the open interest stands at approximately $315 million, representing a 17% decrease over the last six days. This trend supports a bearish forecast for HBAR.

The concept of open interest quantifies the active derivative agreements, like futures or options, that haven’t been resolved or terminated. For instance, when HBAR decreases amid a price downturn, it indicates less market involvement as traders are wrapping up their positions instead of initiating new ones. This suggests a diminishing bearish force and potentially foreshadows another price drop.

HBAR Price Prediction: A/D Line Indicates Selling Pressure

On a day-to-day basis, the declining Accumulation/Distribution Line (A/D Line) for HBAR suggests a decrease in its purchasing activity, as indicated by BeInCrypto’s analysis. Over the last seven days, this important indicator has dropped by approximately 6%.

The A/D Line represents a graphical tool that gauges the inflow or outflow of money related to an asset’s volume by examining both price fluctuations and trading activity. When the A/D Line decreases, it suggests that selling activity is dominating buying activity, implying reduced confidence in the asset’s pricing strength.

If selling pressure for HBAR increases significantly, its value might drop below the support level of $0.24 and potentially move towards $0.16. On the other hand, an increase in demand for this altcoin could lift Hedera’s price as high as $0.33.

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Gold Rate Forecast

- Batman and Deadpool Unite: Epic DC/Marvel Crossover One-Shots Coming Soon!

- Who was Peter Kwong? Learn as Big Trouble in Little China and The Golden Child Actor Dies at 73

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- Hunter Schafer Rumored to Play Princess Zelda in Live-Action Zelda Movie

- SEGA Confirms Sonic and More for Nintendo Switch 2 Launch Day on June 5

- 30 Best Couple/Wife Swap Movies You Need to See

- Every Fish And Where To Find Them In Tainted Grail: The Fall Of Avalon

2025-01-13 16:51