As a seasoned researcher with a decade of experience in the volatile world of cryptocurrencies, I find the recent surge of HBAR intriguing but not entirely convincing. The bearish sentiment around this altcoin remains palpable, even after its 8% uptick.

HBAR, the native cryptocurrency of the Hedera Hashgraph network, has surged by 8% in the past 24 hours. This rebound follows a few days of decline after the altcoin reached a three-year high of $0.39 on December 3.

Yet, HBAR’s 8% increase in the last 24 hours follows the overall market uptrend. Despite this, a negative sentiment persists towards it, suggesting that it could revert back to its declining path. This discussion delves into the factors contributing to this outlook.

Hedera Bears Take Control

In the last day, the price of Hedera’s token increased by 8%, but its trading volume significantly dropped by 21%. This situation, where prices rise while volume decreases, is often seen as a bearish divergence – a warning sign that the upward trend might not continue for long.

It seems like this trend suggests that the rise in price is more due to investors’ speculation instead of actual demand, which reduces its likelihood for holding.

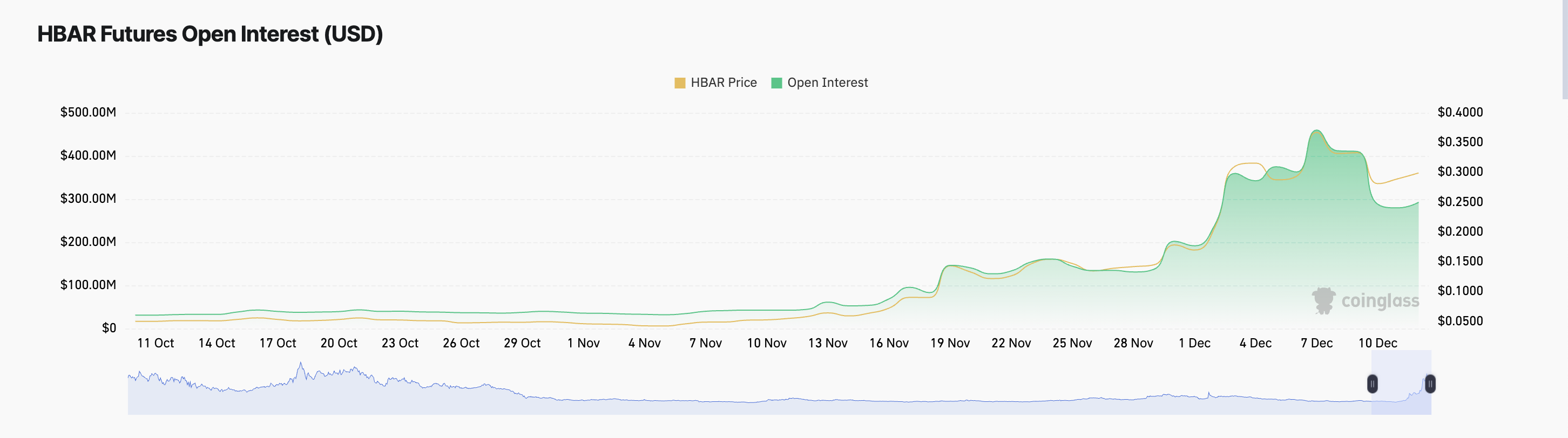

As a crypto investor, I’ve noticed that the derivatives market for HBAR is experiencing low activity, as indicated by the significant drop in open interest. Currently, the open interest stands at approximately $292 million, representing a 38% decrease over the last five days. A decline in open interest usually means fewer contracts are being traded or held, which can suggest less market participation or diminishing confidence among investors regarding this asset.

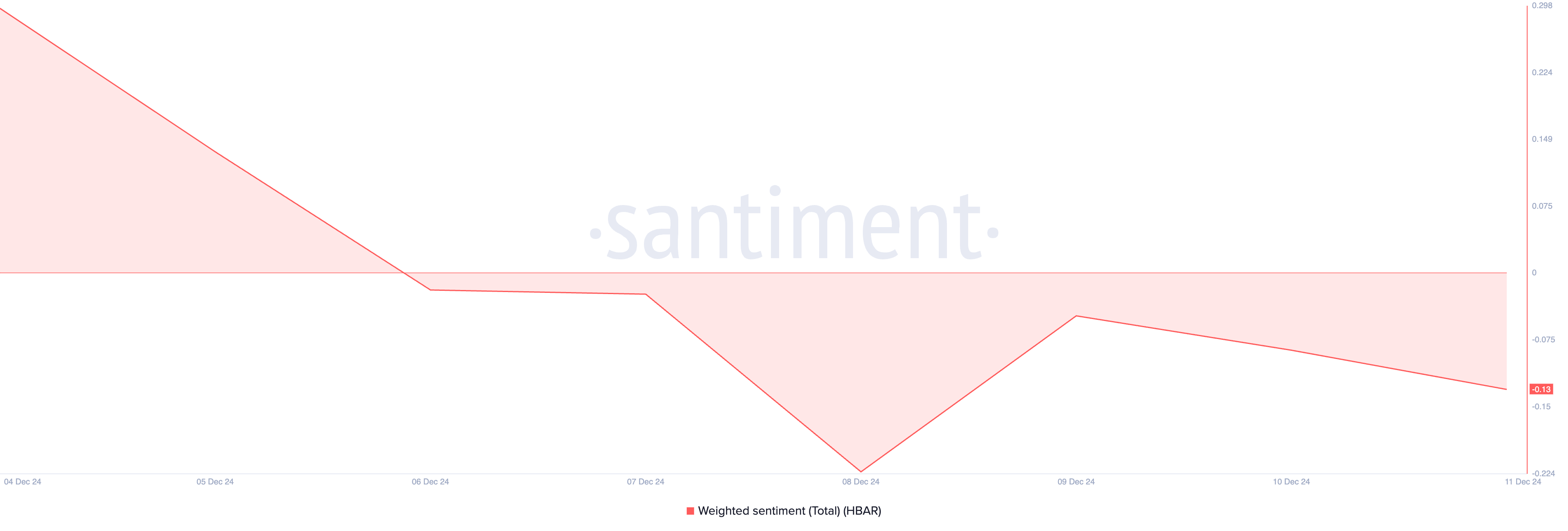

Additionally, it’s worth noting that the overall feeling towards HBAR in the market is pessimistic, indicated by a consistently negative weighted sentiment score. According to Santiment, this metric has recorded only negative values since HBAR dropped from its three-year peak on December 4. At present, the score stands at -0.13.

This measurement, based on blockchain, gauges the general opinion about a particular asset across social media platforms. It takes into account not only the amount but also the tone (positive or negative) of the conversations. A lower score implies that the majority of social media comments are negative, which might indicate a pessimistic viewpoint towards the asset.

HBAR Price Prediction: Key Resistance to Breach

Looking at the daily HBAR/USD chart, the Awesome Oscillator suggests a pessimistic view, as the last five days have displayed nothing but red bars in the histogram. This particular indicator measures market momentum, and these red bars imply that the momentum is decreasing, which could signal a weakening of bullish tendencies or an increase in bearish pressure.

Currently trading at $0.30, HBAR could drop to $0.25 if bearish pressure intensifies.

If the market’s attitude changes from pessimistic (bearish) to optimistic (bullish), there’s a possibility that the Hedera token price could break through the resistance at $0.31 and aim to return to its three-year peak of $0.39.

Read More

- Gold Rate Forecast

- Tom Cruise Bags Gold: Mission Impossible Star Lands Guinness World Record for Highest Burning Parachute Jumps

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Justin Bieber Tells People to ‘Point at My Flaws’ Going on Another Rant, Raises Alarm With Concerning Behavior

- INCREDIBLES 3 Will Be Directed by ELEMENTAL’s Peter Sohn, Brad Bird Still Involved

- Is Justin Bieber Tired of ‘Transactional Relationship’ with Wife Hailey Bieber? Singer Goes on Another Rant Raising Concerns

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Are Billie Eilish and Nat Wolff Dating? Duo Flames Romance Rumors With Sizzling Kiss in Italy

- Tom Hiddleston and Wife Zawe Ashton Announce Second Pregnancy, Know Couple’s Relationship Timeline

- Resident Evil 9: Requiem Announced: Release Date, Trailer, and New Heroine Revealed

2024-12-12 12:26