After closely observing the market trends and analyzing various technical indicators over the past few years, I must admit that Hedera’s recent surge has caught my attention. However, as an experienced analyst who has seen numerous market cycles, I am cautiously optimistic about its current momentum.

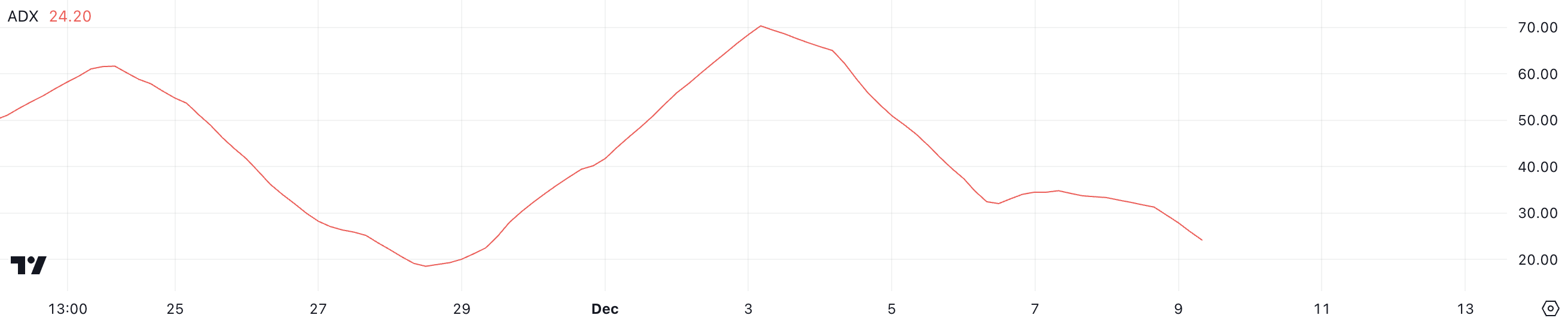

Over the past month, the value of Hedera (HBAR) has skyrocketed by over 506%, bringing its market capitalization close to $12 billion. Yet, this impressive surge seems to be slowing down. At present, the ADX value for HBAR is 24.2, suggesting a weakening trend, as the price has dropped following its peak of $0.39 on December 3.

As long as the coin hovers over the Ichimoku Cloud, indicating a positive outlook, it’s possible that the market is moving towards a period of stabilization, with the momentum of the trend starting to weaken.

HBAR Uptrend Is Losing Its Steam

Over the past month, Hedera’s value has soared by an astounding 506.83%. However, it appears that its upward trajectory might be slowing down. At present, its ADX is at 24.2, suggesting a potential weakening in trend direction.

On December 3, the coin reached its highest value at $0.39, however, since that date, both its price and the ADX (Average Directional Movement Index) have seen a downward trend.

The Average Directional Index (ADX) is a technical tool employed to gauge the intensity of a trend, whether it’s ascending or descending. It varies between 0 and 100, with figures above 25 pointing towards a robust trend, while values below 20 suggest a feeble trend. On December 3, HBAR ADX was close to 70, which indicates a powerful uptrend as its price spiked at that time.

With the ADX falling from more than 30 to 24.2, it indicates that the momentum behind the upward trend might be weakening. This could mean that traders are becoming less certain about the direction of the market price movement, possibly leading to a period of reduced activity or stabilization.

Ichimoku Cloud Shows HBAR Is Still Bullish

Currently, the value of Hedera has been on an impressive upward trajectory, climbing to levels not seen since November 2021. This significant increase is evident in its movement above the Ichimoku Cloud, a clear indicator of its strength. The coin experienced a sharp rise and peaked approximately at $0.39, with the price consistently staying above the cloud, suggesting a bullish trend.

As the cost approaches and nears the upper limit of the cloud, indications show a decrease in momentum’s strength. The minor retreat visible on the graph implies that the HBAR price might encounter resistance at this point.

In simpler terms, when a chart’s Ichimoku Cloud area appears green, it signifies a supportive level for the price. Conversely, if the same area turns red, it might suggest possible resistance to further price increases. At this point, since the price continues to stay above the cloud, the overarching trend remains optimistic or bullish.

If the HBAR price falls beneath the cloud formation, it might indicate a possible transition towards a neutral or downward trend. In this scenario, the upcoming significant support level could likely be located at the bottom of the cloud.

HBAR Price Prediction: Can Hedera Test $0.40 In December?

On December 3, Hedera hit its highest point in three years, but it’s been going through a phase of stabilization since then. If the upward trend changes to a downward one and the price starts falling, the initial support level at approximately $0.27 might be challenged.

Should the current support weaken, the value of HBAR might continue dropping, potentially finding new support around $0.17 or possibly even dipping to $0.12.

If the upward trend of HBAR’s price picks up speed once more, it may surge again, attempting to breach the $0.40 barrier as resistance. Overcoming this hurdle might prompt additional growth, with the next potential goal set at $0.45.

This could indicate a significant increase by about 45%, implying that the bullish momentum is likely to persist further.

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Gold Rate Forecast

- WrestleMania 42 Returns to Las Vegas in April 2026—Fans Can’t Believe It!

- Justin Bieber Tells People to ‘Point at My Flaws’ Going on Another Rant, Raises Alarm With Concerning Behavior

- How a 90s Star Wars RPG Inspired Andor’s Ghorman Tragedy!

- Are Billie Eilish and Nat Wolff Dating? Duo Flames Romance Rumors With Sizzling Kiss in Italy

- INCREDIBLES 3 Will Be Directed by ELEMENTAL’s Peter Sohn, Brad Bird Still Involved

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Is Justin Bieber Tired of ‘Transactional Relationship’ with Wife Hailey Bieber? Singer Goes on Another Rant Raising Concerns

- Tom Cruise Bags Gold: Mission Impossible Star Lands Guinness World Record for Highest Burning Parachute Jumps

2024-12-09 20:32