As a seasoned researcher with years of experience analyzing cryptocurrency markets, I have seen my fair share of market fluctuations, and the current situation with HBAR is no exception. While it’s always exciting to see prices reach new highs, it’s important not to get carried away and instead focus on the technical indicators that can help us make informed decisions.

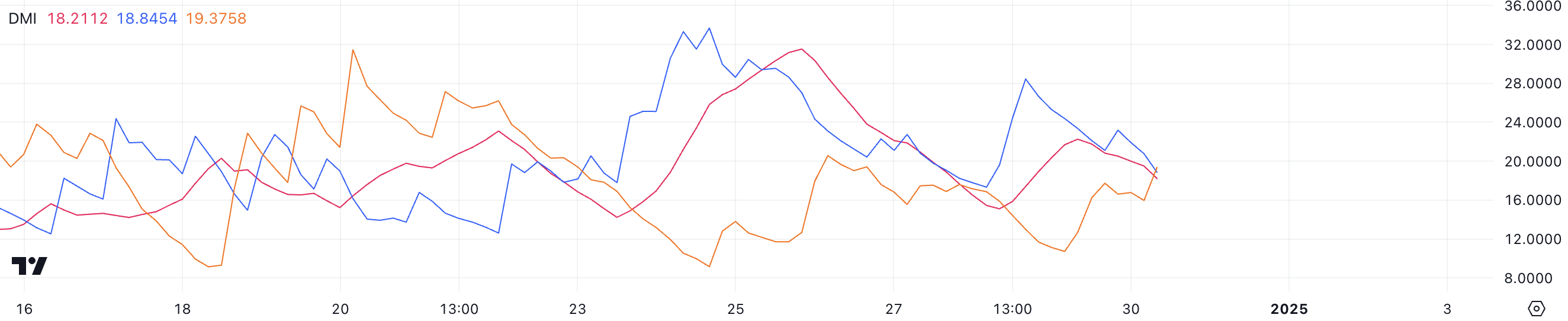

Looking at the DMI chart, it appears that HBAR is still in a downtrend, but the weak trend strength suggests that this could change soon. The lack of a strong ADX indicates that the trend is not firmly established, leaving room for potential shifts in market direction. If history has taught me anything, it’s that the market can be as unpredictable as a rollercoaster ride, so I wouldn’t count on the downtrend lasting forever.

Why don’t cryptocurrencies ever get lost? Because they always follow the blockchain!

In my exploration as a researcher, I noticed that Hedera’s (HBAR) value peaked at several highs during December. However, over the past 24 hours, its price has dropped by over 4%.

Despite multiple signs pointing towards an imminent end to the correction, a potential death cross could exacerbate the downward trend.

HBAR Is Still In a Downtrend

As a crypto investor, I’m closely watching Hedera’s DMI chart, and it seems the trend strength isn’t as strong as I’d like, with an ADX of 18.2. The +DI is at 18.8, which suggests some bullish momentum, but the -DI, or bearish momentum, is slightly higher at 19.3. This means that the bears are still holding a slight edge in this market.

In simpler terms, this arrangement indicates that HBAR continues to decline, yet the weak ADX value implies the trend isn’t well-defined, suggesting there might be opportunities for changes in the market movement.

The Average Directional Index (ADX) rates the intensity of a market’s price trend, ranging from 0 to 100, regardless if it’s an uptrend or downtrend. A value higher than 25 signifies a robust trend, whereas readings below 20, such as HBAR’s current 18.2, imply weak or insignificant trend strength. When the Positive Directional Index (DI) and Negative Directional Index (DI) are close together, it suggests that neither buyers nor sellers have strong dominance over the market.

In the immediate future, I anticipate that the HBAR price might maintain its current range with minimal fluctuations, unless one party significantly strengthens their position. An increasing ADX could serve as an indication of a more pronounced trend momentum, hinting at a potential breakout from this range.

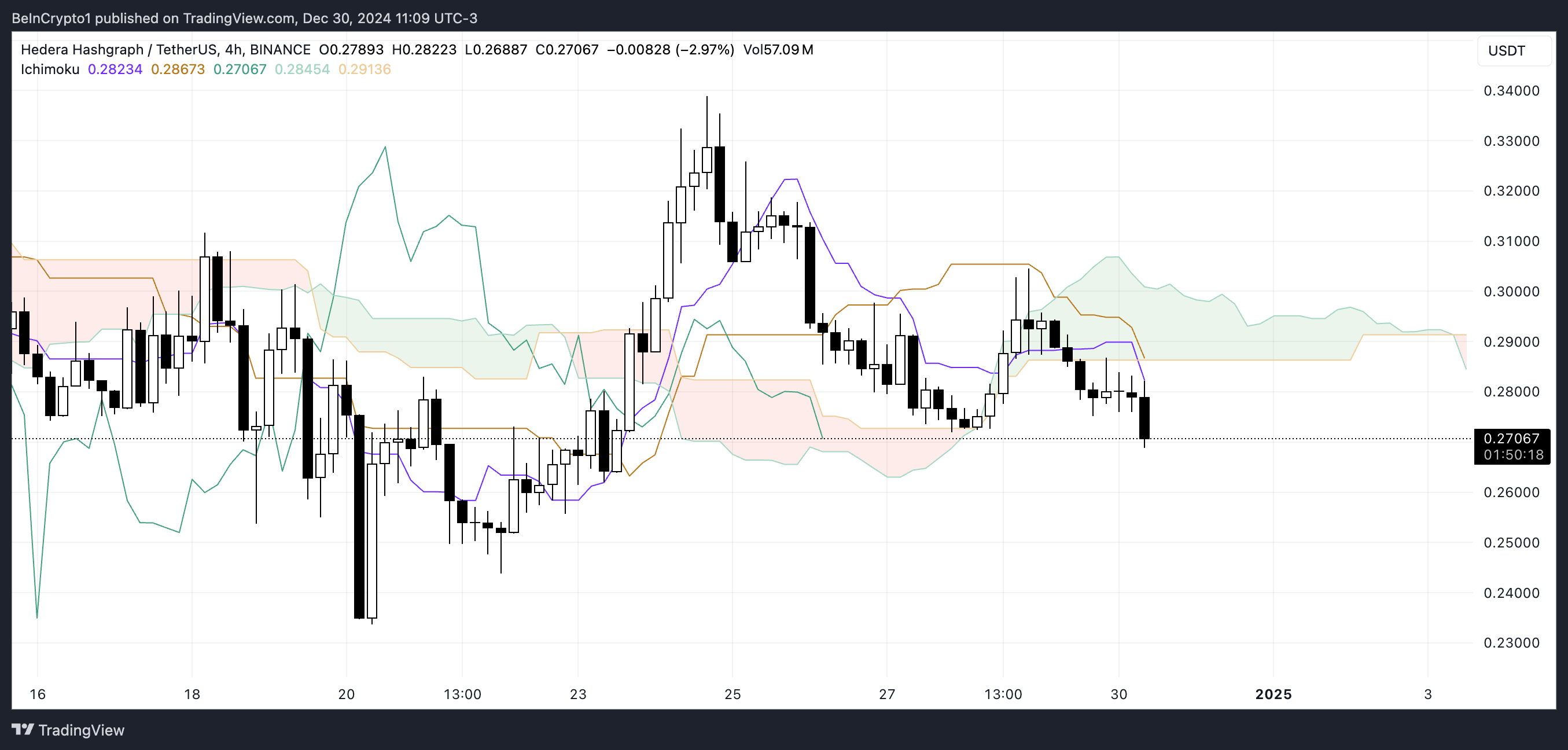

Ichimoku Cloud Hints at Further Decline

As a researcher examining the Ichimoku Cloud chart for Hedera, I observe a bearish setup taking shape. The current price is hovering beneath the red-tinted cloud, which is composed of Senkou Span A and Senkou Span B. This red hue signifies bearish momentum since Senkou Span A is yet to breach above Senkou Span B, indicating a continued downward pressure in the market. Thus, HBAR appears to be under the dominance of bearish forces for now.

Furthermore, the purple “Conversion Line” sits beneath the orange “Baseline,” suggesting a continued bearish outlook since the short-term price movement lags behind the long-term trendline.

As I examine the Ichimoku chart for HBAR, I notice that the Chikou Span, usually a reflection of the average price over a certain period, currently lies below both the current price action and the cloud. This alignment suggests that bearish conditions persist and are reinforcing the downward trend. However, it’s essential to note that a break above the cloud could signal a possible reversal, indicating a shift towards bullish sentiments. In essence, until HBAR manages to surpass the cloud, it seems we may continue experiencing a downtrend.

HBAR Price Prediction: Will Hedera Fall 13.7% Next?

If the ongoing decrease in HBAR’s price continues and intensifies, it might lead the price to drop even more towards the potential support point at $0.233. This could occur when the short-term trend (represented by the red line) goes beneath the long-term trend (indicated by the light blue line), forming what is known as a “death cross.” If this support level isn’t maintained, it could suggest an increase in bearish sentiment, which might push the price downward further.

Conversely, should the trend change direction and short-term graphs intersect above their long-term counterparts, the HBAR price may try to rebound.

If we encounter such a scenario, the price could challenge the resistance at $0.31. If it manages to break through this barrier, it might lead us toward $0.33. Such a bullish reversal suggests a resurgence of buying interest and implies that there might be more upward movement to follow.

Read More

- DC: Dark Legion The Bleed & Hypertime Tracker Schedule

- Summoners War Tier List – The Best Monsters to Recruit in 2025

- To Be Hero X: Everything You Need To Know About The Upcoming Anime

- Elder Scrolls Oblivion: Best Battlemage Build

- ALEO PREDICTION. ALEO cryptocurrency

- Jennifer Aniston Shows How Her Life Has Been Lately with Rare Snaps Ft Sandra Bullock, Courteney Cox, and More

- When Johnny Depp Revealed Reason Behind Daughter Lily-Rose Depp Skipping His Wedding With Amber Heard

- 30 Best Couple/Wife Swap Movies You Need to See

- Revisiting The Final Moments Of Princess Diana’s Life On Her Death Anniversary: From Tragic Paparazzi Chase To Fatal Car Crash

- Who Is Emily Armstrong? Learn as Linkin Park Announces New Co-Vocalist Along With One Ok Rock’s Colin Brittain as New Drummer

2024-12-30 22:40