As a seasoned crypto investor with battle-scarred fingers from navigating market volatility, I find myself intrigued by Hedera’s (HBAR) recent growth spurt, which has seen it climb an impressive 21.43% in the past week and a whopping 172.58% over the last month. The bullish trend is evident in its EMA lines, with short-term lines comfortably above their long-term counterparts, pointing to sustained upward momentum.

The price of Hedera (HBAR) has experienced significant gains recently, increasing by 21.43% over the past week and an astounding 172.58% in the last month. This impressive rise is underpinned by a bullish trend in its EMA lines, where the short-term lines are positioned above the long-term ones, suggesting a consistent upward trajectory.

Keep in mind that while both the Ichimoku Cloud and DMI indicators suggest possible shifts in trend direction, it’s crucial to exercise caution. If bearish forces gain traction, HBAR could experience a substantial decline, challenging key support at $0.117 and possibly dropping down to $0.053.

HBAR Current Uptrend Is Still Strong

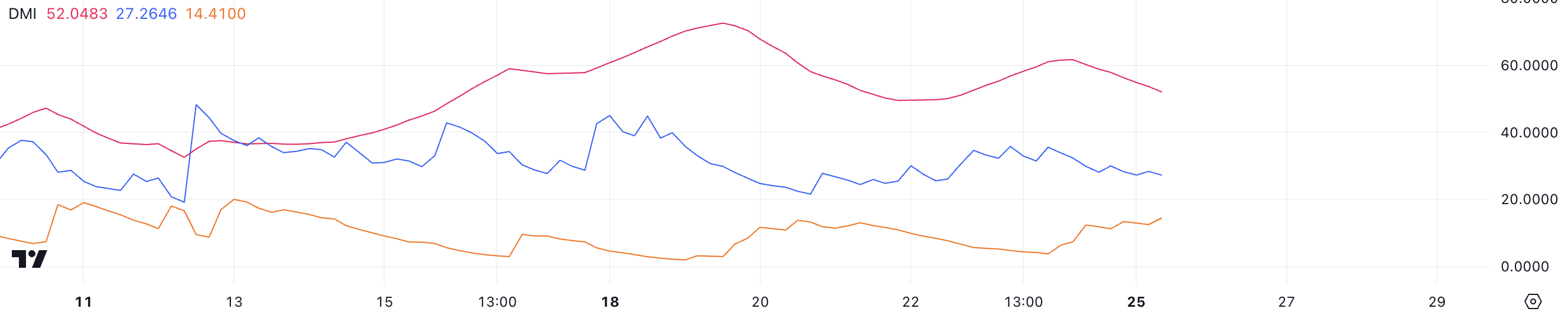

The Hedera DMI graph emphasizes a robust market trend indicated by an ADX value of 52. To put it simply, the ADX (Average Directional Index) gauges the intensity of a trend’s direction. Values exceeding 25 suggest a notable trend, while figures above 40 signal an extremely powerful one.

A reading of 52 on the ADX indicates that the ongoing market direction, be it rising or falling, is well-established and appears unlikely to lose strength in the near future. Notably, this figure has stayed above 40 since November 14, suggesting consistent market momentum.

At present, HBAR’s positive diffusion (D+) is at 27.2, while its negative diffusion (D-) is at 14.4. This shows that the overall trend is moving upwards. However, as D+ decreases and D- rises sharply, it hints at a possible weakening of this upward trend. This contradiction suggests an increasing selling force, which might undermine the current bullish control if it persists further.

For now, the powerful trend continues for Hedera. However, the balance between positive (D+) and negative (D-) factors indicates a crucial juncture. If the negative influence persists and grows stronger, it could potentially sway market opinion.

Ichimoku Cloud Shows Caution Is Needed

According to an Ichimoku analysis of HBAR’s chart, the current trading price hovers around two key lines: the orange Kijun-Sen and the blue Tenkan-Sen. This proximity indicates that HBAR is in a period of consolidation. The Kijun-Sen being flat implies there isn’t much strong momentum pushing the price one way or another. Moreover, the cloud, consisting of Senkou Span A and B, lies beneath the trading price, functioning as a potential support area.

In simple terms, a green cloud signifies optimistic feelings for the long term, yet the difficulty the price has in staying above the Kijun-Sen suggests some ambiguity or indecision.

If the price of HBAR holds steady above its current trendline (cloud), there’s a possibility it may initiate an upward turn (bullish reversal). The next significant barrier for this rise could be near the Tenkan-Sen line and the recently reached peak.

However, a breakdown below the cloud could signal bearish momentum, potentially targeting lower levels. The thinning cloud toward the end of the chart also suggests weakening support, making this a critical phase for HBAR trend direction.

HBAR Price Prediction: A 62% Correction After The Recent Surge?

In simpler terms, when you look at HBAR’s Exponential Moving Averages (EMA), you see that the shorter-term averages are sitting above the longer-term ones. This suggests a bullish trend, meaning the price is likely to keep rising due to strong upward pressure.

Over the last week, the value of this token has significantly increased by 21.43%. If this positive trend continues, it may attempt to break through the resistance levels at $0.157 and $0.1711. This bullish outlook indicates a consistent buying interest, maintaining the price on an upward course.

On the other hand, signals such as the Ichimoku Cloud and DMI hint towards a possible change in trend direction. If the trend does turn bearish, it’s possible that the HBAR price could be tested at the significant support level of $0.117, a key point for preserving its momentum.

If this support fails, the price could plummet to $0.053, marking a significant 62% correction.

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Gold Rate Forecast

- Batman and Deadpool Unite: Epic DC/Marvel Crossover One-Shots Coming Soon!

- Who was Peter Kwong? Learn as Big Trouble in Little China and The Golden Child Actor Dies at 73

- Hunter Schafer Rumored to Play Princess Zelda in Live-Action Zelda Movie

- 30 Best Couple/Wife Swap Movies You Need to See

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- Every Fish And Where To Find Them In Tainted Grail: The Fall Of Avalon

- Gachiakuta Chapter 139: Rudo And Enjin Team Up Against Mymo—Recap, Release Date, Where To Read And More

2024-11-25 19:37